Bickering over the Proposed Billionaire's Minimum Tax in France’s Senate

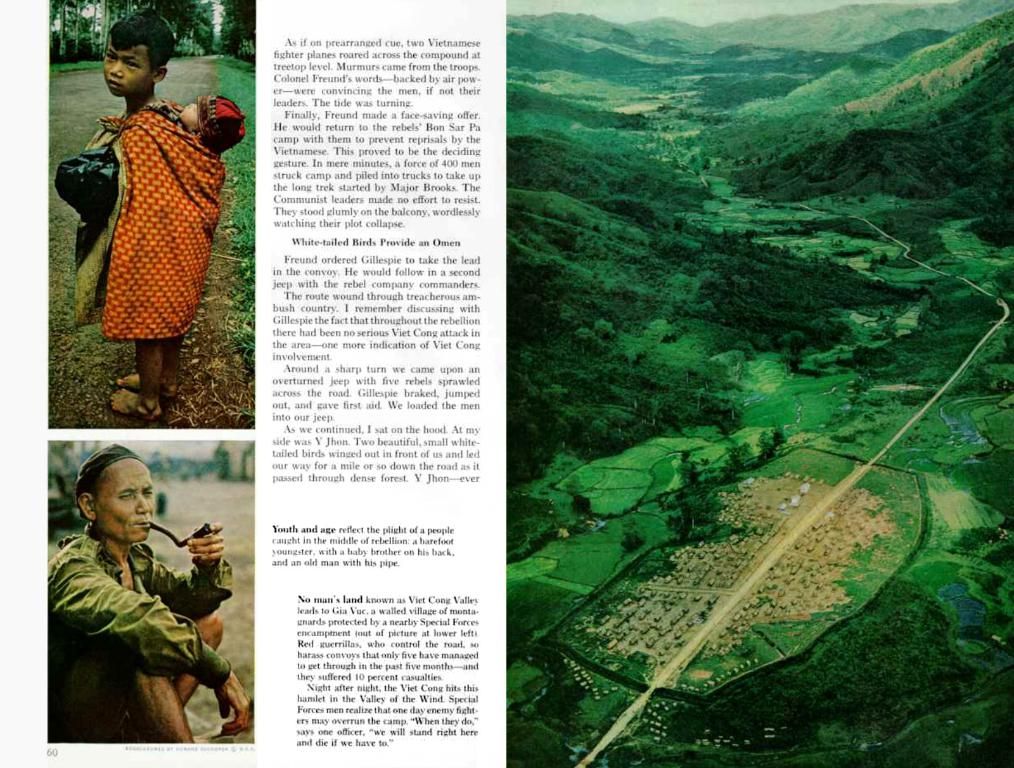

Billionaire wealth under scrutiny: French Senate mulls over proposed 2% tax minimum. - Discussing a proposed 2% tax on French billionaires in Senate debates

The reckless chatter about the two-percent minimum tax slapped on billionaires in France has hit the Senate. François Villeroy de Galhau, the pompous chap heading the French central bank, voiced his concerns before the debate unfolded. He warned France Info that this bizarre scheme could lead to disastrous consequences for French businesses, branding the potential added revenue as "illusory."

The brainchild of this wacky plan is none other than French economist Gabriel Zucman. He thrives on peddling this concept worldwide. In a report by his own think tank EU Tax Observatory, Zucman exposes that billionaires worldwide virtually pay zilch to 0.5 percent tax on their obscene wealth, often finding loopholes by abusing shell companies in tax safe-havens.

Zucman, however, insists that this tax wouldn't affect companies one bit, stating on X that this planned wealth tax would not ruin the allure of French business.

A gaggle of smug non-governmental organizations barged into the Senate Thursday, armed with a whopping 64,000 signatures on a petition supporting the wealth tax. Layla Abdelké Yakoub of Oxfam France enthusiastically declared that this move would herald a new era of tax equality in France.

Senator Emmanuel Capus, a member of a tiny party within the ruling coalition, countered by declaring that the wealth tax proposal equates to outright pilferage and a blatant violation of tax equality.

- Money Grab

- Senate

- France

- Billionaire Tax

- Head

Seemingly out of nowhere, here's some background info:

The proposed “Zucman Tax” aims to impose a 2% annual tax on those with a net wealth exceeding €100 million. Proponents of the tax believe it is necessary to correct a tax system that disproportionately burdens the less fortunate. The tax is also projected to generate about €20 billion annually, which could be used to fund essential public services like healthcare and education, as well as reduce public debt.

On the flip side, opponents argue that the tax could create economic instability, potentially causing billionaires to flee the country with their assets, damaging French businesses. Some also argue that the tax could be unconstitutional, even though this claim is disputed by proponents.

Other countries have pursued similar taxation methods, such as Germany and Sweden, where employees have significant voting power on company boards, aligning with proposals to use wealth taxes to grant more controlling interests. The United States has contemplated wealth taxes but haven’t been enacted at the federal level. The EU has also discussed implementing a uniform wealth tax across its member states to combat tax evasion and promote fairness.

- The debate in France's Senate revolves around the proposed "Zucman Tax," a 2% annual tax on billionaires with a net wealth exceeding €100 million, with concerns over its potential impact on French businesses and economics, as voiced by François Villeroy de Galhau, the head of the French central bank.

- The controversial proposed wealth tax in France, if implemented, could significantly alter the landscape of money distribution, as it aims to generate €20 billion annually to fund essential public services and reduce public debt, as supporters argue, or potentially create economic instability and contribute to the exodus of billionaires from the country, as opponents caution.