Alarming High: Company Default Rates Skyrocket in Germany, Affecting Small and Young Businesses

Rise in Germany's Bankruptcy Rate Reaches Critical Point

At present, the default rate for companies in Germany is escalating, reaching levels not seen since the financial crisis of 2008 and 2009. Worryingly, this trend seems to be persisting, and experts predict it will likely exceed two percent in 2025.

Causes of Soaring Default Rates

- Sluggish Economy and Elements of Weak Investment: The German economy experiences a gloomy outlook, with reduced growth prospects and suppressed loan dynamics that contribute to these increased default rates.

- Difficulties in the Banking Sector: Banks face the adverse effects of dwindling interest rate margins, making lending less attractive, and growing credit default risks, leading to stricter credit conditions for businesses.

- Regulatory Buffers and Unpaid Loans: The non-performing loans in the corporate sector have continually increased, prompting banks to set aside regulatory buffers to ensure stability in the banking system. This tightening of credit may impact the ability of small businesses to access necessary funds.

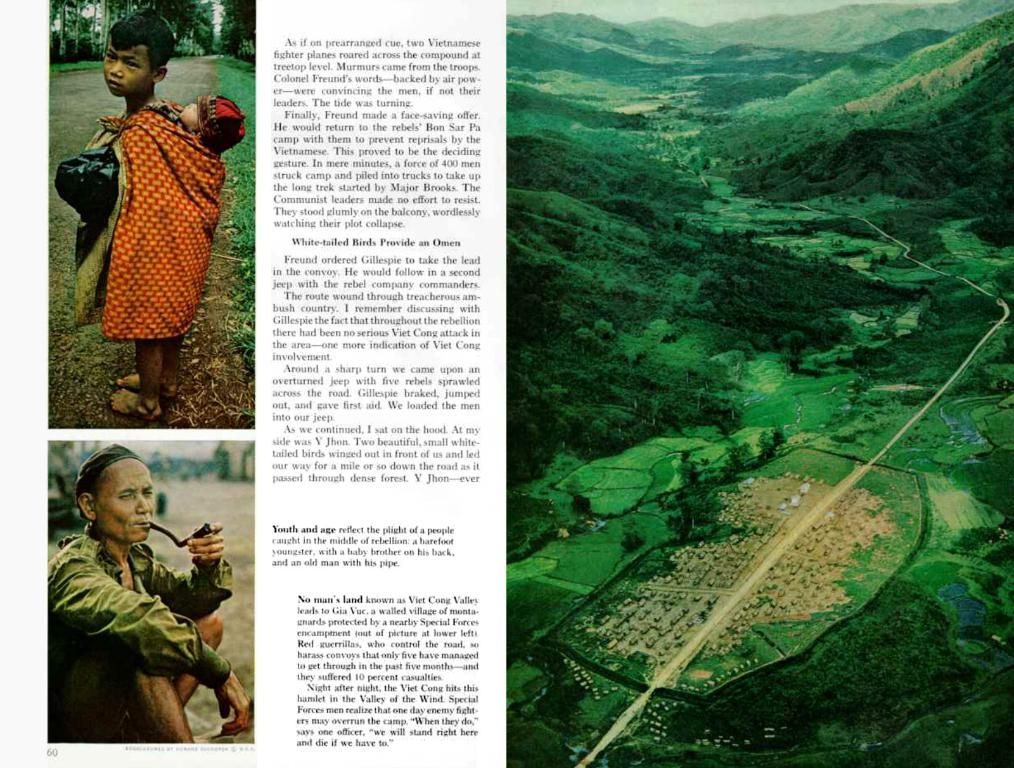

- Export-Reliant Economy: Germany's strong dependence on foreign trade exposes its economy to global economic fluctuations, making it more susceptible to shocks during periods of economic instability.

Industry Impact

The transport and logistics sector tops the list of industries most affected by the rising default rates, closely followed by the construction industry. In contrast, basic chemicals show the lowest default rate.

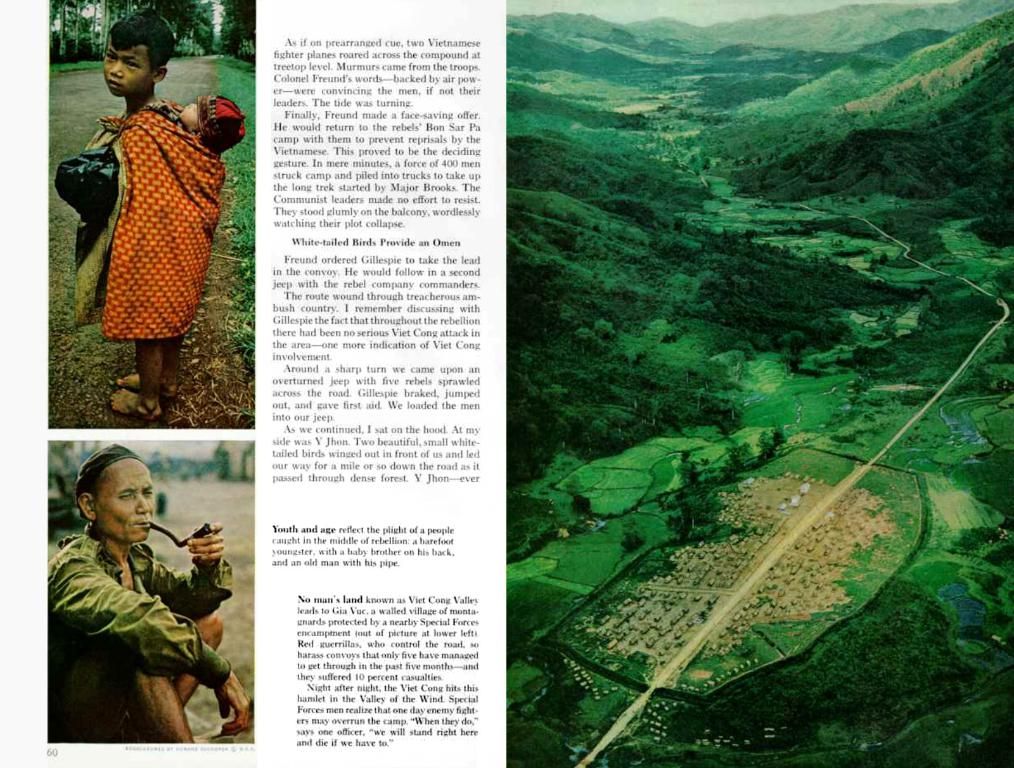

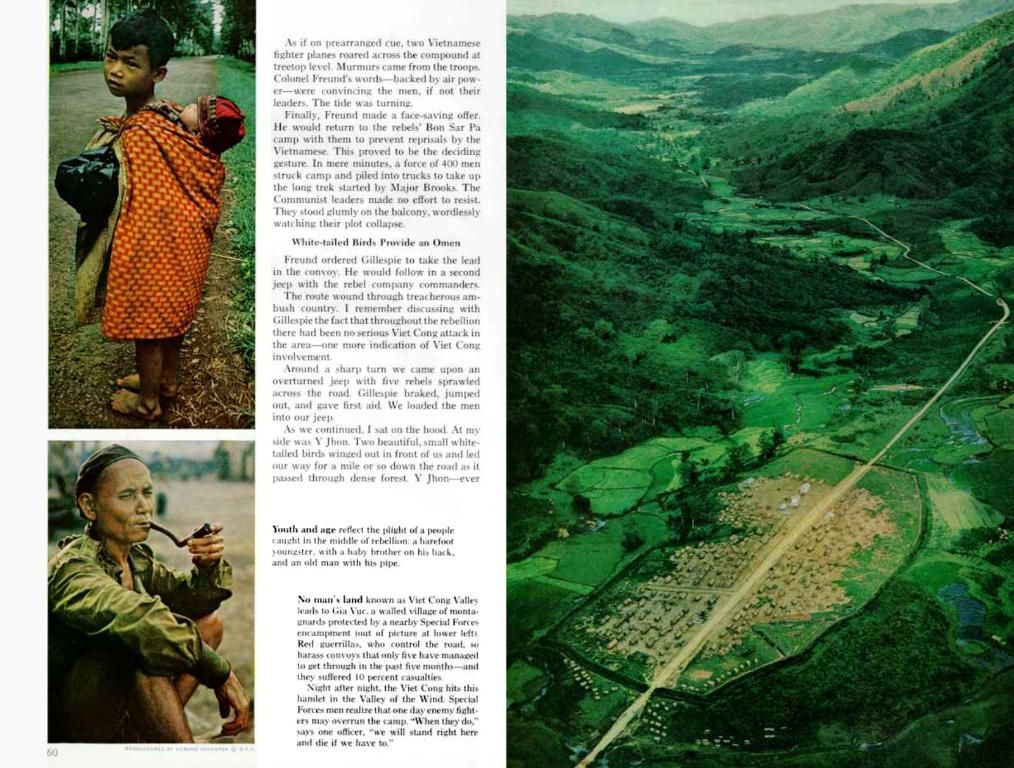

Smaller businesses, particularly those with an annual turnover between €500,000 and €2 million, are disproportionately affected, while larger corporations with an annual turnover of €250 million or more fare better. Additionally, young companies, those between two and five years old, show a higher default rate than older, established businesses.

Potential Repercussions

- Fiscal and Economic Impact: Increased defaults can lead to a reduction in economic activity, as failed businesses shed workers and cut back on production. This can create a self-perpetuating cycle where economic decline exacerbates default rates.

- Credit Market Consequences: Tightened lending standards due to rising defaults can limit the ability of small and young businesses to secure loans, restricting their capacity for growth and innovation.

- Employment and Spending Power: Small ventures often act as significant employers, and their failure can lead to job losses, which can weaken the labor market and reduce consumer purchasing power.

- Banking System Resilience: The resilience of the banking system is essential to maintain overall financial stability. If default rates continue to increase, banks may face substantial losses that could result in tighter lending restrictions and further economic contraction.

These troubling trends in company defaults across Europe suggest a complex and evolving economic landscape. Nonetheless, it's essential to remain vigilant and adapt our strategies to accommodate these challenges in order to prevent the long-term aftermath of a prolonged economic downturn.

- Currency Fluctuations

- Global Economy

- Economic Stability

In response to the escalating default rates in the German corporate sector, it may be prudent for institutions to review and update their employment and community policies to better accommodate small and young businesses that are disproportionately affected. This could involve measures such as flexible work arrangements and affordable lending options, supported by provisions that facilitate access to finance for these businesses.

Moreover, given the financial and economic consequences of increased defaults, such as restrictions in the credit market and potential job losses, it becomes crucial that policy-makers initiate discussions regarding the development of targeted employment and finance policies to bolster the resilience of small and young businesses, with a special focus on export-oriented industries, thus addressing the root causes of the rising default rates and fostering economic stability.