Boeing's Recent Announcements Indicate Positive Prospects for the Stock by 2025

Boeing's (BA 0.19%) announcement of a substantial 737 MAX order from Pegasus Airlines is a significant event. It's a show of faith in the aircraft and Boeing's capacity to deliver, boosting the optimistic outlook for the stock in 2025. Boeing lacks straightforward or prompt remedies, but most of its challenges and solutions reside within its own control, and the recent news hints at a rebound on the horizon.

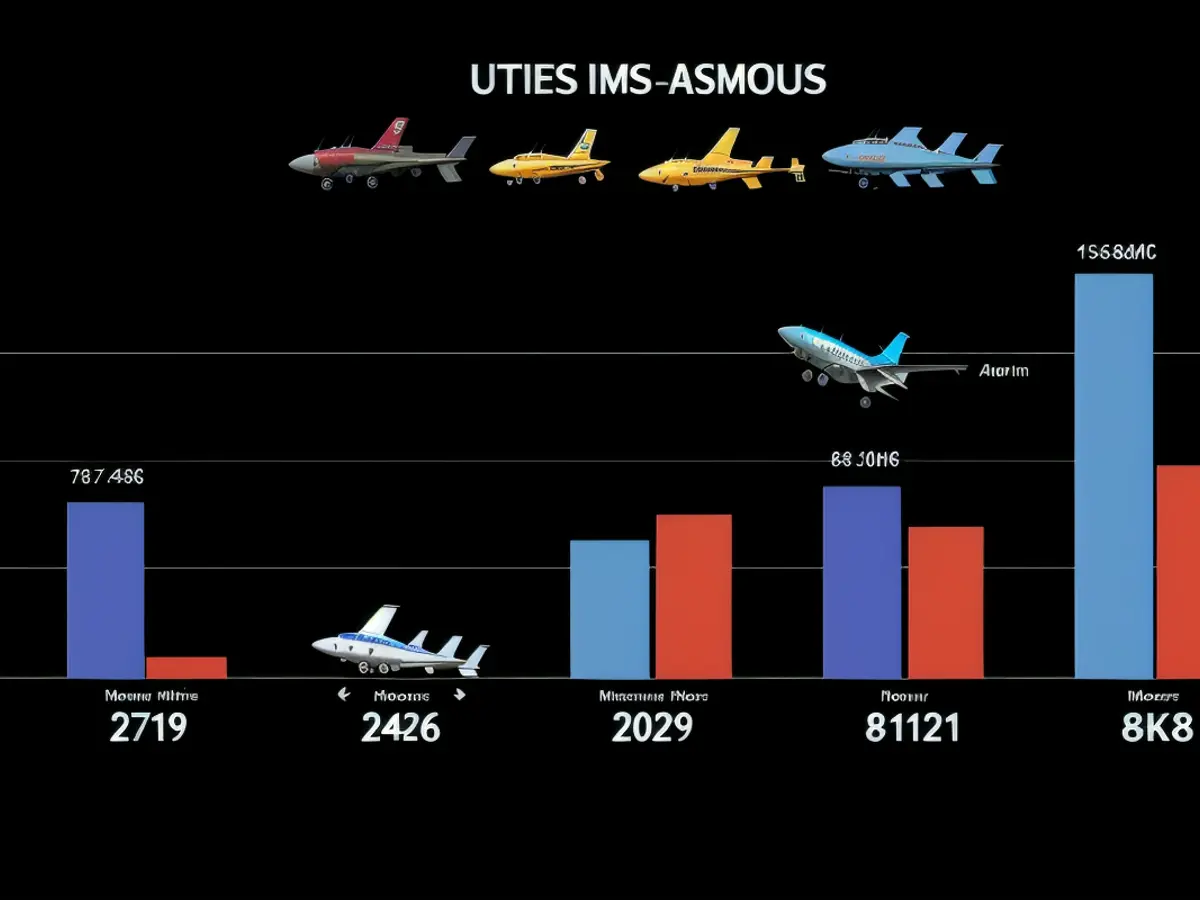

Boeing's Orders in 2024

Pegasus placed a binding order for 100 Boeing 737 MAX airplane models and has the option to order an additional 100. To put the importance of this order into perspective, consider that Boeing had only received 314 gross orders for the 737 by the end of November this year.

The following chart does not incorporate the Pegasus order, allowing you to visually appreciate the significance of an order for 100 Boeing 737 MAX airplanes in the competition for narrowbody orders with Airbus.

Why Boeing Lagged Behind Airbus in the Narrowbody Market

The order is a boost for Boeing, particularly given that its recent problems have resulted in it trailing Airbus in the critical narrowbody market. The tragic accidents in 2018 and 2019 were partially due to its flight stabilization system (MCAS) and led to the 737 MAX being grounded from March 2019 to December 2020.

If that wasn't enough, the pandemic struck in 2020, and the 737 MAX suffered a high-profile explosion in early January 2024, prompting management to undertake a fundamental review of manufacturing quality. Add to that a costly labor agreement negotiation, which led to strikes – potentially delaying orders for airlines – and it's clear that the 737 MAX has suffered in comparison to the Airbus A320neo in the latest generation of narrowbody aircraft. I'll revisit this point later.

The Order Indicates Confidence

Although one order, regardless of its size, isn't likely to be a turning point by itself, it underscores Boeing's potential. This begins with executing its outstanding orders, which stood at 6,268 (including 4,818 Boeing 737s) at the end of November. Apart from quality control issues at Boeing, there was also the concern that airlines would fail to place orders due to a lack of confidence in Boeing's ability to deliver.

These concerns are justified when considering how Boeing's 737 production and delivery rates have slowed due to the need to review quality management and strikes. As a reminder, Boeing's initial goal was to reach a consistent rate of 38 a month for the 737 MAX in the second half of the year, a target that is now delayed until 2025. Nonetheless, the Pegasus deal helps alleviate these concerns.

Where Will Boeing Stand in 2025?

Despite the hurdles in recent years and the underwhelming deliveries in 2024, Boeing's orders have not dwindled, and management still has a backlog that it can fulfill.

As previously mentioned, Boeing has fallen behind Airbus in the current generation of narrowbodies, but this might already be reflected in the share price. It's not expected that Boeing will suddenly surpass Airbus in the narrowbody market, but it doesn't necessarily need to do so for the stock to outperform. Investing in a stock is about acquiring value rather than, in this case, casting a vote for the winner of the narrowbody aircraft war.

The primary long-term ambition is to increase 737 MAX and 787 widebody production and deliveries while delivering the new 777X. Simultaneously, Boeing needs to restore its defense business to profitability. These are the keys to maximizing shareholder value.

All of these factors will enhance Boeing's financial standing, enabling it to develop a new aircraft for the next generation of aircraft. As CEO Kelly Ortberg stated on an earnings call, "Boeing is an aircraft company, and at the right time in the future, we need to develop a new aircraft. But we have a lot of work to do before then."

Next year, Ortberg plans to set Boeing on that course, but there won't be a course without Boeing continuing to secure orders and maintain the confidence of the airline industry, and that's what the Pegasus order assists in confirming.

This significant 737 MAX order from Pegasus Airlines not only boosts Boeing's optimistic outlook for the stock in 2025 but also encourages investors, as they see a potential for increasing returns through investing in Boeing's finance sector. The substantial influx of money from this deal can significantly contribute to Boeing's capacity to deliver more aircraft and further strengthen its financial position.