Cashing Out on Combo Meals: A Taxing Conundrum for Fast-Food Chains

Customer Cost in Saving Plans Can't Exceed Individual Purchase Price, Rules Financial Court - Bank Savings Deposit Fees Cannot Exceed Retail Burger Prices, Rules Federal Finance Court

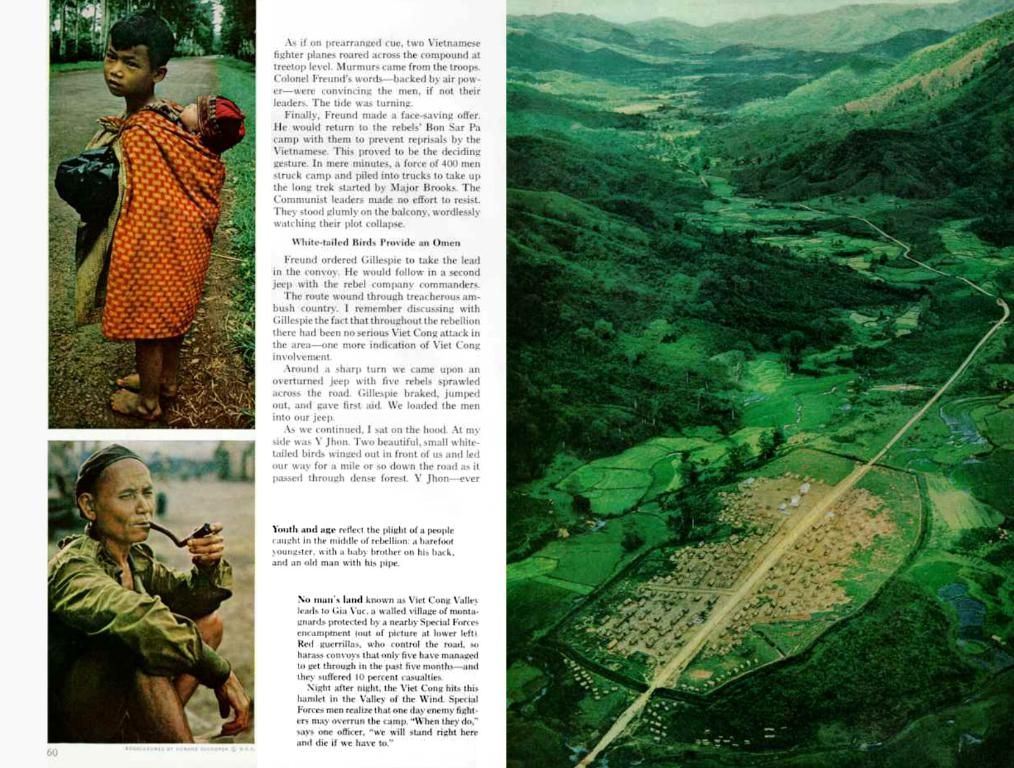

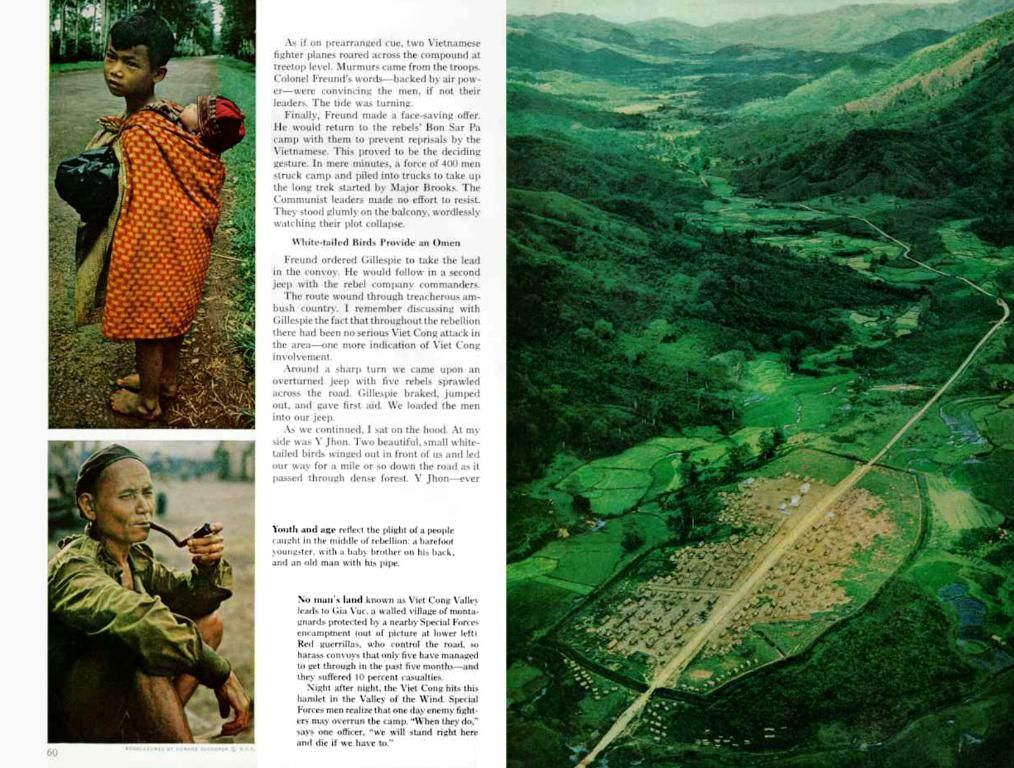

When you gobble down a burger, fries, and a drink from your favorite fast-food joint, you probably don't ponder the price breakdown of each item in your meal combo. But believe it or not, that's exactly what the restaurant and tax office consider!

Why, you ask? Well, here's the lowdown. In Germany, only 7% Value Added Tax (VAT) is charged on food, while a whopping 19% is levied on drinks. That means restaurants and tax offices keep a close eye on the proportion of food and drinks in the combo meal price to reduce the VAT they must pay.

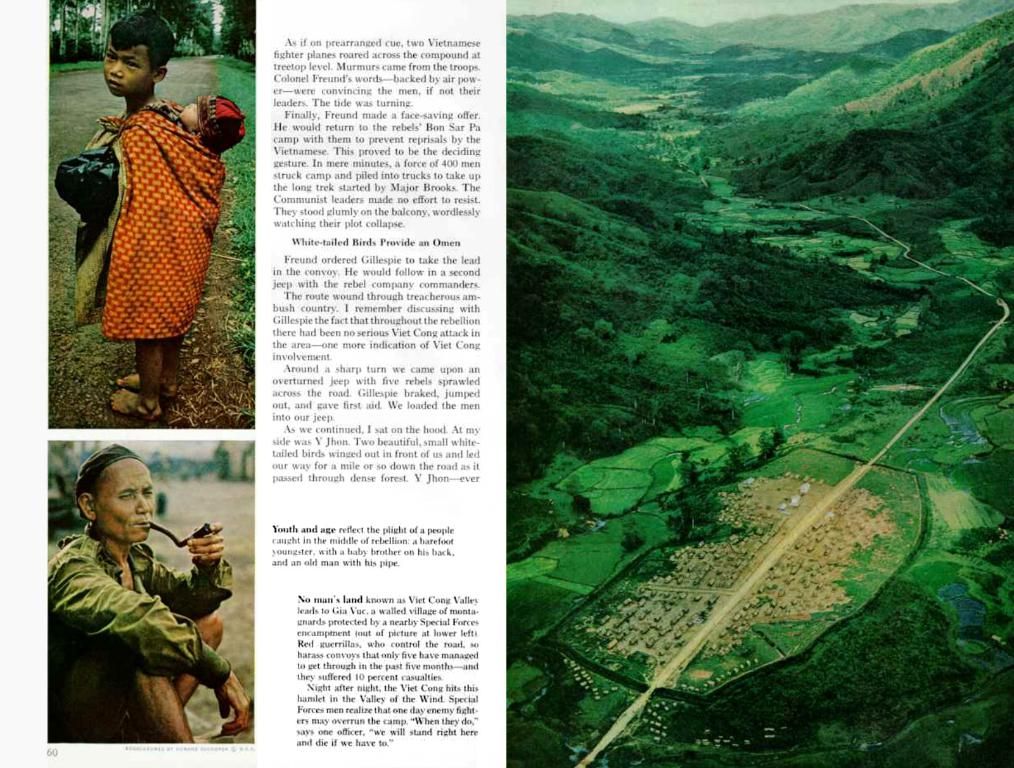

A certain fast-food franchisee in Baden-Württemberg took the matter into their own hands, though. Using a move dubbed the "food-and-paper method" or the "cost of goods sold method," they allocated the cost of the combo meal in a way that made the burger pricier in the meal combo than when purchased separately.

The Federal Fiscal Court (Bundesfinanzhof or BFH) wasn't exactly thrilled with this approach, labeling it unnecessarily complicated and inappropriate for this situation. Consequently, the franchisee must now toe the line and divide the combo meal price according to the individual sale prices of the items, as argued by the tax office.

That being said, other methods have a chance of flying if they're deemed reasonable and less complex. To get the scoop on what method is best for your business, consult a tax professional or jump into the official BFH rulings and German tax authority publications. Remember, the fast-food tax game is a complexity challenge à la Simon Says, so make sure you're armed with the latest knowledge!

The "food-and-paper method" or the "cost of goods sold method" used by a fast-food franchisee in Baden-Württemberg to allocate the cost of a combo meal was considered unnecessarily complicated and inappropriate by the Federal Fiscal Court. For businesses seeking the most effective way to divide combo meal prices, consulting a tax professional or reviewing official BFH rulings and German tax authority publications is recommended, as the fast-food tax game is a complex one.