Business Experiences Net Loss by Flowing Cloud During First Half of 2025

In a surprising turn of events, Flowing Cloud Technology Ltd. (6610.HK) has announced expectations of a loss between 100 million yuan and 130 million yuan for the first half of 2023, marking a stark contrast to the profit of 63.5 million yuan reported during the same period last year. This news comes as the company's stock price dips, currently sitting 60% below its 52-week high.

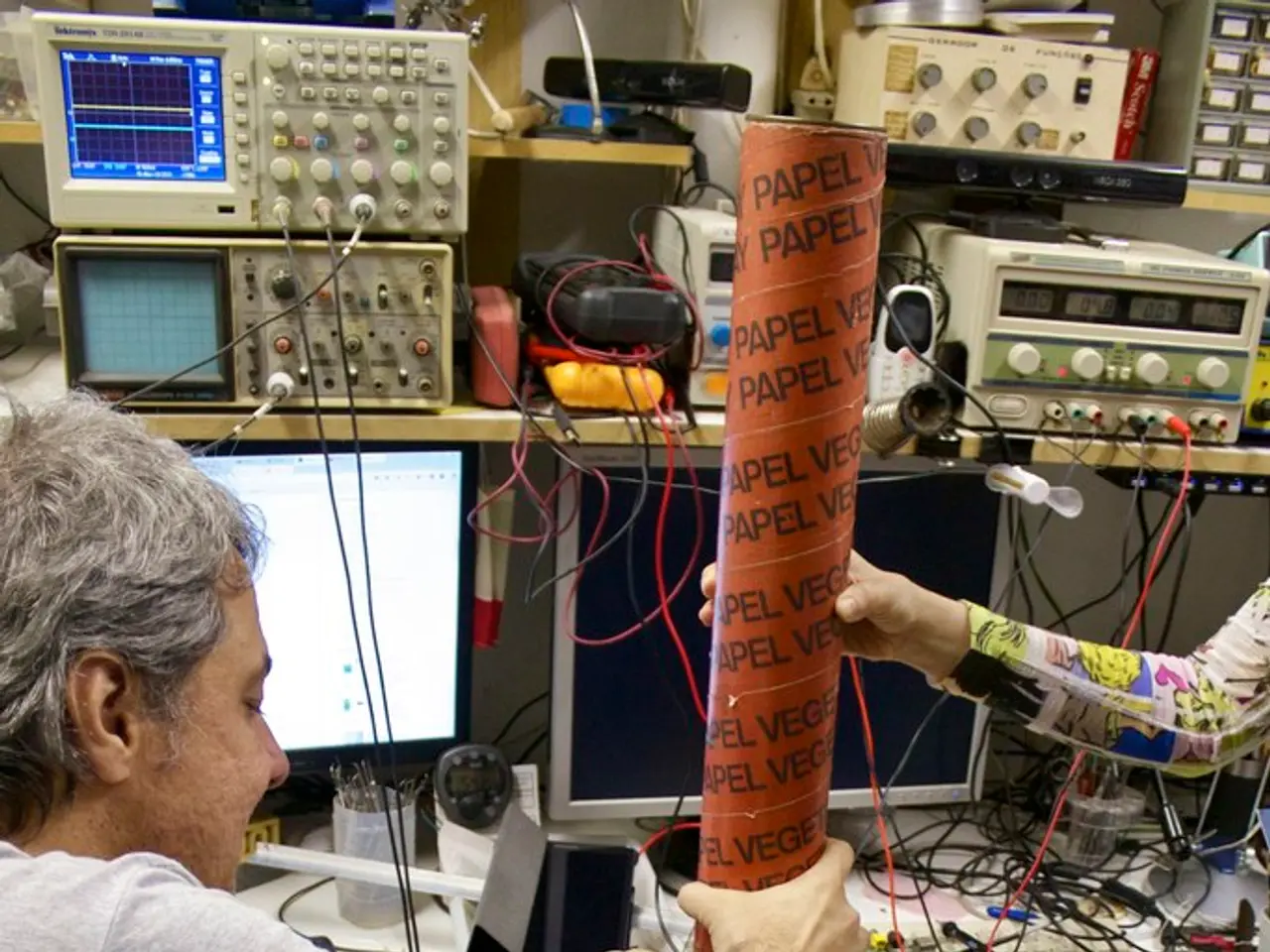

The primary cause of the loss appears to be a decrease in revenue from AR/VR marketing services by 108.2 million yuan compared to the year-ago period. Additionally, increased sales and distribution expenses by approximately 59.2 million yuan during the reporting period have also contributed to the loss.

The company also anticipates an additional impairment loss of 90 million yuan year-on-year due to an internal assessment of trade receivables recoverability.

Shares of Flowing Cloud Technology opened down 9% at HK$0.25 on Tuesday.

For a comprehensive understanding of the company's financial performance, it is advisable to consult the company’s published interim report for the first half of 2021 on the Hong Kong Stock Exchange website or the company’s investor relations page. Financial news sources or databases that track Hong Kong-listed companies’ earnings releases can also provide valuable insights.

This article is written by Lau Chi Hang and serves as a news piece, not an advertisement. For more detailed information about the financial performance elements like impairment losses and revenue changes, or help with interpreting such reports, feel free to ask.

In light of the loss and financial difficulties faced by Flowing Cloud Technology Ltd., it's clear that the technology company's financial and business sectors are experiencing turbulence, with a significant drop in revenue from AR/VR marketing services and increased expenses adversely impacting the bottom line. Meanwhile, technology expenses are anticipated to add an impairment loss of 90 million yuan year-on-year, further contributing to the financial challenges. To gain a better understanding of the situation, it's advisable to refer to the company's published interim report on the Hong Kong Stock Exchange website or their investor relations page.