Anticipated Implementation Timeline for the Social Security Fairness Act

title: Social Security Fairness Act: A Game Changer for America's Heroes

Are you a hardworking public servant? A teacher, firefighter, or cop? Well, take a seat and listen up, ‘cuz the Social Security Fairness Act (SSFA) has your back and could change your life!

This groundbreaking legislation abolishes two antiquated provisions that have been unfairly cutting benefits for folks just like you: Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

What's This SSFA Thing All About?

The Social Security Fairness Act was crafted to give public sector workers the respect they deserve. It scraps the WEP and GPO, bringin' peace of mind and extra cash to millions of retired public servants.

Windfall Elimination Provision - The Angry Elephant in the Room

The WEP first saw the light of day in 1983 to discourage folks from getting disproportionately high benefits from splittin' their time between Social Security-covered and non-covered jobs. Unfortunately, it ended up crushin' the pensions of countless teachers, firefighters, and law enforcement officers by slashin' their expected Social Security benefits.

Government Pension Offset - The Silent Assassin

Introduced to target spousal or survivor benefits, the GPO decreased the amount of those benefits by two-thirds of the retiree's pension from a non-Social Security-covered job. For many, this meant receivin' little or no spousal benefits from the Social Security Administration (SSA).

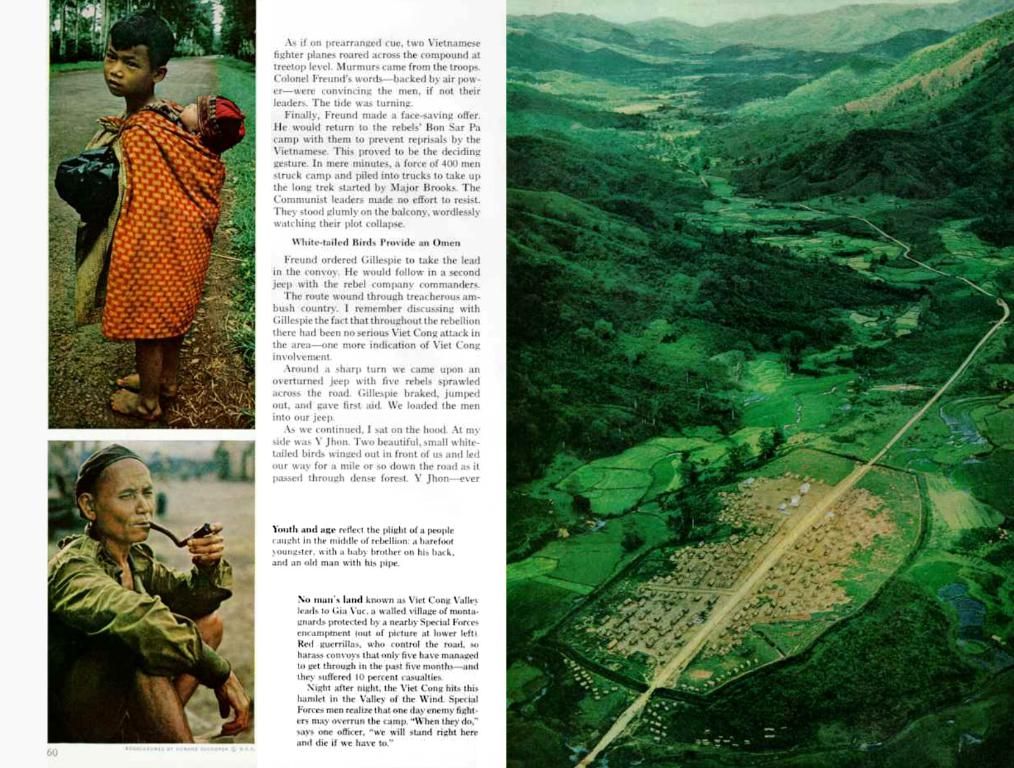

So, When Does This Life-Changing Delight Get Served Up?

The SSFA became official on January 5, 2025. While the law went into effect immediate-like, the process of recalculating benefits and issuing retroactive payments will take a smidgen o' time.

The SSA has provided an outline of when each step will be completed:

- March 2025: The SSA kicks off the process of recalculatin' benefits for those affected.

- April 2025: Folks start collectin' higher monthly Social Security payments.

- Mid-2025: Retroactive payments flow to those who previously received less due to WEP and GPO.

Who's In Line For a Bigger Slice?

This Act’s Helping Hand reaches out to:

- Teachers

- Firefighters

- Police officers

- State and local government employees

- Federal workers hired before 1984 (under the Civil Service Retirement System)

Since the elimination of WEP and GPO means no more benefit reductions, retirees who were squashin' their bills with smaller Social Security payments will see a substantial boost in their monthly benefits.

Sighed and Dollar Signs - SSFA's Impact on Your Wallet

More Money in Your Pocket

With the WEP out of the picture, prospective retirees can expect their Social Security payments to increase by an average of $400-$500 per month.

For those hit by GPO, they might now qualify for the spousal benefits they were blocked from earlier.

Retroactive Bonus Cash

The act authorizes retroactive benefits that'll be credited back to January 2024. Eligible retirees will receive a one-time payment coverin' the months when they were underpaid.

Money for Tomorrow, Today

For decades, many public employees have been workin' their tails off, expectin' a combo of pension and Social Security benefits... then WEP or GPO stepped in and smacked ‘em in the face. With these provisions eliminated, retirees will experience greater financial stability, ensuring they receive the benefits they were promised.

Challenges, Roadblocks, and Snags

Though the SSFA's a win for public sector retirees, it's not all smooth sailin' ahead.

The Waiting Game

The SSA has their work cut out for them, recalculatin' benefits for millions of retirees. This could take a while, makin' some retirees wait for their corrected payments.

Social Security's Struggles

Some Politicians have expressed concern that eliminatin' WEP and GPO will increase the strain on Social Security funds. However, supporters argue that the impact will be minimal compared to other challenges tauntin' the program.

'Fess Up and Stay Informed

Many retirees might not even know they qualify for increased benefits under the new law. It's essential to stay informed and check your Social Security statements.

Top Tips for Beneficiaries: Wake Up and Smell the Fairness

- Check Your Social Security Benefits Statement: Compare new estimated benefits to previous calculations to make sure the WEP/GPO repeal has been applied.

- Contact the Social Security Administration: If you think your benefits haven't been adjusted correctly, give the SSA a ring for a reassessment.

- Stay Updated: Follow official SSA announcements and news reports to track payment adjustments.

- Financial Advisor Visit: Public sector retirees should consider consultin' a financially-savvy advisor to plan for retirement based on their updated benefits.

Conclusion

The Social Security Fairness Act is long overdue, but it's finally here! This legislation abolishes the unfair reductions in Social Security benefits for public sector employees. With the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) in the rearview mirror, millions of retired teachers, firefighters, police officers, and other government workers can look forward to fairer and more equitable retirement benefits.

As the implementation moves forward throughout 2025, retirees will need to stay proactive, check their Social Security benefits statements, and ensure they receive any retroactive payments owed to them. For many public sector workers, this Act represents the hard-earned justice and financial security they deserve after decades of service.

- The Social Security Fairness Act (SSFA) aims to bring financial relief to hardworking individuals in the public sector, including teachers, firefighters, police officers, and state and local government employees, by abolishing antiquated provisions like the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

- The SSFA will ease the financial burden for millions of retired public servants by enhancing their monthly Social Security payments, with many prospective retirees expected to receive an average increase of $400-$500 per month due to the WEP’s elimination.

- Retroactive payments will be issued to those who were underpaid due to WEP and GPO, with eligible retirees receiving a one-time payment covering the months from January 2024 to the time of payment issuance, ensuring greater financial stability for these workers in the long term.