Key Rate Slash to 20% by Central Bank: Anticipated Impacts on Price Levels, Loans, and Deposits

Let's break down the Central Bank's latest key rate decision.

Picture this: the Central Bank's board of directors huddled up on a Friday, discussing what to do with the key rate again. Should they drop it, hike it, or leave it as is? The decision seemed usual, but this time, most analysts pointed towards the first option.

The debate boiled down to this – would they lower the rate to 20%, or dive directly to 19% per annum. What caused this change in strategy? What happens next? Let's dive in and find out.

Inflation's Final Onslaught?

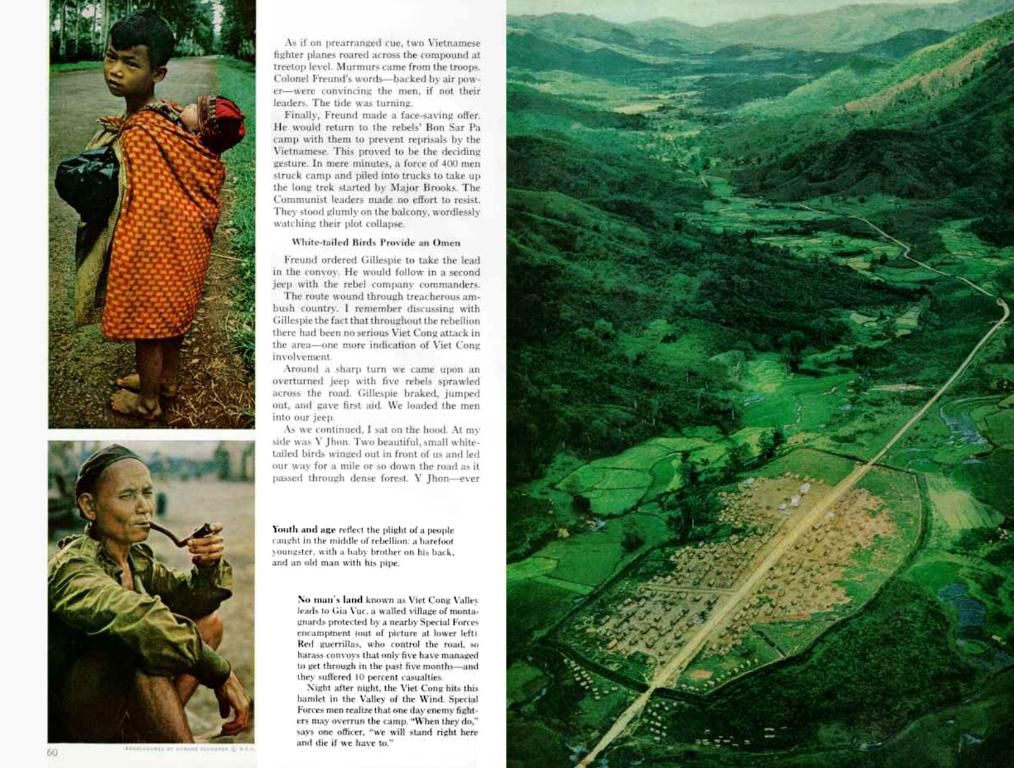

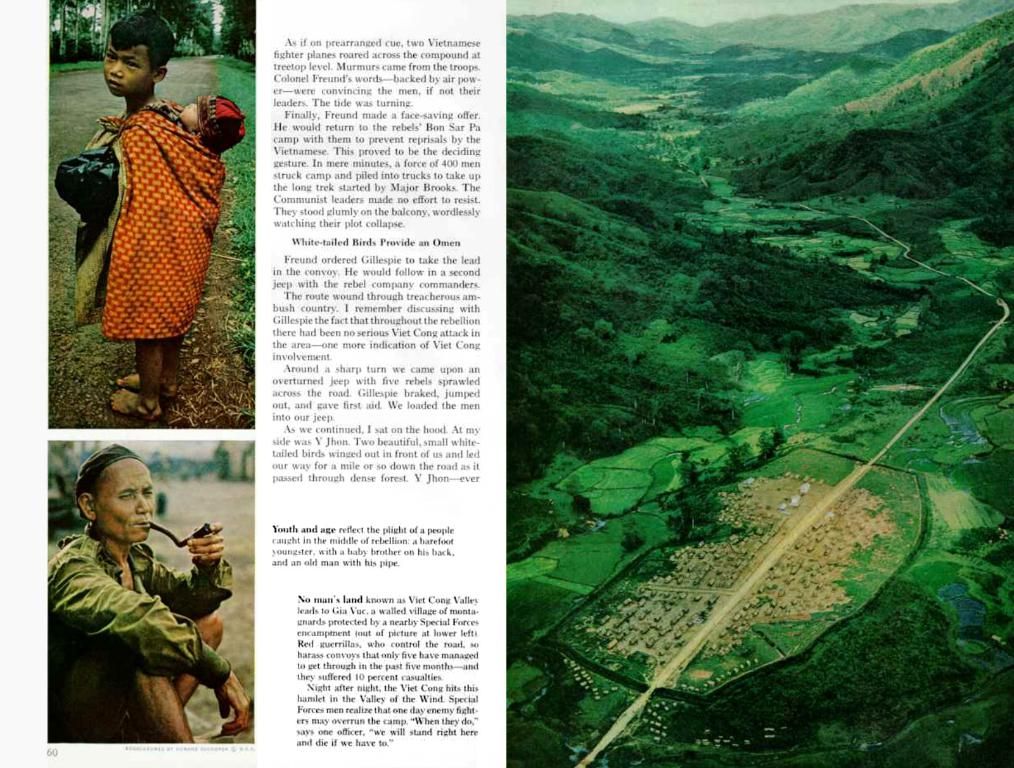

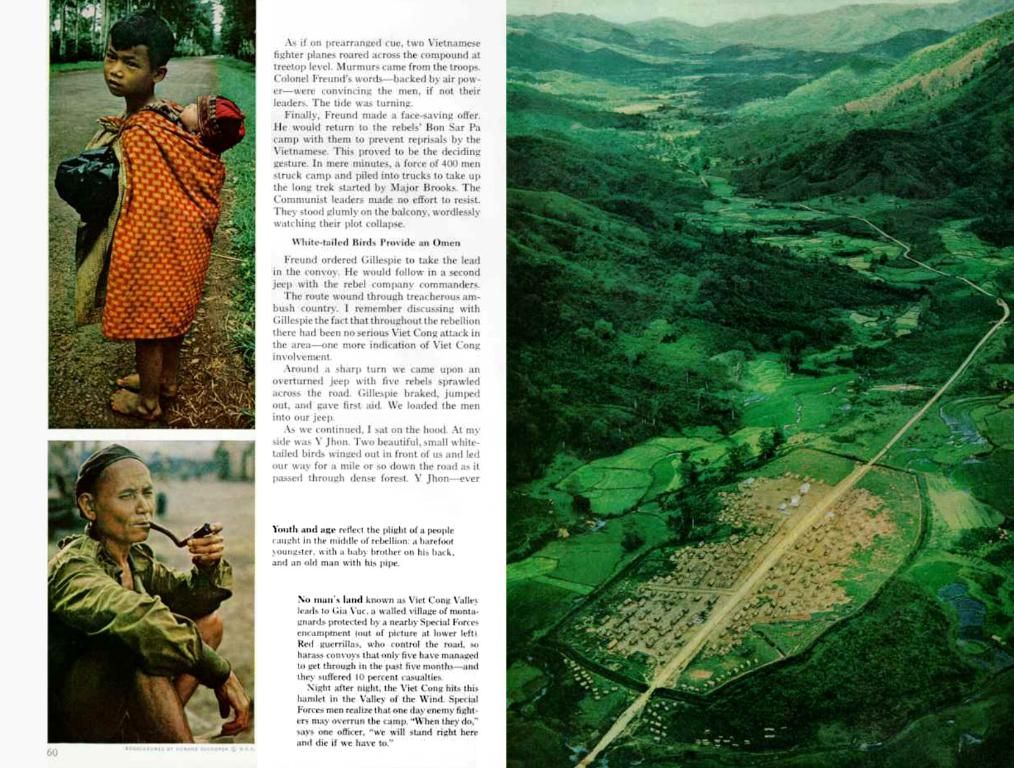

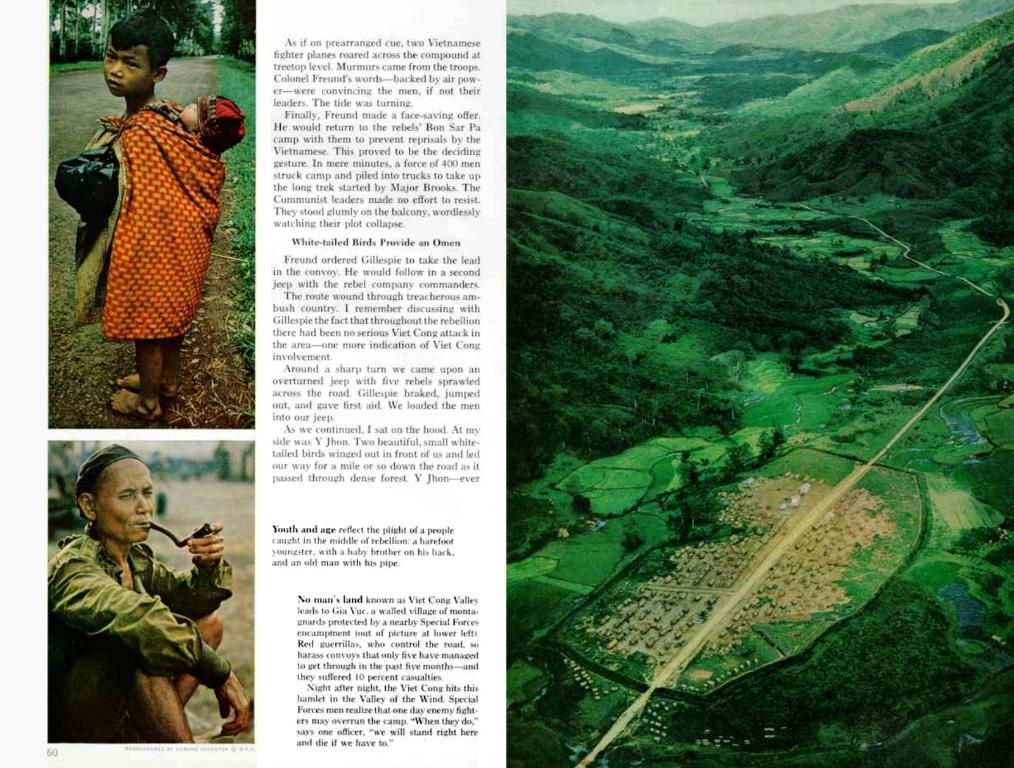

Remember, the key rate plays a significant role in shaping deposit and loan rates (for more details refer to the Graph). So, what happens at Neglinnaya Street affects our financial lives. From summer 2022 to summer 2023, the key rate rested at 7.5% annually, about double the current figure. Due to this, market mortgages were offered at 8-10%, and deposits fell to 6-7%. However, a low rate combined with increased money supply triggered a surge in inflation. So, the Central Bank had to crank up the rate to curb the rising prices.

Do you think the high key rate effectively countered inflation? Not overnight, but yes. The Central Bank believes that the rate impacts real prices in stores with a lag of 9 to 18 months. And we've been traveling this journey for almost a year now since the rate was raised to 16% annually towards the end of 2023.

Here's the latest data from Rosstat. Inflation in Russia declined to 9.7% annually. This means inflation is consistently decreasing. For instance, this wasn't the case last year. In April, prices shot up by 0.4%, and in May, by a mere 0.25%. In total, the inflation rate has reduced by 3.39% since the start of the year.

Experts predict a seasonal factor ahead (vegetables and fruits becoming cheaper in summer), and the inflation forecast for this year is 7-8% annually.

It's time to Call it Quits – Inflation's Defeat is Complete! It's astounding that the Central Bank has accomplished this feat without causing an economic downturn: the economy has been growing at a steady rate of 2.2% per year over the past six months, according to economist Dmitry Polevoy.

But Polevoy isn't advocating for rapid lowering of the rate. If it's implemented too quickly, inflation could spike again.

Mind Blackouts? What Else Should We Watch Out For?

Interestingly, the slowdown has been significantly influenced by… a strong ruble. It has been strengthening since the beginning of the year, and this trend isn't a temporary anomaly. The dollar rate currently hovers below the 80 ruble level. Lending rates have already slowed down dramatically. Plus, the labor shortage has started to dwindle. Unemployment has also crept up slightly.

Still, enterprising businesses have been complaining about expensive loans. Although they always insist there aren't many companies drowning in debt, on average, they spend only a small fraction of their profits on interest payments. Help has come in the form of subsidies for loans in priority sectors.

However, there are other factors causing the Central Bank and experts sleepless nights and preventing them from lowering the rate further and swifter. The main one is the inflation expectations of the population. These haven't yet stabilized and are currently at 13.4%. So, the key rate should not only be above real inflation but also above inflation expectations for effectiveness.

And finally, the elephant in the room – geopolitics. The Central Bank is on red alert about new sanctions, as they can directly or indirectly impact the cost of goods and services in our stores. However, the Central Bank cannot control geopolitical developments.

The Key Rate – a Cast Iron Ball Connecting Inflation, Interest Rates, and the Economy

In essence, banks have gotten quite good at predicting the Central Bank's moves with uncanny accuracy. Deposit rates started dipping even before the announcement. This trend is likely to persist. This was the case in 2022 when deposit yields, then record high at 22-23% per annum, plummeted to 6-8% within six months. The decline won't be as precipitous this time, but living happily on high interest rates for savers is no longer a viable option.

So, here's a possible game plan:

- Maximizing Deposits: Keep the majority of your savings in deposits. Rates are still attractive;

- Stock Market Investments: A portion of your funds can be moved to the stock market. A decrease in the key rate augurs well for businesses, which may lead to increased stock prices (although this is not guaranteed);

- Loan Considerations: It's too early to think about loans. Rates are still sky-high. But if you already have them, stay vigilant for any bank offers. Opportunities for refinancing may pop up as rates decrease.

NOTE FROM KP

The key rate is a powerful tool used by the Bank of Russia to control inflation. It influences both deposit and credit rates offered by commercial banks. High interest rates (up to 20%) act as disincentives for borrowing but provide attractive returns on deposits, thereby discouraging borrowing. This slowdown in demand helps to rebalance the economy with supply, eventually reducing inflation. That's what the Central Bank is hoping for.

GRAPHIC

Photo: Nailed VALIULIN. [Switch to KP Photo Bank]

- The Central Bank's decision to lower the key rate signifies a significant shift in its strategy, aiming to regulate inflation and stimulate economic growth.

- This potential move in the key rate could have a substantial impact on both businesses and individuals, influencing deposit and loan rates, as shown in the Graph, consequently shaping our financial lives.