Unearthing the Investment Euphoria: A €46B Tax Break Wave for Businesses

Government endorses financial stimulus for businesses

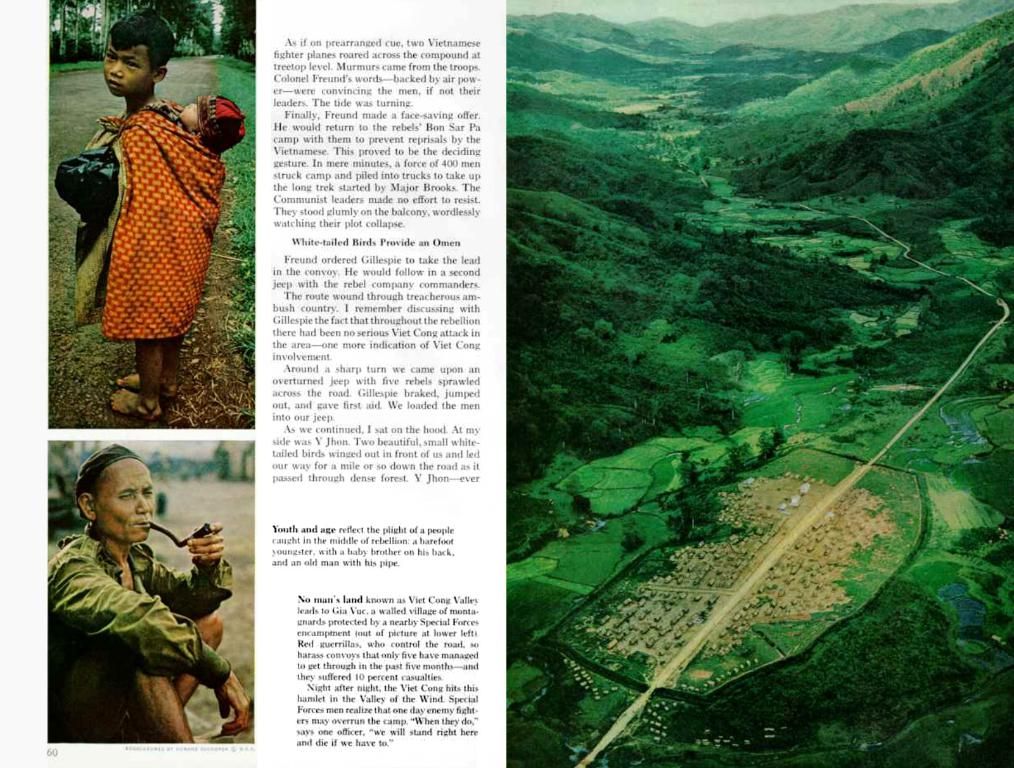

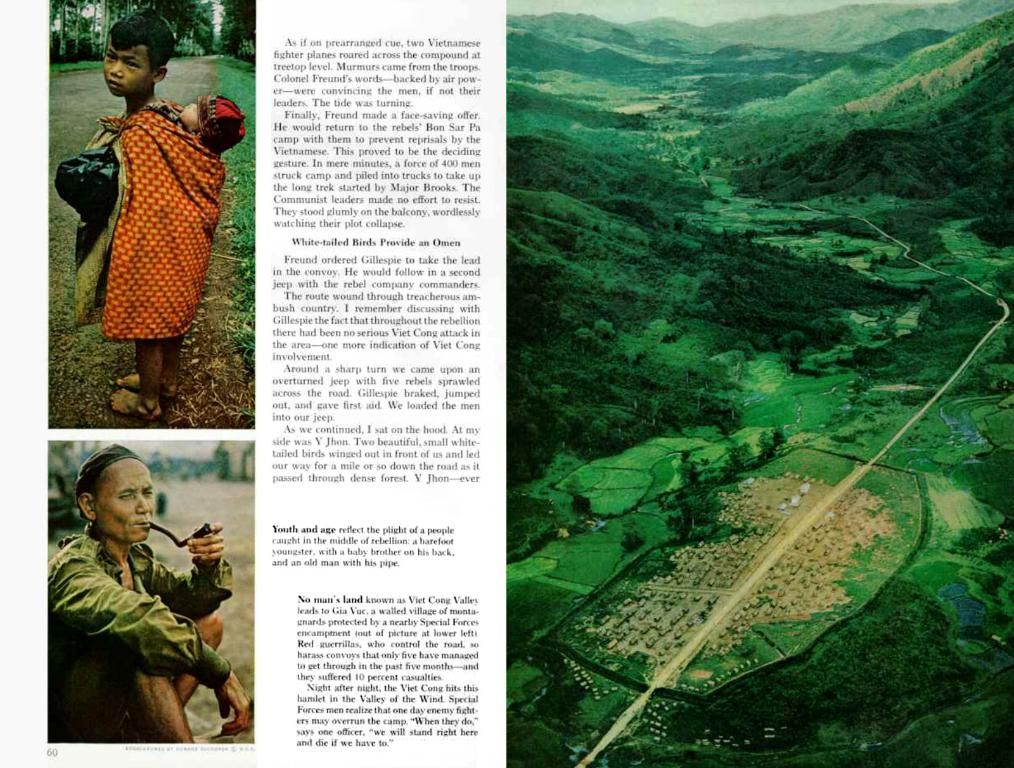

Chatter Now: Facebook, Twitter, WhatsApp, Email, Print, Copy Link

In a glowing green light from the federal cabinet, a jaw-dropping €46 billion relief bill aims to breathe life back into Germany's economy. Here's what's in store for businesses over the next five years:

The Big Four: Investment Booster's Key Components

- Super Deductions (Accelerated Depreciation):

- An instant 30% corollary off your bill for machinery investments from 2025 to 2027. Say goodbye to heavy early tax burdens!

- Reduced Corporate Tax Rate:

- Get ready for a successive reduction in corporate tax rates, sliding down to 10% by 2032. You'll be more competitive and attractive to overseas investors!

- Electric Mobility Booster:

- Hop in an electric vehicle priced under 100k euros, and savor a lucrative 75% instant depreciation on your investment in 2025-2027. This initiative sparks an electric revolution!

- Research Promotion:

- A generous research funding scheme lies at the heart of this initiative, though specifics remain a mystery for now. Prepare for more groundbreaking advancements in key industries!

This steaming economic gusher is set to hit businesses in 2025, with the parliament pledging to fast-track the decision-making process for a summer break conclusion.

Optimism Unfurled: Experts' Take

Tobias Hentze, renowned tax expert from the Cologne Institute of the German Economy, voices enthusiasm about the government's commitment to the package, calling it a welcome departure from idle promises. Degressive depreciation, says Hentze, supercharges inherent financial incentives for earlier and bigger investments, stimulating economic growth. But remember, he cautions, these tax benefits are only temporary relief.

Simon Pex, a seasoned investment professional at Carlyle, identifies an uplifting change in Europe's investment climate. With renewed focus on Germany, he predicts a potential investment bonanza in the following decade, positioning the country as a hub for new opportunities!

A Cautious Note of Warning

The federal states may pose the biggest hurdle to the enactment of this relief package. While they can offset lower tax revenues thanks to debt brake changes, municipalities may face financial peril. Bearing a third of the relief (around 11 billion euros from 2025-2028), massively overstretched municipalities risk diving even deeper into the red.

Tune in for the debate on Thursday, as our elected officials weigh the pros and cons of this grand tax-relief package. Brace yourselves for an exciting summer in the world of corporate taxation!

Sources: ntv.de, rog/rts

- Government Relief Package

- Additional Insights:

- Infrastructure Drive: Accompanying the tax relief package, an €500 billion infrastructure fund has already been greenlighted. This hefty investment will modernize transport, energy, and digital networks over a 12-year stretch, extending holistic support to the country's economic recovery.

- Job Market Impact: By stimulating growth and attracting foreign investors, Germany’s tax relief package may create new job opportunities, contributing to overall employment figures in the country. This may, in turn, help to alleviate unemployment and provide a boost to both business owners and workers.

- The community policy should address the potential financial implications of the government relief package, particularly in relation to the increased employment opportunities that may arise due to the €46 billion tax break wave for businesses.

- The employment policy needs to be aligned with the government's investment strategy, focusing on attracting and retaining skilled workers to capitalize on the expected growth in business activities driven by the finance-related aspects of the relief package and the accompanying infrastructure improvements in the business sector.