Revised investment guidelines now permit non-governmental pension funds to buy shares in Initial Public Offerings (IPOs)

Pension Funds Get More Access to IPOs in Russia 🚀

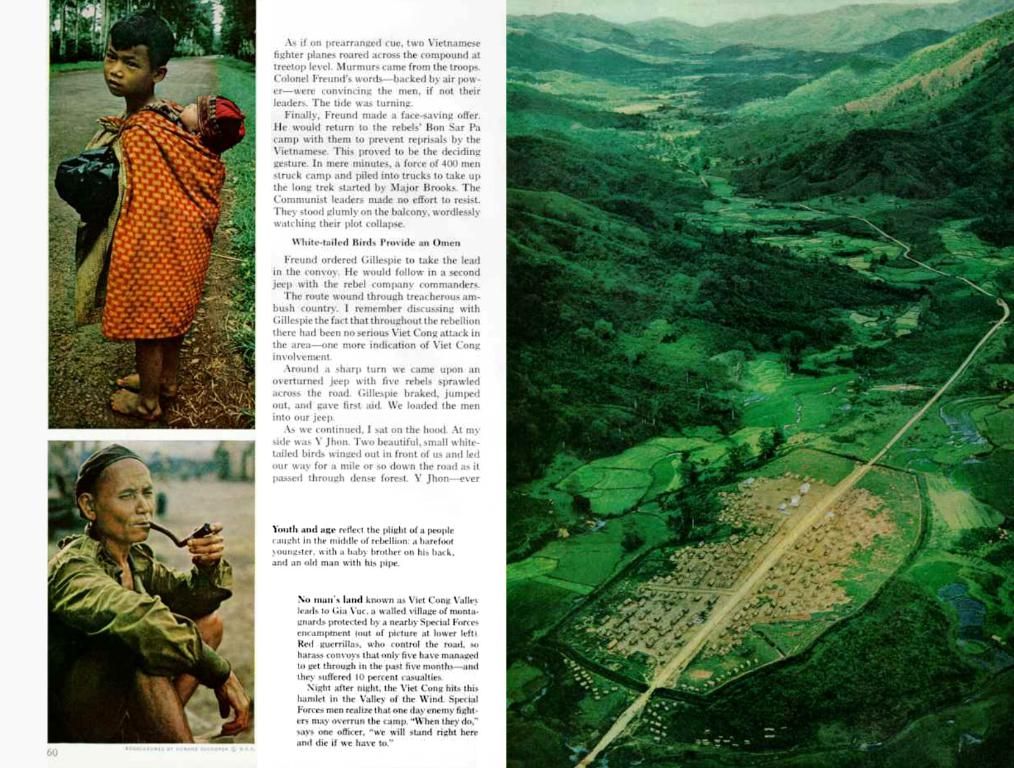

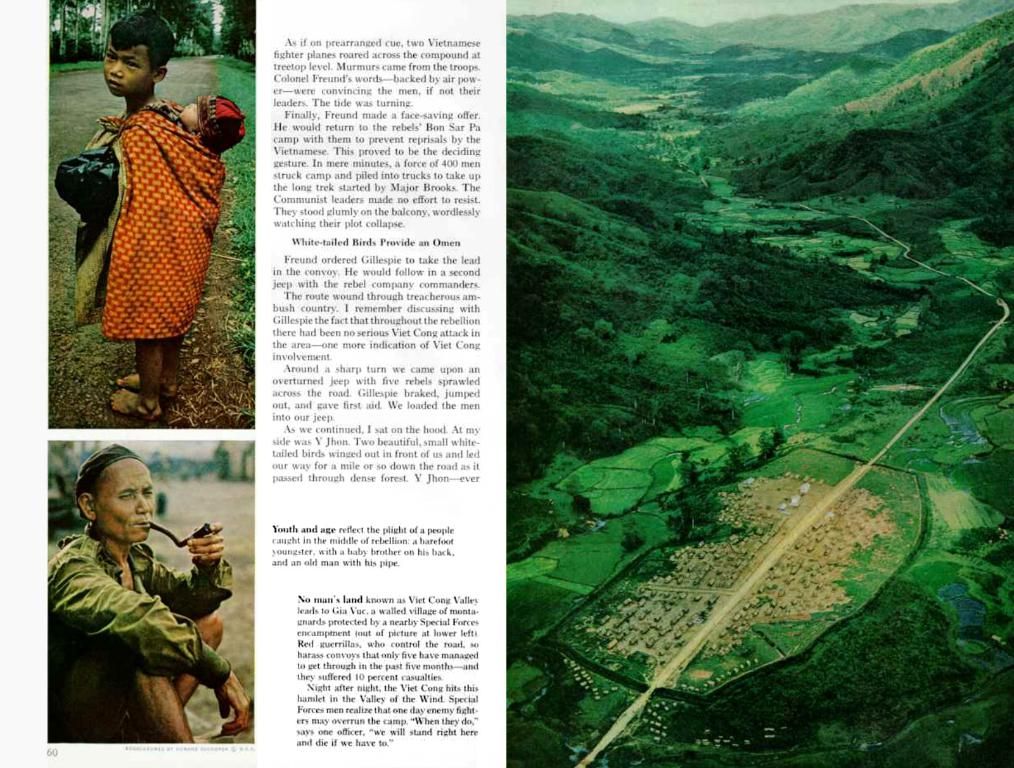

Starting in 2024, Non-state pension funds (NPFs) in Russia will have expanded opportunities to join Initial Public Offerings (IPOs) 🎯. Previously, pension funds needed to invest a huge sum of 50 billion rubles to participate in IPOs, but now, as long as the total volume placed on organized trading reaches 3 billion rubles, funds can jump on board 💰.

The Central Bank of Russia (CB) has eased the requirements for pension fund investments, allowing them to acquire certain derivative financial instruments in the over-the-counter market with a central counterparty 📈. Good news for NPFs! The share of shares they can buy in IPOs has been increased from 5% to 10% of the total placement volume 📉.

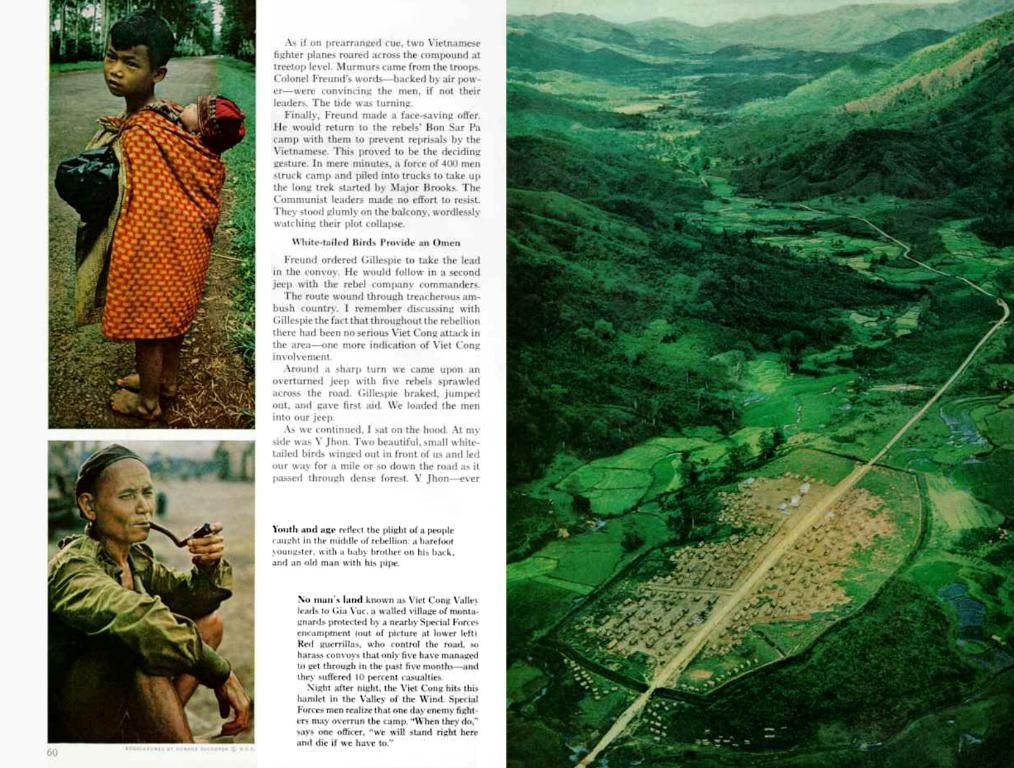

With these new norms, NPFs will have wider investment possibilities. This can lead to institutions investing more in IPOs, boosting public share offerings on the Russian market 🌟. Don't forget to check out our Telegram channel @expert_mag for more updates!

💡 Insights:With these changes, NPFs will experience more investment diversification and potential growth in returns on pension savings, supporting economic growth. However, experts warn about the risks due to market volatility and high inflation. The Russian Central Bank is working on economic stability by making interest rate cuts, but they remain prepared to adjust rates if inflation surges again.

💡 Connection:This move can stimulate investment in the Russian market, but careful management is crucial to mitigate risks associated with economic instability.

Pension funds in Russia can now invest more in Initial Public Offerings (IPOs), thanks to the Central Bank's easing of requirements, as they only need a total volume of 3 billion rubles to participate. Additionally, the share of shares that NPFs can buy in IPOs has increased from 5% to 10%. These adjustments will likely lead to broader investment possibilities for pension funds, potentially enhancing economic growth while also presenting risks due to market volatility and high inflation.