Market's Attention Shifts to $83K CME Gap as Bitcoin Pauses at this Level

Bitcoin on the Fence at a Crucial CME Gap

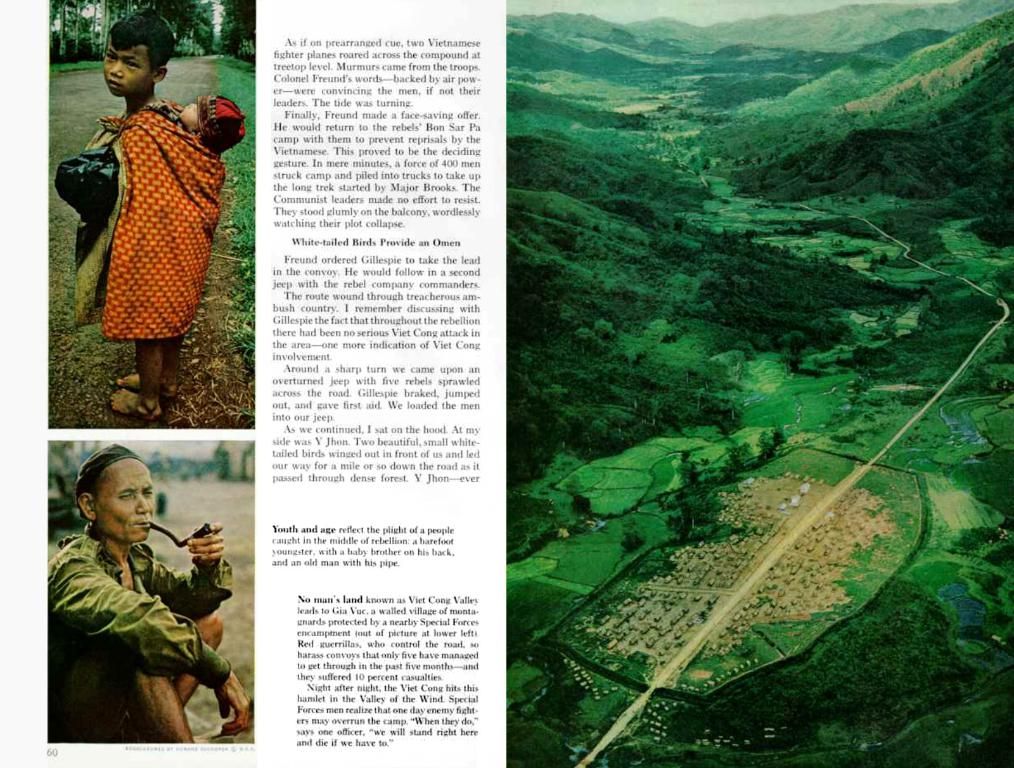

It's a tense game in the Bitcoin world as the digital currency hovers near a critical CME gap, at around $83,000, while market operators keep a close eye on the opportunity for it to be filled.

Over the weekend, Bitcoin experienced restrained trading, stuck between $82,200 and $83,887, showing signs of uncertainty coupled with low market volatility during off-hours. Although funding may exist at $83,887, the inability to breach this level could trigger a new drop.

Weekend Consolidation and CME Gap

Bitcoin stayed put over the weekend, clinging tight to the $83,000 mark. A recent chart published on TradingView shows Bitcoin consolidating beneath a significant CME gap at $83,887. The price action, depicted in four-hour candlesticks, reveals limited volatility, with no decisive breakout in either direction.

This temporary pause comes after a downward correction from recent highs. The consolidation hints at market indecision, possibly due to lower weekend liquidity and trader caution before the new week kicks off.

The Psychological Impact of CME Gap

The CME gap at $83,887, a result of the Chicago Mercantile Exchange's weekend closure, is now a powerful psychological level. Historically, such gaps have a habit of attracting price movement, with many traders optimistic about possible closure in the near future.

The chart shows this gap as an empty zone extending horizontally and clearly marked with a resistance line. Bitcoin's failure to close above the gap reflects the hesitation among buyers at current levels.

The Short-Term Picture: A Wrestle Between Bulls and Bears

In the short run, the trend exhibits a rebound from around $82,200, creating a minor higher low structure but still below the CME gap resistance. The candles display mixed emotions, switching between bullish and bearish closes while volume declines.

Implications for Broader Market Participants

This range-bound movement raises important implications for both retail and institutional investors. If Bitcoin fails to breach the $83,887 resistance, it could mark the beginning of another corrective wave. Conversely, a breakout above that gap could encourage further bullish continuation, potentially testing previous highs near $85,000.

Insights: As of June 2025, the sentiment surrounding Bitcoin and the broader cryptocurrency market is slightly bearish, with wariness among traders and a focus on key support levels. However, there are signs of potential recovery and upward momentum for Bitcoin specifically. The presence of a CME gap at $83,887 could serve as a significant influence on future price movements, and reaching this level would require sustained momentum and a shift towards bullish sentiment. Monitoring key technical levels and macroeconomic trends will be crucial for traders and investors.

Cryptocurrency investors are keeping a close watch on Bitcoin's approach towards a significant CME gap at $83,887, as this psychological level could potentially influence future price movements. The failure of Bitcoin to breach this resistance could indicate the beginning of another corrective wave, while a breakout above it could encourage further bullish continuation, even testing previous highs in the cryptocurrency market. In essence, the short-term trend is a battle between bulls and bears, with technology playing a crucial role in shaping Bitcoin's trajectory in the finance arena.