Heat on Former Greensill Bank Managers as Lawsuit Looms

Litigation Filed Against Ex-Bank Manager of Bankrupt Greensill - Investigation or Penalty against Previous Administrator of Collapsed Greensill Bank

In the aftermath of Greensill Bank's demise, the ex-managers are finding themselves under a substantial spotlight. The insolvency administrator, Michael Frege, has taken legal action against no less than seven individuals, as reported by Handelsblatt. The lawsuit, worth an astonishing 92 million euros, is making waves in the Regional Court of Bremen.

Currently, the written preliminary process is underway, according to the court spokesperson. This stage involves the parties presenting their arguments in writing, a process that's currently unfolding.

The Bremen public prosecutor's office is eager to bring the investigations to a close. "Our aim is to wrap up the proceedings by year's end," remarked Chief Public Prosecutor Frank Passade to Handelsblatt. The allegations stack up; they range from bankruptcy and balance sheet fraud to downright deception. Preliminary findings suggest that the bank had booked nonexistent billions in receivables. Yet, the 13 suspects have kept mum on the issue, leaving the outcome uncertain. To determine whether an indictment will be issued, we'll have to wait and see.

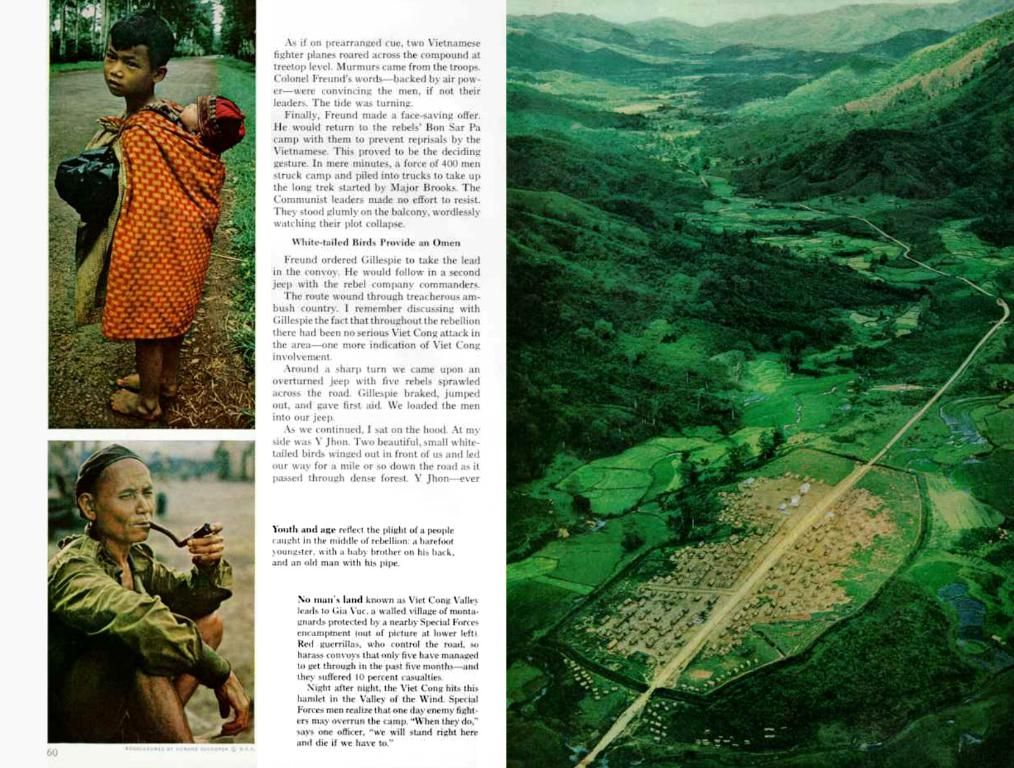

Bremen's Greensill Bank was a popular choice among customers, enticing them with high-interest rates on time and fixed-term deposits. Regrettably, the bank bit the dust in March 2021. While private savers were compensated, municipalities were left with hefty sums.

It's worth noting that Greensill Capital's administrators are engaged in several legal battles, including a $250 million lawsuit against Zurich Insurance. Another lawsuit, worth $400 million, implicates Greensill and Gupta, with a trial date scheduled for October 2027.

Moreover, Credit Suisse has found itself in hot water too. FINMA concluded a proceeding against Credit Suisse for serious breaches of supervisory and risk management while handling $10 billion in supply chain funds. UBS is currently settling a US tax probe associated with Credit Suisse.

If you're in search of detailed information about the lawsuit against former Greensill Bank managers, it might be beneficial to delve deeper into legal or financial news sources.

- The lawsuit against seven former Greensill Bank managers, currently underway in the Regional Court of Bremen, alleges bankruptcy, balance sheet fraud, deception, and the booking of nonexistent billions in receivables.

- The outcome of the lawsuit is uncertain, as the 13 suspects remain silent on the issue.

- Greensill Bank, popular among customers for high-interest rates on time and fixed-term deposits, ceased operations in March 2021, leaving municipalities with substantial financial losses.

- Greensill Capital's administrators are also involved in other legal battles, including a $250 million lawsuit against Zurich Insurance and a $400 million lawsuit involving Greensill and Gupta with a trial date scheduled for October 2027.

- Credit Suisse is facing criticism for serious breaches of supervisory and risk management while handling $10 billion in supply chain funds, and UBS is currently settling a US tax probe associated with Credit Suisse.