Decrease in remittances forecasted by BBVA for 2025, attributed primarily to reduced Mexican workers in the EU labor market

In a significant development, the BBVA specialist has ruled out the possibility of mass deportations of Mexicans and other migrants in the United States, citing the potential negative impact on the U.S. economy and the possibility of a recession.

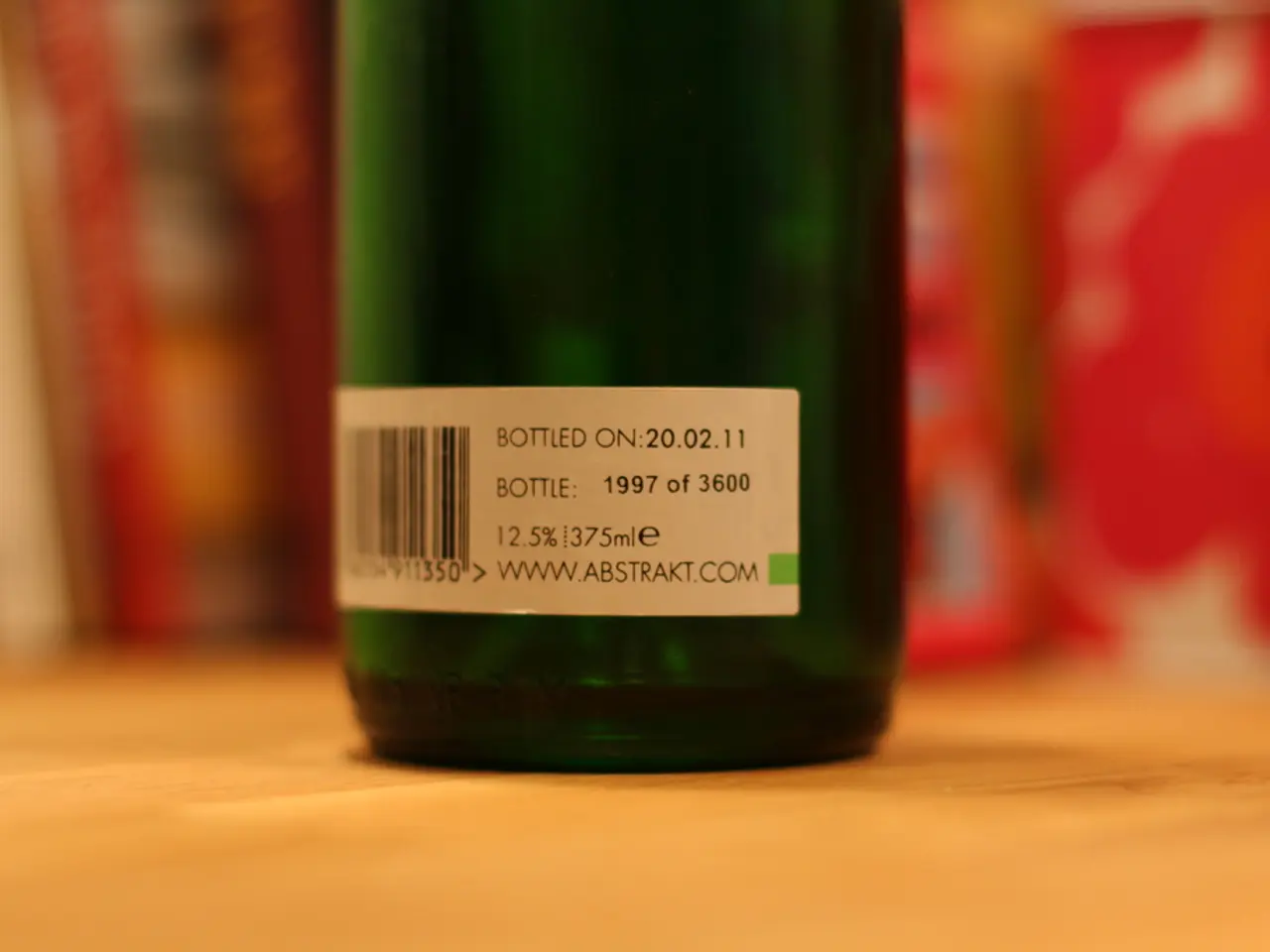

Meanwhile, the Mexican population in the United States has remained stagnant at around 12 million for a significant period. However, remittances from the U.S. to Mexico have been declining since 2013, and this trend is set to continue. According to the 2025 Mexico migration and remittances annual report, presented in conjunction with the National Population Council (Conapo), remittances are estimated to reach $61 billion by the end of 2025, but with an annual decline of 5.8%.

The decline in remittances is primarily due to changes in the U.S. economy and policy, which affect migration and work opportunities. BBVA Mexico's chief economist, Carlos Serrano, stated that the main cause of the decline is the stagnation of the Mexican population in the United States. Fluctuations in employment levels, wages, and immigration policy enforcement in the U.S. affect the ability and willingness of Mexican migrants to send money home.

Remittances have traditionally been a vital source of foreign currency for Mexico, helping to stabilize the Mexican peso and support national economic stability. Many Mexican families depend heavily on remittances for daily expenses such as food, education, health care, and housing. A decline in remittances increases their financial vulnerability and may exacerbate poverty. Reduced remittances can also limit investment in local communities, slowing development and increasing economic disparity between regions reliant on migrant income and those less so.

The decline in remittances is not considered catastrophic from a macroeconomic perspective, but it could have implications for families that rely on remittances from the United States as their main income. BBVA Mexico's chief economist, Carlos Serrano, has stated that about 85% of Mexicans in the U.S. have a bank account, including undocumented ones, so the vast majority will avoid the tax.

Elsewhere, Tesla aims to have the new advanced model for autonomous driving ready by September, according to an announcement by Elon Musk. This development is set to revolutionize the automobile industry and pave the way for a more sustainable and efficient future.

Stay updated on relevant news, opinion articles, entertainment, trends, and more by visiting the website of your trusted news outlet, now available on WhatsApp for your convenience.

- The decline in remittances experienced by Mexico is not only affecting individual families but also impacting the business sector, as remittances have traditionally been a vital source of foreign currency for the country, supporting national economic stability.

- As the automobile industry braces for a potentially revolutionary change with Tesla's advanced model for autonomous driving expected to launch in September, the finance and business sectors should also observe this development closely, as it could significantly influence the future of the industry and usher in a more sustainable and efficient era.