Scanty Wash of Money through Non-Banking Channels

It Seems Germany's Focus on Money Laundering Ain't As Intense as Ya Might Think 🤨

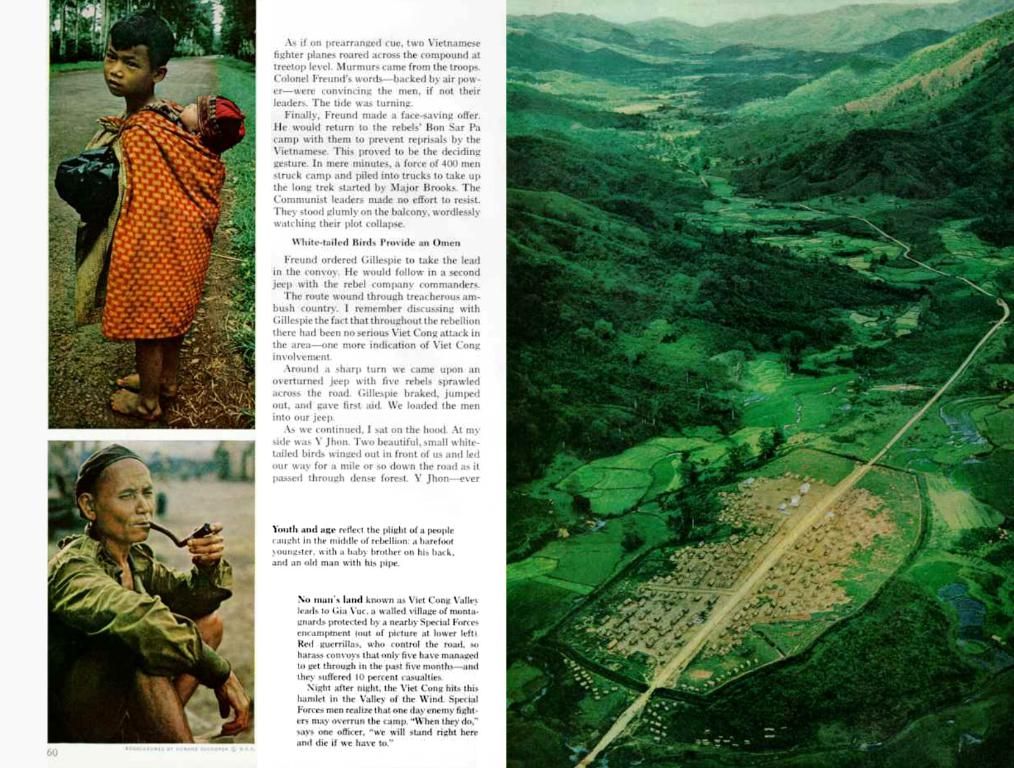

You heard right, folks! Suspected money laundering activity outside the banking sector doesn't seem to be a priority in Germany, according to a recent FDP inquiry as reported by "Der Spiegel." In 2019, a paltry 1.3% of all suspicious activity reports (SARs) received by the Financial Intelligence Unit (FIU) came from non-financial sectors, like real estate agents and jewelers. The numbers were even lower in previous years, dipping below one percent. 📉

Who's responsible for keeping an eye on this shady activity? The federal states, with only a puny 215 full-time positions in their supervisory authorities in 2019. Saarland had one, Bremen two, and Saxony-Anhalt three. North Rhine-Westphalia had the most, with a beefy 69 positions. 🤩

The federal government can't even tell you how many reporting entities, such as lawyers, notaries, and tax advisors, there are under the Anti-Money Laundering Act. 🤔 Markus Herbrand, the FDP's Finance Committee rep, calls it a "joke." In 2017, the Bundestag instructed the government to discuss better oversight structures with the states, and some might say the government ain't doin' enough to live up to those instructions. Herbrand wanted a database to prevent money launderers from simply moving from one federal state to another. 🤨

Why is this happening? Historically, there's been a strong focus on the banking sector in terms of anti-money laundering (AML) regulations. Other sectors, like non-profit organizations or real estate, may face challenges in implementing effective AML measures due to limited resources and complexity in monitoring transactions. 🔍 Regulatory challenges compound these difficulties.

The German government, though, has taken some steps to improve oversight and data collection. They've enhanced reporting requirements for obliged entities, adopted a risk-based approach, increased scrutiny on non-traditional sectors, and taken regulatory actions against entities that flout AML requirements. 💪 Definitely some progress, but there's still a long way to go. Don't hold your breath, folks. 😴

Sources:

- Money Laundering in Germany: An Overview

- Money Laundering and Terrorist Financing Risk Assessment 2021

- GwG - German Money Laundering Act (Federal Financial Supervisory Authority)

- BaFin Imposes Fines on Credit Institutions for AML Violations

Other sectors, such as non-profit organizations or real estate, may struggle to enforce effective anti-money laundering (AML) measures due to limited resources and complexity in monitoring transactions. The federal government, however, is increasing its focus on ensuring better AML oversight in non-financial business sectors.