Bybit Reinforces Institutional Relationships through Invitational Symposium for INS Members During TOKEN2049 Event

╔════════════════════════════════════════════════════════════════════════════════╗║ Unveiling Bybit's Strategic Moves and Industry Influence ║╚════════════════════════════════════════════════════════════════════════════════╝

Welcome to the jungle, but this ain't your typical jungle! Bybit, the beast of the cryptocurrency world, has been shaking things up, carving its path in the digital asset sector. With a trading volume that rivals the mighty, Bybit is the second-largest exchange out there. Let's take a peek at the strategic moves that have put Bybit on the map and its relationships built within the industry.

Recently, Bybit hosted an exclusive shindig called the INS Symposium. The event aimed to foster connections between traditional financial institutions and the digital asset sector, under the catchy theme, 'Bridges of the World.' The guest list included Bybit's institutional clients and ecosystem partners for a day of high-octane discussions about everything from the global economy to e-finance trends. Participants got the lowdown on Bybit's nifty services, including advanced derivatives, rock-solid custody solutions, API infrastructure, and security tools beefed up to fortify financial infrastructure.

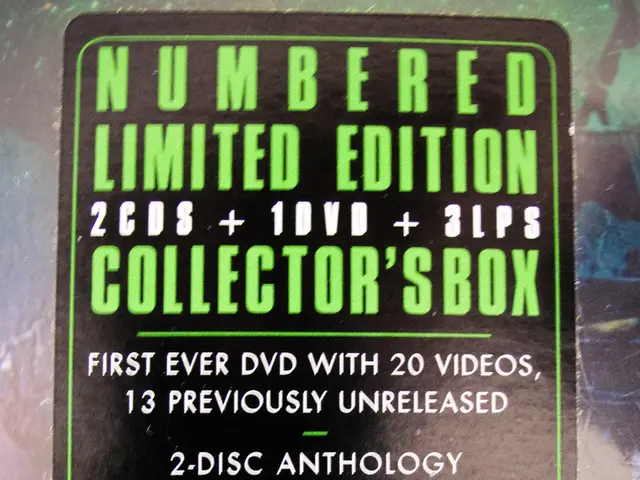

The INS Symposium highlighted Bybit's focus on institutional-grade tools and services. This event underscored the exchange's unified trading account and secure wallet technologies, which cater to the growing institutional demand for robust infrastructure and smooth operational experiences. In 2024, Bybit boosted its institutional clients by a whopping 100%, welcoming over 2,000 active users into the Bybit family.

Strategic Partnerships were a hot topic during the symposium. Shunyet Jan, Bybit's Head of Institutional and Derivatives, spoke about collaborations like the off-venue settlement partnership with Zodia Custody. Bybit also integrates with Fireblocks and Copper for safe asset custody. These alliances help the industry address big wig concerns about safety and compliance, especially for entities entering the crypto market.

Industry heavyweights like Cumberland, SLN Selini Capital, and Zodia Custody graced the event with their presence. The presentations revealed a growing unity between traditional finance and digital assets, with industry leaders praising Bybit's transparency and swift response, particularly in security management. Institutional participants offered valuable feedback, hinting at the event's importance in fostering relationships and collaboration opportunities in the future.

While the search results don't provide many details about recent partnerships within the digital asset sector, Bybit's expansion into traditional assets like US stocks and commodities signals a broader strategic shift in the financial industry. This shift involves blurring lines between traditional finance and crypto-native platforms.

Bybit's cooperation with the Vietnamese Ministry of Finance is another piece of the puzzle. Bybit's CEO, Ben Zhou, has agreed to collaborate with Vietnamese authorities on subjects like system architecture design, transaction oversight, and implementing international best practices in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes. This partnership underscores Bybit's commitment to regulatory compliance and broader financial sector integration.

That's the lowdown on Bybit's strategic moves and industry collaborations! It's just the beginning of a new era in finance, as traditional and digital assets continue to dance in a choreography of innovation and prosperity. 🕺💃️💸🎉.

- Bybit's strategic moves have been crucial in carving its path within the digital asset sector, especially with its focus on institutional-grade tools and services.

- The INS Symposium, hosted by Bybit, brought together traditional financial institutions and the digital asset sector, fostering connections and discussions about global economy, e-finance trends, and Bybit's advanced services.

- Bybit’s strategic partnerships with Zodia Custody, Fireblocks, and Copper aim to alleviate safety and compliance concerns for entities entering the crypto market.

- Bybit has seen a significant institutional growth, boosting its client base by 100% in 2024, welcoming over 2,000 active users.

- The collaboration with Vietnamese Ministry of Finance signifies Bybit's commitment to regulatory compliance and broader financial sector integration, focusing on system architecture design, transaction oversight, and implementing international best practices in AML and KYC processes.

- The broader strategic shift in the financial industry involves blurring lines between traditional finance and crypto-native platforms, as evidenced by Bybit's expansion into traditional assets like US stocks and commodities.

- The dance between traditional and digital assets is a choreography of innovation and prosperity, setting the stage for a new era in finance, with Bybit playing a pivotal role.