Keeping the Money Tight: Russia's Stubborn Stance on High Interest Rates

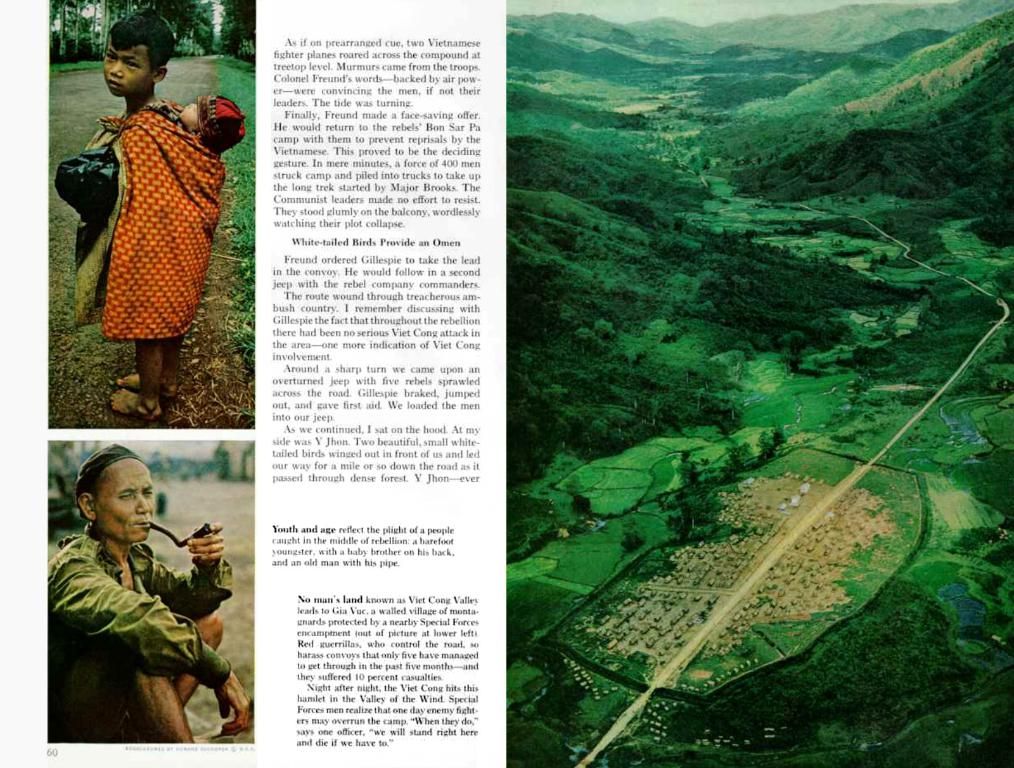

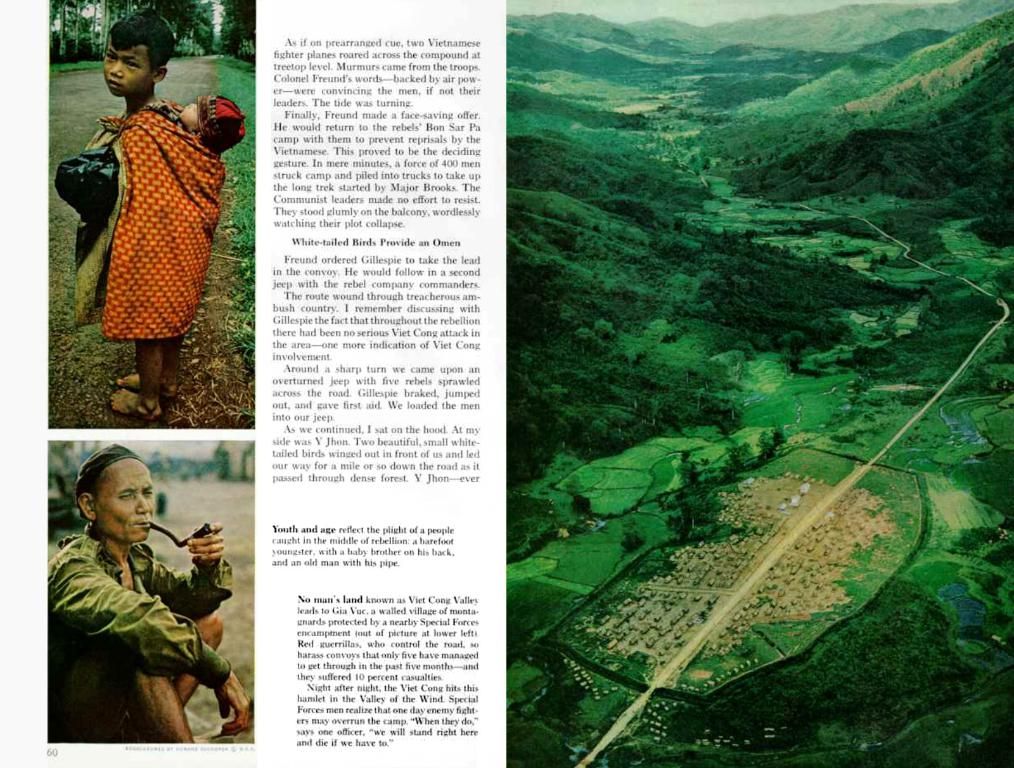

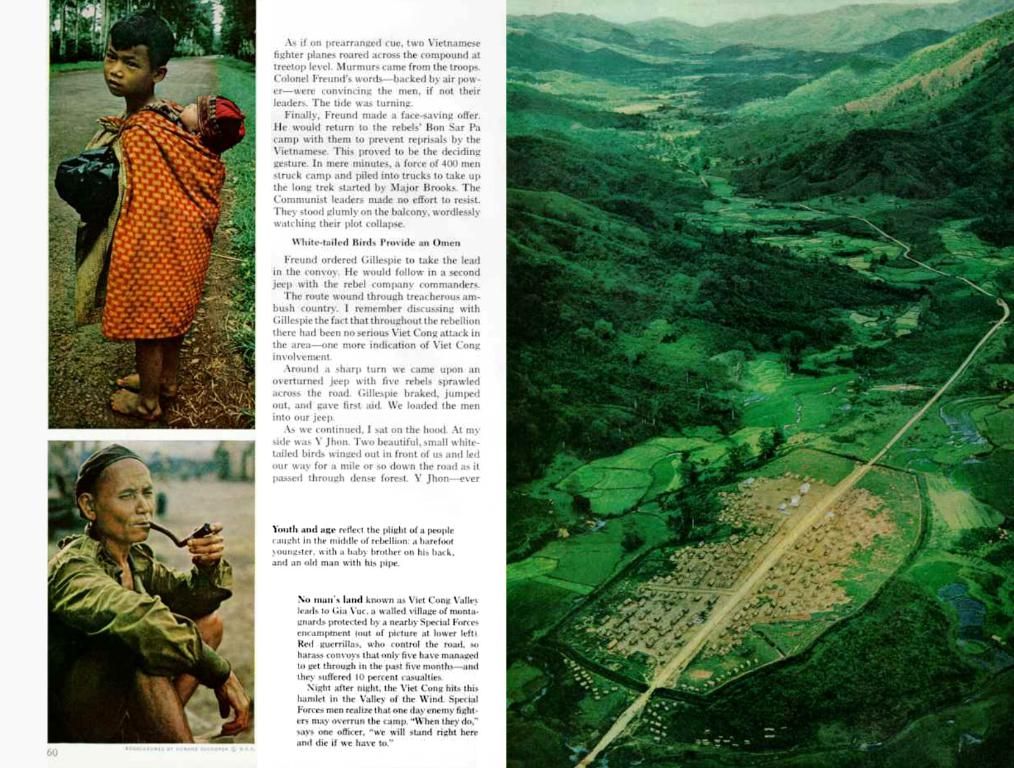

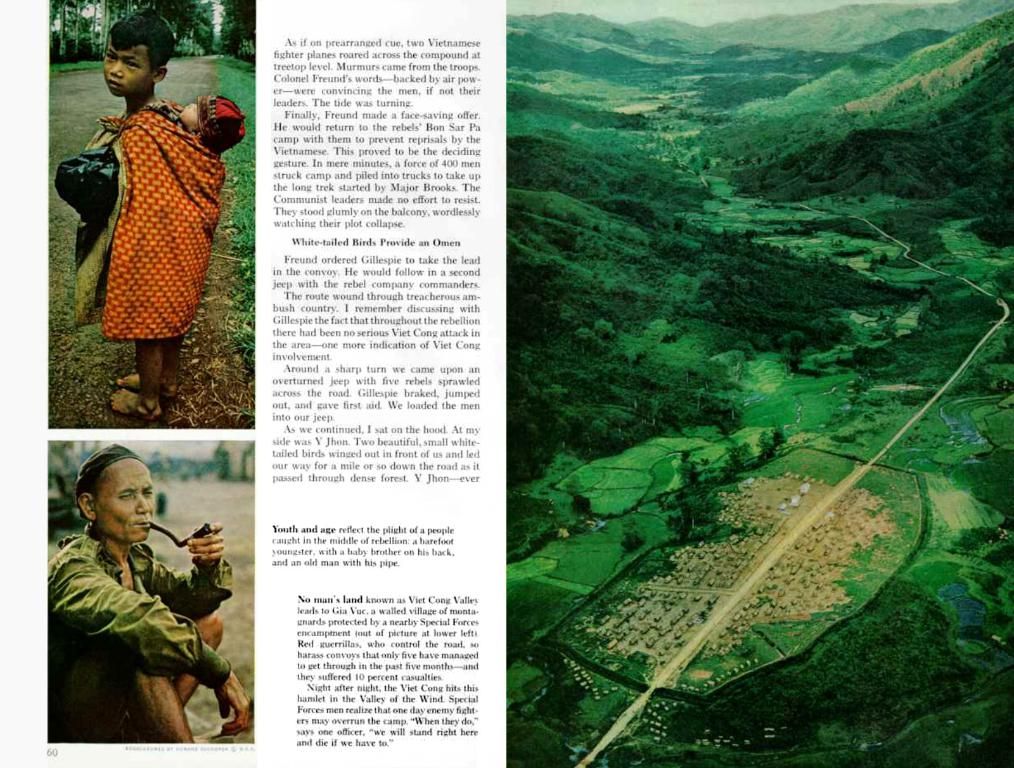

Central Bank of Russia implements stricter monetary measures

Hang out with the cool kids: Facebook Twitter Whatsapp E-Mail Print Copy Link

The Russian Central Bank is sticking to its guns, keeping interest rates sky-high to quell rampant inflation. They've made it clear they'll keep the monetary policy tight as a drum until they bring inflation down to 4% by 2026, as announced on a Friday dust-off. Although credit issuance has taken a nosedive, inflation is still zooming well over 10%.

Consumer prices in Russia have been skyrocketing for months, and predictions suggest an average inflation rate of somewhere between 7 and 8% this year. The Central Bank cranked its key interest rates up to a whopping 21% back in October, and they haven't budged since.

The incessant price hike is simply a reflection of increased military spending, tough Western sanctions, and a massive workforce shortage - more than half a million men are either on the front lines or have Freedomish'd out of the country due to Russia's offensive in Ukraine. To attract workers, companies are shelling out big bucks in salaries, which, in turn, fuels inflation.

The current interest rate of 21% is the highest since 2003, and businesses are howling about the crippling borrowing costs that sap their investments. During a video conference with the Governor of the Russian Central Bank, Elvira Nabiullina, and cabinet members, President Vladimir Putin put his foot down on Thursday, declaring that inflation was through the roof and that Russia's economic growth in 2025 would be "somewhat lower."

Source: ntv.de, AFP

Enrichment Data:

- Overall: Russia is maintaining an historically high key rate of 21% to combat persistent inflation, which remains above 10% annually, driven by wartime spending and structural economic imbalances[1][2][4]. Below are the key factors behind this policy and the inflationary pressures:

- Reasons for High Interest Rates: The Central Bank aims to return inflation to its 4% target by 2026, requiring prolonged tight monetary policy[4].

- Excessive demand: Domestic demand growth continues to outpace supply capacities, necessitating restrictive borrowing costs[4].

- Wartime fiscal pressures: Soaring government spending on the Ukraine conflict exacerbates monetary supply expansion[1].

- Factors Sustaining Inflation:

- Military expenditure: Increased defense and security spending injects liquidity into the economy, driving price growth[1].

- Labor shortages: Acute workforce deficits, partly due to military mobilization, strain production and service sectors[1][3].

- Debt burdens: High corporate debt levels (notably in construction and energy sectors) limit productivity growth, perpetuating supply-demand gaps[3].

- Expectations anchoring: Inflationary psychology among businesses and households risks entrenching elevated price growth[4].

- Economic Outlook: The Central Bank projects 7–8% average inflation for 2025, with gradual rate reductions to 13–14% by 2026[4]. While VTB Bank predicts a modest rate cut to 19% by late 2025, the overall policy stance prioritizes inflation control over growth stimulation[3][4]. President Putin has framed this trajectory as a deliberate "soft landing" to stabilize the economy amid wartime pressures[1].

- The Russian Central Bank, in an effort to combat inflation, has maintained a high key interest rate of 21%, a level not seen since 2003.

- Despite the drop in credit issuance, inflation in Russia remains above 10%, prompting concerns about its employment policy.

- The central government's emphasis on controlling inflation through tight monetary policy could impact the community policy, potentially denting business growth in the finance sector.

- The Russian government's focus on maintaining high interest rates to combat inflation could have broader implications on political and general-news discussions, given the potential effects on employment and overall economic growth.

- The Russian Central Bank's employment policy, focused on combating inflation, could face challenges in the wake of escalating military expenditure, workforce shortages, and existing debt burdens in the construction and energy sectors.