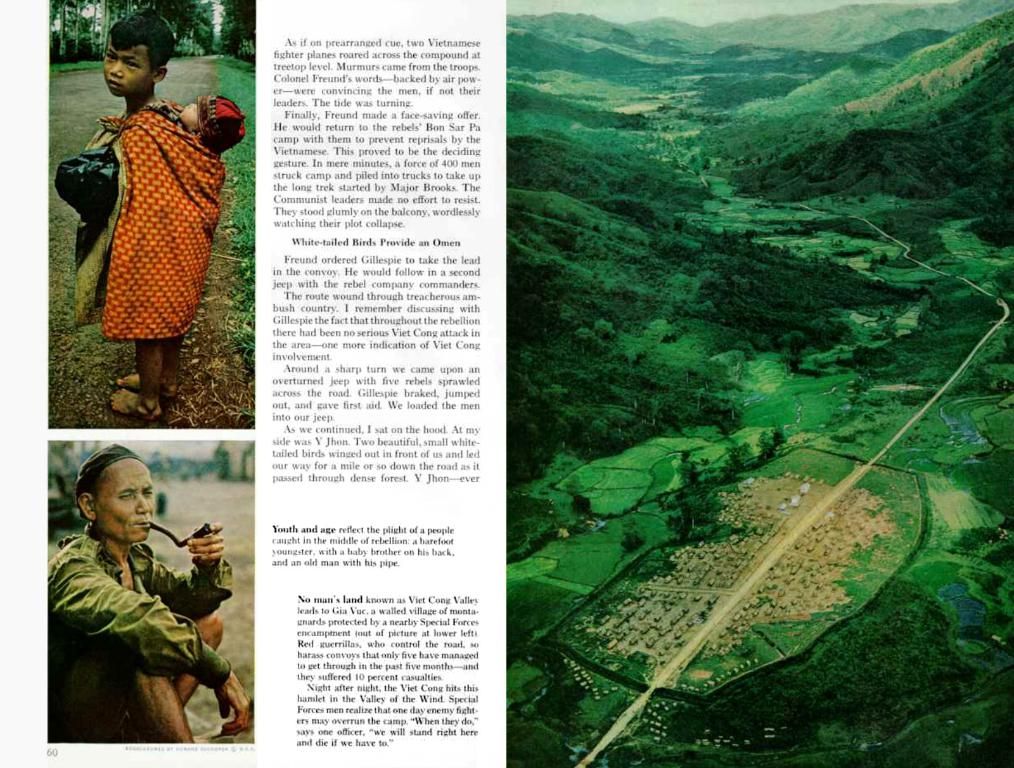

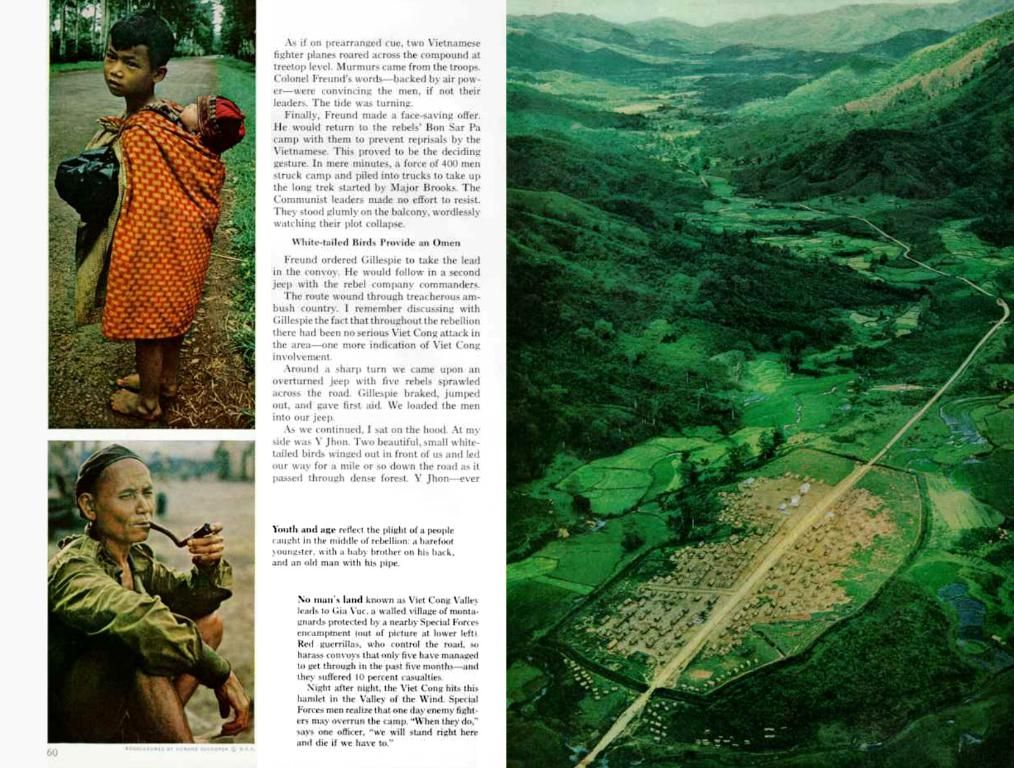

"Investment guru Jeffrey Gundlach issues warning: $25 trillion of assets could be withdrawn from the U.S. market due to mounting fiscal deficits."

Gundlach's Alarm Bell: Foreign Investors to Exit US Markets?

Jeffrey Gundlach, the much-revered "Bond King," has issued a warning putting US investors on edge. In a candid interview with Bloomberg, the CEO of DoubleLine Capital pointed to a string of peculiar occurrences in the stock market, the dollar, and the Treasury market, that need closer examination.

Gundlach highlighted a growing sense of unease among investors concerning the US government's unsustainable fiscal trajectory, signaling looming risks ahead [6]. "Weird stuff is happening," he remarked, pointing out that the dollar normally strengthens during market corrections, the Fed rate cuts usually send yields plummeting, and the 10-year Treasury typically rallies following the first Fed cut. However, this time around, the trends are flipping on their heads [6] [7] [8].

Echoing his concerns, Gundlach zeroed in on foreign investors, underscoring that they hold around $25 trillion in US assets. With the dollar plummeting and the increased fiscal risk, it isn't inconceivable that foreign investors might decide to cash out, shifting funds to more stable international markets [6].

Stop by our channels on Twitter, Facebook, and Telegram to be the first to catch the latest developments [9]. Never miss a beat with our email alerts, or check out our Price Action and Daily Hodl Mix for updates on crypto markets [9].

Some insight for you: Gundlach's warnings can be understood within broader financial contexts, including the U.S. debt levels, the trajectory of interest rates, the fading confidence in US assets, a potential shift away from dollar-denominated assets, and market patterns and signals signaling a change in investor sentiment [10].

Industry Announcements* FIFA Rivals takes the world stage, delivering immersive arcade football action for mobile users [1].* Polemos, together with BUFF, accelerates Web 3.0 adoption with a groundbreaking strategic partnership [2].* Bitpanda steps into the Web 3.0 era, launching Vision (VSN) [3].* tBTC expands its presence in the multi-chain DeFi landscape by launching on Starknet [4].* Allnodes bolsters the Solana ecosystem by launching bare-metal servers for validators and builders [5].* Falcon Finance cements its custody integration with BitGo for USDf synthetic dollar [5].* Interactive Strength Inc., under the ticker NASDAQ: TRNR, enters a $500 million facility to acquire AI-focused FET tokens and launch a crypto treasury asset strategy [6].

Join us on Telegram, X, or Facebook for more industry insights! Receive the latest updates directly to your inbox by subscribing to our newsletter [8].

Disclaimer: Opinions in The Daily Hodl do not constitute investment advice. Investors should conduct their due diligence before making high-risk investments in bitcoin, crypto, or digital assets. Keep in mind that transfers and trades are at the investor's own risk; any losses are your responsibility. The Daily Hodl, with its affiliate marketing, is not an investment advisor [8].

Generated Image: Link to image source

Industry Announcements* FIFA Rivals Launches Worldwide, Bringing Non-Simulation Arcade Football Action to Mobile DevicesJune 12, 2025* Polemos Announces TGE and a Game-Changing Strategic Partnership With BUFF Accelerating Web 3.0 AdoptionJune 12, 2025* Bitpanda Opens the Gate to Web 3.0 With Vision (VSN)June 12, 2025* tBTC Launches on Starknet, Expanding Bitcoin's Role in Multi-Chain DeFiJune 11, 2025* Allnodes Launches Bare-Metal Servers for Solana Validators and BuildersJune 11, 2025* Falcon Finance Announces Custody Integration With BitGo for USDf Synthetic DollarJune 11, 2025* Interactive Strength Inc. (Nasdaq: TRNR) Enters Into $500 Million Facility To Acquire AI-Focused FET Tokens and Launch Crypto Treasury Asset StrategyJune 11, 2025

$*$*105,403.240.26%$*$*2,527.600.62%$*$*650.700.06%$*$*147.471.07%$*$*2.170.13%### Spotlight

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should undertake thorough research before making any significant crypto investments. You acknowledge the risks associated with such investments, and any resulting losses are your responsibility. The Daily Hodl is not an investment advisor.

Copyright Daily Hodl, 2025.*

- FEATURES

- News

- Bitcoin

- Ethereum

- Altcoins

- Financeflux

- Trading

- NFTs

- Blockchain

- Futuremash

- Regulators

- Scams, Hacks & Breaches

- HODLX

- Latest Stories

- FAQ

- Submit Guest Post

- INDUSTRY ANNOUNCEMENTS

- Latest

- Press Releases

- Chainwire

- Sponsored Posts

- Submit Your Content

- CRYPTO MARKETS

- SUBMIT

- Guest Post

- Press Release

- Sponsored Post

- Advertise

Covering the future of finance, including macro, bitcoin, ethereum, crypto, and web 3.

Categories

Bitcoin • Ethereum • Trading •Altcoins • Futuremash • Financeflux •Blockchain • Regulators • Scams •HodlX • Press Releases

ABOUT US | EDITORIAL POLICY | PRIVACY POLICY| TERMS AND CONDITIONS | CONTACT US | ADVERTISE WITH US

JOIN US ON TELEGRAM | JOIN US ON X | JOIN US ON FACEBOOK

Copyright © 2025 The Daily Hodl

- Jeffrey Gundlach, the CEO of DoubleLine Capital and the "Bond King," suggested that foreign investors could potentially withdraw their $25 trillion worth of assets from the US markets due to the plunging dollar and increased fiscal risk.

- In discussing the US financial landscape, Gundlach pointed out the growing concern among investors about the unsustainable fiscal trajectory of the US government, which could lead to risks for the cryptocurrency market, including altcoins, considering foreign investors' key role in the crypto industry.

- With Gundlach's warnings underlining the fading confidence in US assets and a potential shift away from dollar-denominated assets, the business environment for digital assets like blockchain, cryptocurrency, and investing in this sector could be significantly impacted by foreign investors' allocation decisions.