Exploring the Foundation of National Economy: The Government's Crucial Role within the Financial Panorama

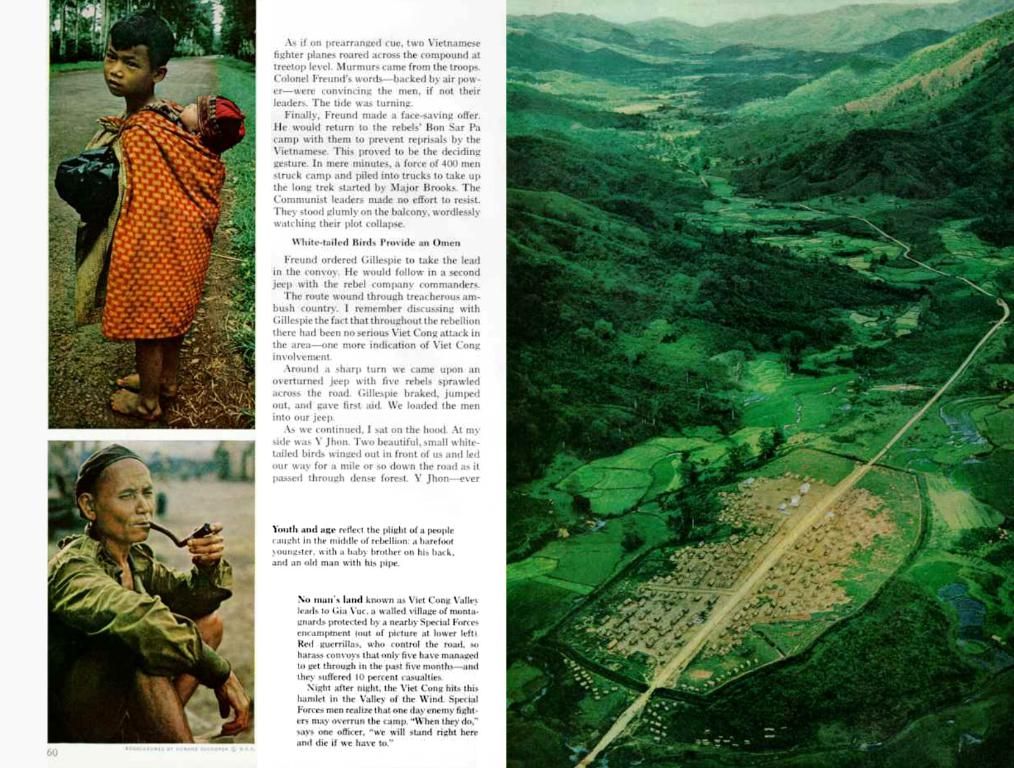

The Realm of Government:

The macreconomic sphere splits into two primary sectors: the public and the private. This piece burrows into the thick of the public sector, delving into its key features, budgetary structure, and far-reaching ramifications on the entire macroeconomic tapestry.

Defining the Government Sector

Embracing all institutional bodies, including the central government, state governments, local governments, and some independent organizations such as the Central Bank and Financial Services Authority, the government sector sits at the heart of the public sphere. State-owned companies, though funded by the government, are excluded, as these entities generate income through selling goods or services, and do not rely on taxes to finance operations.

Harnessing its regulatory powers, the government sector substantially impacts economic activities by issuing rules and policies that directly or indirectly impact the broader private sector.

The Split Between the Government Sector and the Public Sector

Although sharing a common thread, the government sector and the public sector differ slightly in definition. The government sector primarily encompasses units that receive funding through taxes or compulsory contributions. These entities do not produce private goods or service for commercial sale. On the other hand, the public sector includes the government sector along with state-owned companies, which are profit-driven entities generally active in strategic sectors such as utilities, energy, and finance.

The Treasury of the Government Sector

The revenue lifeblood of the government sector derives from taxes. These were traditionally collected from the household and business sectors, divided into two main categories:

- Direct tax: Collected from companies based on their profit margins and revenues. Examples include income tax, corporate tax, and capital gains tax.

- Indirect tax: Imposed on goods and services rather than the taxpayers. Examples of indirect taxes are value-added tax and excise.

The government uses tax revenues for myriad purposes, including funding public services, purchasing goods and services from the business sector, and funding transfer payments to households in need, such as unemployment benefits or income support for low-income families.

In managing the budget, the government faces three options: balanced budget, budget deficit, or budget surplus, with surpluses representing public savings and additional loanable funds on the financial markets, to be potentially lent to private sectors.

The Government Sector's Direction on the Economy

Keynesians argue that the government exerts substantial influence on the economy through fiscal policy, affecting aggregate demand, thereby impacting prices, output, and employment. By way of taxes and government spending, the government tests two economic variables: economic growth, inflation rates, and unemployment rates. The two types of fiscal policy are:

- Expansionary fiscal policy: Deployed to stimulate economic growth and emerge from economic downturns. Options include augmenting government spending and decreasing taxes.

- Contractionary fiscal policy: Adopted to curb inflationary pressures and avoid an overheated economy. Here, the government enacts reduced spending and increased taxes.

When the government spends more, demand for goods and services increases, which encourages businesses to boost production. Lowering tax rates bolsters disposable income, allowing households to set aside less money for taxes and expend more on goods and services. This increased demand bolsters business output.

The Consequences of Budget Deficits

Implementing expansionary policies generally grows the budget deficit or transforms a budget surplus into a deficit. If successful, deficits stimulate economic growth, with the prospect of business profits and household income on the rise, allowing the government to cover its deficit and collect more taxes.

However, continuous deficits over an extended period can harm the economy in the long run. The accumulation of debt increases interest expense and the risk of default, leading to a crowding-out effect. Crowding-out occurs when an increase in government borrowing leads to an increase in interest rates. Higher interest rates stifle private sector investment and consumption, undermining aggregate demand and ultimately impacting economic growth adversely.

The Value of Budget Surpluses

A budget surplus occurs when a government collects more revenue than it spends over a specific period, usually a fiscal year. This extra income provides a financial buffer for the government. Two primary ways to achieve a surplus involve increasing tax revenue or decreasing spending.

Surpluses have multiple advantages for the economy, including:

- Reduced Debt: Surpluses contribute to lowering existing national debt, freeing future resources for alternate priorities and reducing the interest burden on the government.

- Lower Interest Rates: With reduced borrowing, there is an increase in loanable funds in the economy, leading to lower interest rates. This encourages borrowing for investments and spending, fostering economic growth.

- Increased Public Investment: Surpluses can fund public investments in infrastructure, education, or research and development. These investments improve the economy's growth potential over the long term.

Though advantageous, surpluses can also yield disadvantages:

- Slower Growth: If tax cuts are employed to create a surplus, this can diminish government revenue, potentially impeding economic activity. Lower government spending has a similar effect.

- Reduced Social Programs: To achieve a surplus, governments may slash social programs, negatively impacting vulnerable populations.

- The government sector, through its regulatory powers and fiscal policies, impacts the business sector significantly by issuing rules, policies, and implementing taxations, which can directly or indirectly affect economic activities and private businesses.

- The government sector predominantly finances its operations through taxes collected from both the household and business sectors, with taxes imposed on profits and revenues of businesses (direct taxes) and goods and services (indirect taxes) being major sources of income.

![Regional leaders debated financial matters in Berlin (Archived photo) [Image]](/en/img/20250608010726_pexels-image-search-image-description-headline-text.jpeg)