Changin' Up the Crypto Game: A Look at Recent Bitcoin Outflows

Derivative Exchange Bitcoin Withdrawals Signal Structural Change within Marketplace

In the ever-evolving landscape of cryptocurrencies, Bitcoin's recent move from derivative exchanges to spot markets signals a seismic shift in market dynamics. Traders are reportedly reducing their leverage as they opt for a more conservative approach.

Spottin' the Trend

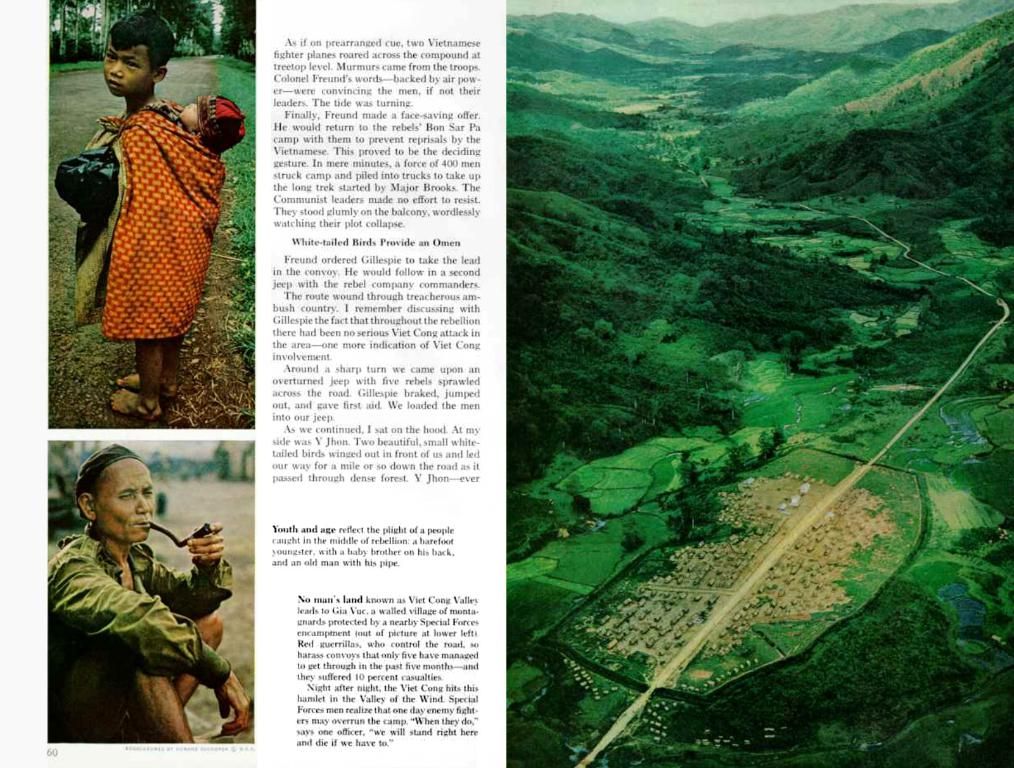

Data shows that Bitcoin is pouring out of derivative platforms and into spot exchanges like never before. This exodus suggests that traders are paring down their leverage or lowering their risk exposure by transferring funds to less volatile environments.

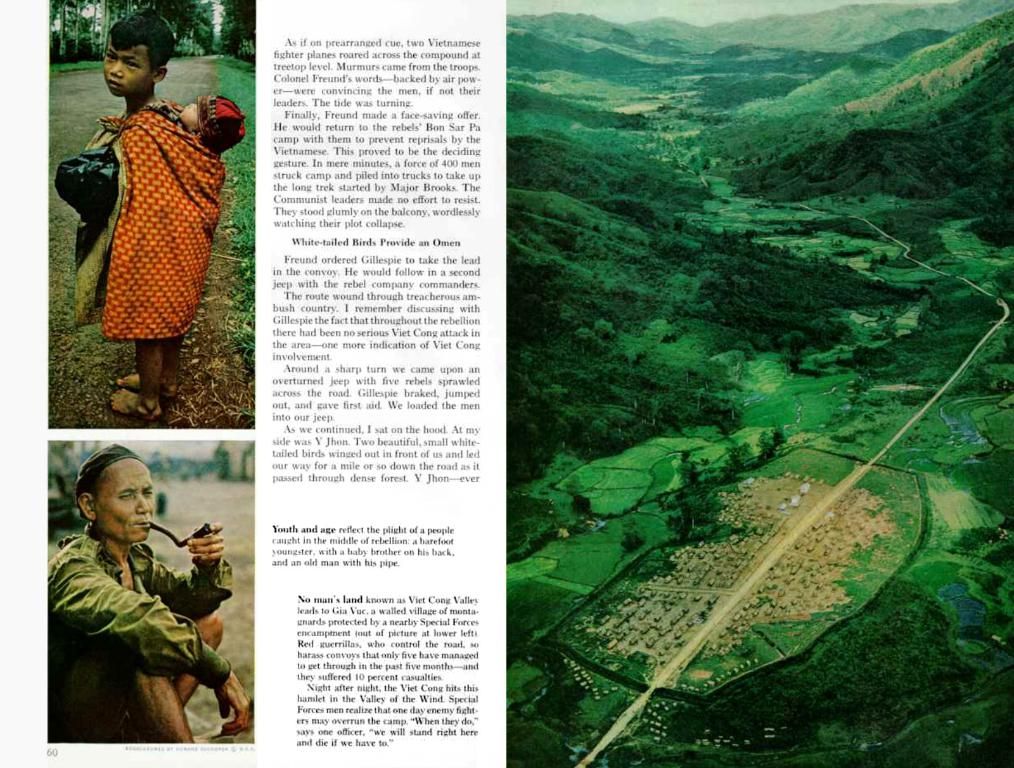

The rumblings in the market can't be ignored. By tracking the Bitcoin Inter-exchange Flow Pulse (IFP), we gain insights into market cycles based on exchange flow activity. Green zones are associated with bull markets, while red regions signal bear markets or corrections.

Bitcoin's price correlates with IFP trends, peaking during bullish phases and dropping during bearish periods. The 90-day moving average of the IFP follows price movements. Notably, significant corrections occurred in 2018, 2020, and 2022, coinciding with red zones. The latest data points to Bitcoin trading near historic highs, with an impressive uptick in IFP.

The Deets Behind the Shift

Giant investors, often referred to as "whales," are the driving force behind this migration from derivatives to spot platforms. This trend hints at a preference for holding Bitcoin over engaging in high-stakes, leveraged trades. Lower activity on derivative exchanges could mean reduced speculative trading, resulting in lower short-term volatility.

Historically, the transfer of Bitcoin to spot exchanges is associated with market stability. Unlike derivatives, where leverage amplifies price swings, spot trading involves owning assets directly. As more Bitcoin moves to spot markets, liquidity may come into play, potentially impacting price action and market depth.

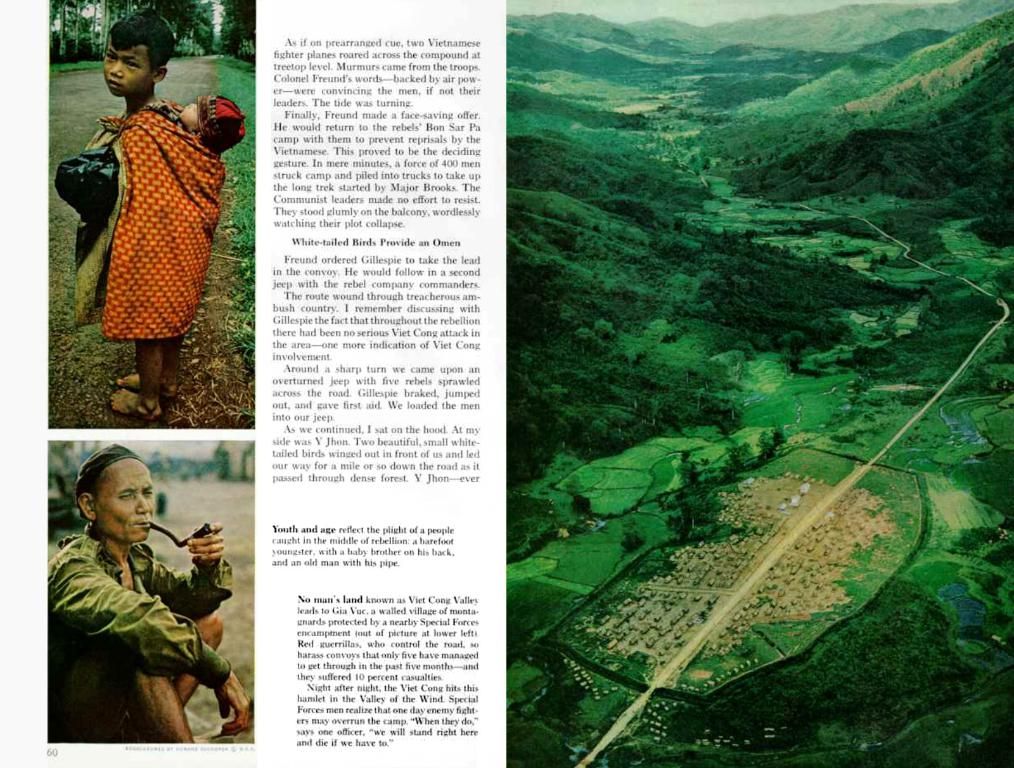

According to Coinglass, current market data reveals mixed movements in Bitcoin's price and trading volume. At the time of this article, Bitcoin trades at a whopping $96,162.50, with a volume of $35.71 billion.

Just a while back, the price soared to a staggering $98,555.16. During these rallies, volume experienced sharp spikes. Historical data exhibits volatility, with price and volume going back and forth like tides. The pattern points to significant market activity, as spikes in volume are often accompanied by major price movements.

Crypto Insider Tip

- Traders and investors should keep a close eye on the flow of Bitcoin between derivative and spot exchanges for insight into potential market shifts.

- In the realm of cryptocurrencies, the ongoing shift from derivative exchanges to spot markets in Bitcoin could indicate a change in market dynamics, as traders opt for a more conservative approach.

- Data indicates that Bitcoin is transferring from derivative platforms to more stable, low-risk spot exchanges at an unprecedented rate, suggesting a withdrawal from leveraged trades.

- By monitoring the Bitcoin Inter-exchange Flow Pulse (IFP), we can discern market cycles based on exchange flow activity, with green zones implying bull markets and red regions signaling bear markets or corrections.

- The latest data shows Bitcoin trading near historic highs with an increase in IFP, indicating the possibility of ongoing bullish trends.

- The migration of Bitcoin from derivatives to spot platforms, driven by large investors, may impact market volatility, liquidity, and price action due to the direct ownership of assets in spot trading.