Speed comparable to a swift cock'sard - Faster Progress Regarding Tax Documents

Title: Speedy Tax Returns: A Fast-Paced Race Across Germany

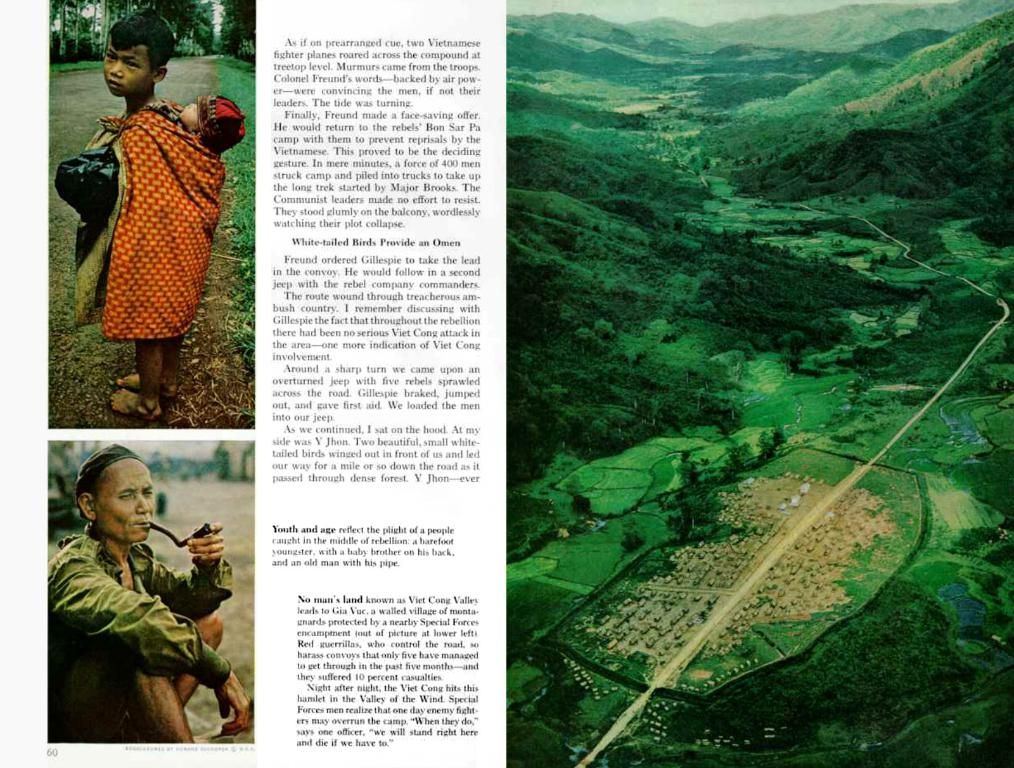

Got 41 days to spare? That's how long Baden-Württemberg taxpayers had to wait, on average, for their income tax assessments in 2024. A leisurely stroll to Santiago de Compostela, or approximately the time it takes a chicken to reach full broiler size in a battery farm.

A significant improvement, you might say? Not quite, when compared to the 54-day average wait time for taxpayers nationwide in 2023. But, Baden-Württemberg's fiscal officers have markedly upped their game. They've jumped from 16th to 4th place, leaving most competitors in the dust. Only Thuringia, Saxony-Anhalt, and Hamburg managed to serve tax assessments faster.

Eike Möller, from the Association of Taxpayers Baden-Württemberg, applauded the advancements. But exactly how have the officials managed to speed things up? Overtime on weekends, skipped lunches, and mountains of paperwork?

Not so much. According to financial administration, the improved speed is due to a decrease in additional work with property tax assessments and the handling of the federal energy price allowance. Moreover, an increasing number of tax returns are being processed automatically. These cases are typically decided in just 10 to 14 working days.

Currently, one out of every five tax returns in Baden-Württemberg is being handled by computers, not humans. Not a lot, compared to other states—Baden-Württemberg ranks 15th with an automatic case quota of 20.1 percent. The national average stands at 22 percent. Möller, the tax association head, believes there's still room for improvement, with the goal of increasing the automatic case quota rapidly in the coming years.

Efficiency, it seems, is the name of the game. So, if you submit your tax return today, you might just get it back before the next chicken dinner.

Now, why the rush? [Insight: General Improvements in Tax Processing]- Technological advancements- Streamlined procedures- Proper training of staff- Changes in tax laws and regulations- Resource allocation

How does automation speed things up? [Insight: Role of Automatic Case Processing]- Increased efficiency- Lower error rates- More time for human review of complex cases

Still curious about Baden-Württemberg's specific trajectory? Check out announcements from the regional tax administration or local government resources.

In the spirit of improving personal-finance management, one might consider channeling the speedy tax return process in Baden-Württemberg towards community aid. For instance, vocational training programs could be funded faster, enabling fewer jobless individuals to join the workforce and manage their own budgeting more effectively. Consequently, more vocational training, such as skilled trades or technical education, could be offered to unemployed individuals, fostering a more self-reliant and financially stable community.