Ratio Demarcation: Meaning, Formula, and Illustration

Unleashing the Power of the Cash Ratio

Ready to dive into the world of liquidity? Let's talk about the cash ratio, a pivotal tool for businesses everywhere! The cash ratio assesses a company's ability to meet its short-term obligations by examining its liquid assets.

What Is the Cash Ratio?

Think of the cash ratio as a snapshot of a company's liquid resources. This liquidity index provides insight into the company's potential to snuff out its short-term liabilities.

Here's the lowdown on the formula: A company's cash ratio equals its cash and cash equivalents divided by its current liabilities. Cash equivalents encompass assets like marketable securities that can be swapped for hard cash in a jiffy. An appealing cash ratio demonstrates that a company is more than capable of paying off all current payments due on debt. Typically, the numbers in this field range between 0.5 and 1.0, but this varies as per industry standards.

Driving Insights with the Cash Ratio

Lenders and investors alike scrutinize cash ratios to gauge a company's stability.

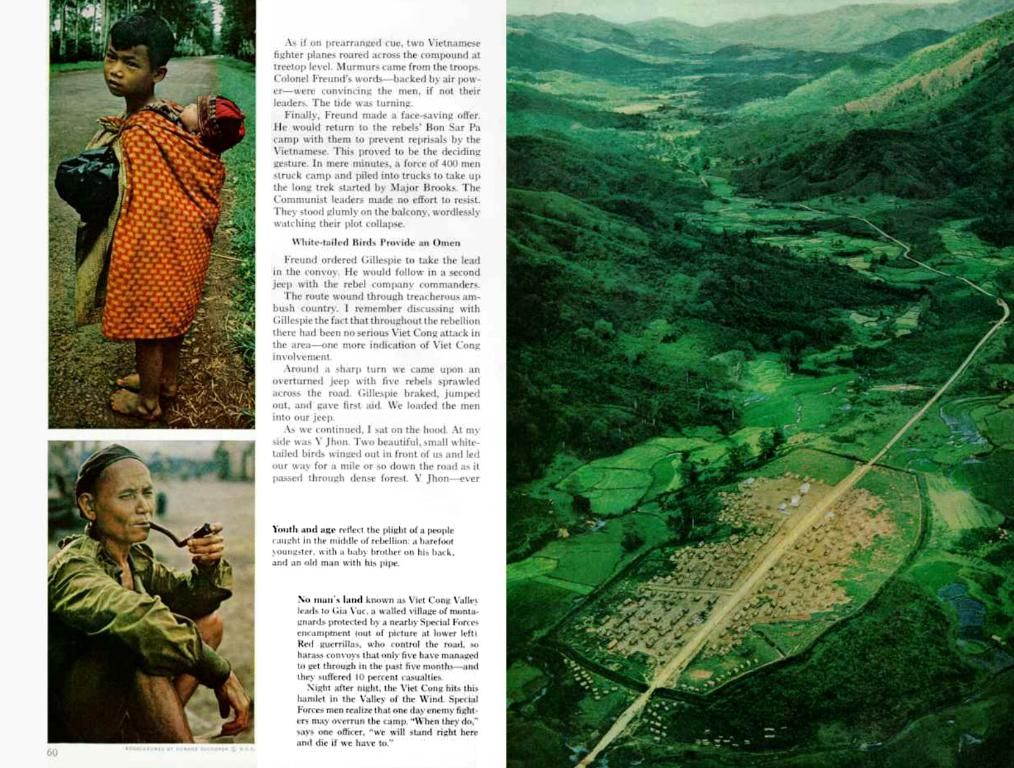

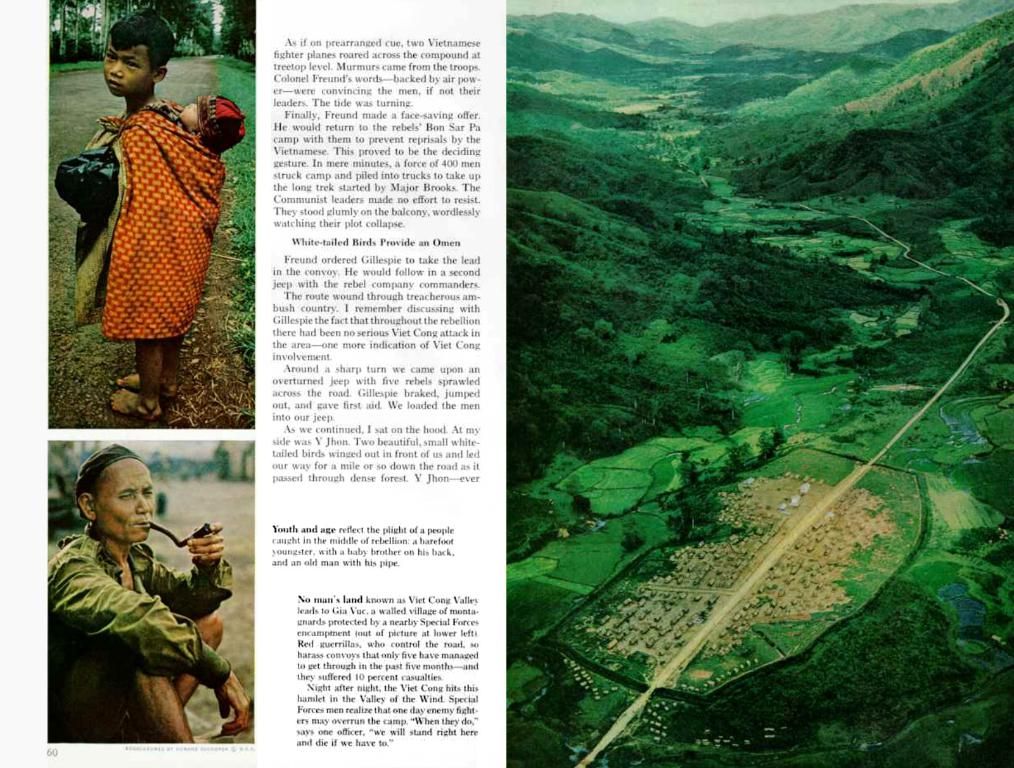

Revelations When Ratios Are Low

If a company's cash ratio is less than one, it signifies that the business has insufficient cash reserves to cover its short-term debts. Granted, this doesn't necessarily spell disaster – it may indicate that the company relies on lenient payment terms, savvy inventory management, or judicious credit extension to clients.

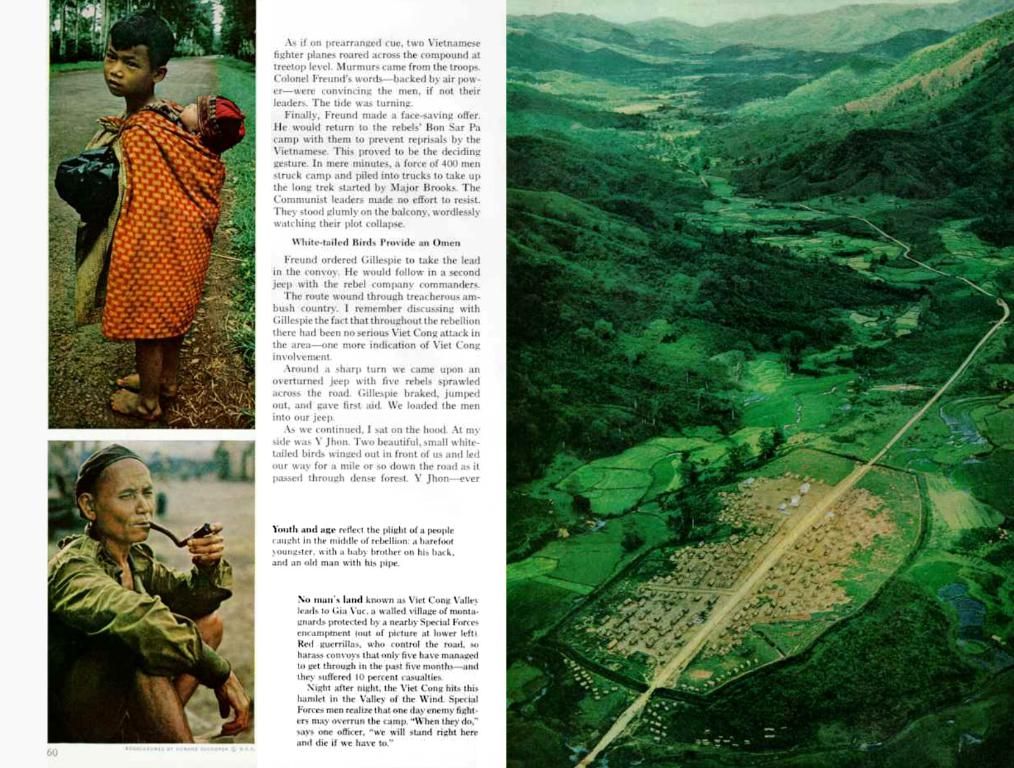

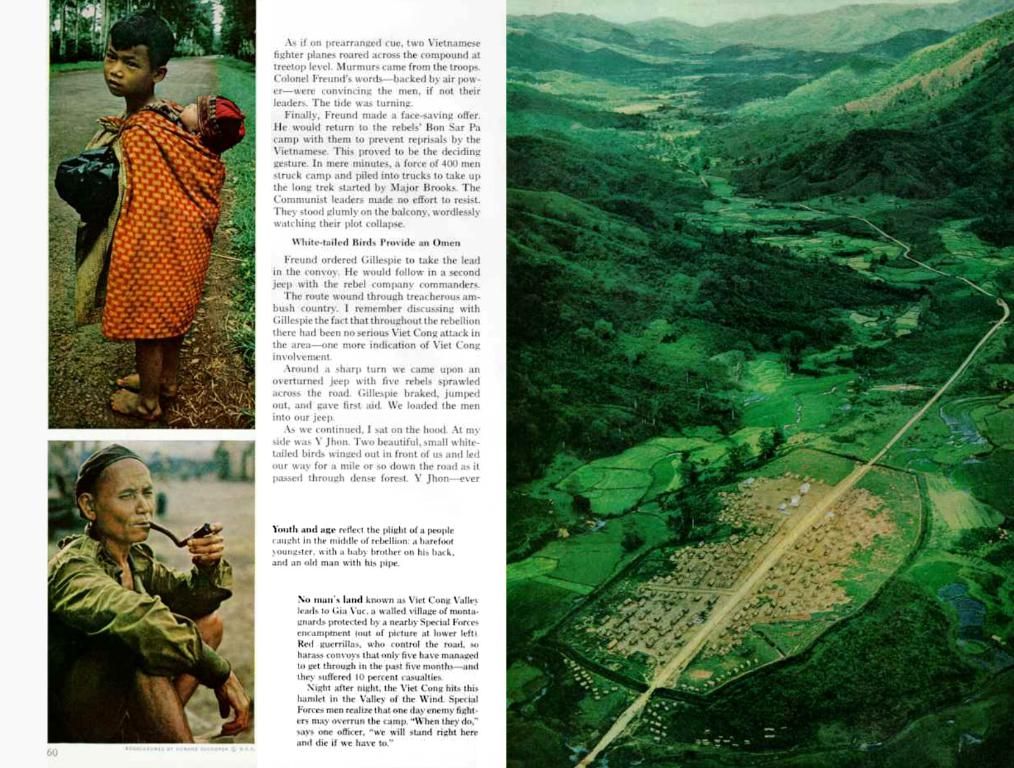

Significance When Ratios Are High

On the flip side, when a company's cash ratio surpasses one, it means that they have more readily available funds than short-term liabilities. They can comfortably settle their short-term debt and have additional cash left to spare.

However, a high cash ratio might hint at inefficient cash management. The company could be missing out on the potential to grow by investing in low-interest loans. Conversely, a high cash ratio could indicate that the company is building a cash buffer out of caution due to fears about future profitability.

Evaluating Cash Ratios

To illustrate how the cash ratio serves up actionable insights, let's consider Apple Inc. The tech behemoth boasted a whopping $53.7 billion in liquid cash and marketable securities at the end of 2024.[2] When weighed against account payables and other current liabilities of $123 billion,[2] the company's cash ratio came out to approximately 0.43. This suggests that Apple manages its operating structure by juggling debt, seizing favorable credit conditions, and preserving cash for strategic growth.

The Nitty-Gritty

The cash ratio is but one of numerous liquidity ratios; its definitive stance lies in its focus on only cash or cash-equivalent assets, leaving other assets like accounts receivable out of the equation. The formula for calculating a firm's cash ratio is:

Cash Ratio: Cash + Cash Equivalents / Current Liabilities

Comparing Apples to Apples

Taking industry averages into account or benchmarking against competitors offers invaluable insights when analyzing cash ratios. For instance, retailers with their lightning-fast inventory turnover often maintain a lower cash ratio. In contrast, industries that rely more heavily on research and development, such as technology or biotech, might favor a higher cash ratio to fund their ventures better.

Remember, an acceptable cash ratio varies by industry due to operational needs, access to credit, financial structure, and regulatory environments. By understanding these nuances, you'll be empowered to interpret cash ratios with shrewdness and finesse!

[1] Enrichment Data[2] Enrichment Data

- In the world of finance and business, the cash ratio, a liquidity index, acts as a token of a company's readily available resources, providing valuable insights into its ability to meet short-term financial obligations.

- Earlyvesting in DeFi projects, like token sales (ICOs), can potentially yield high returns, but a solid understanding of a company's liquidity, as measured by ratios such as the cash ratio, is crucial to making informed decisions.

- When assessing the financial health of a business, lenders and investors often analyze the cash ratio, identifying not only the business's liquidity but also its potential for strategic growth and investment opportunities.