Stock market corrective action underway?

Pricey Markets Stir Fears of a Correction: What Goldman Sachs Thinks

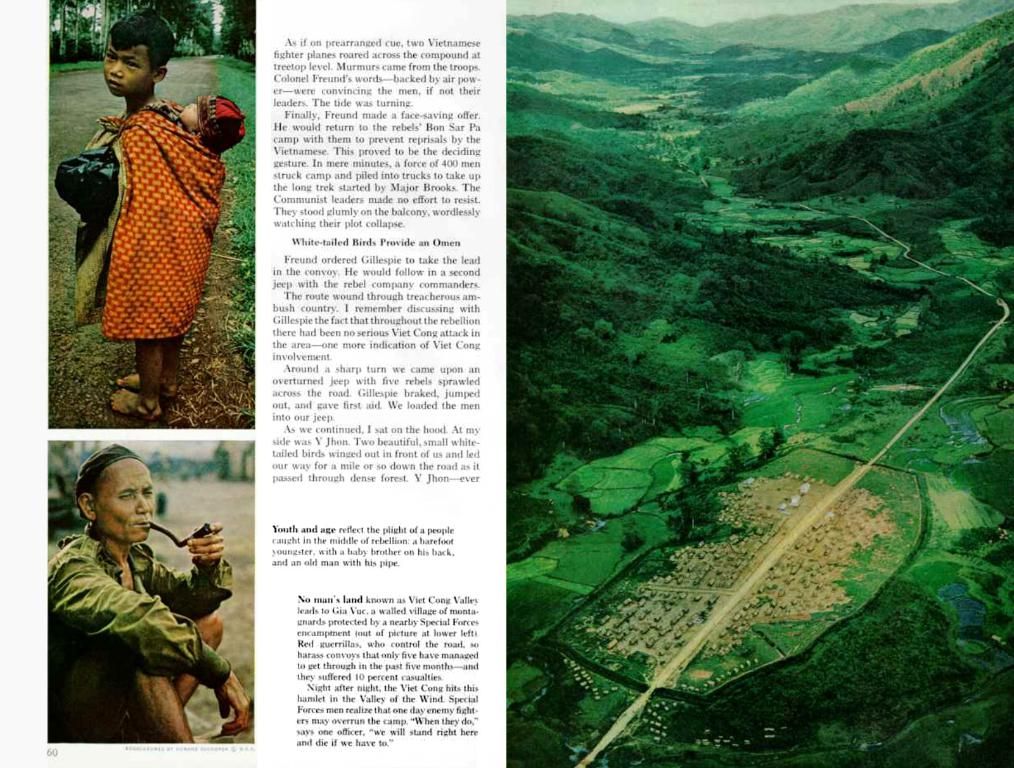

Wall Street's seen a rollercoaster ride in 2024, with the markets yet to match their previous record peak. The short question on everyone's mind? Will we see a drastic correction soon? According to Goldman Sachs' analysts, the answer may be yes.

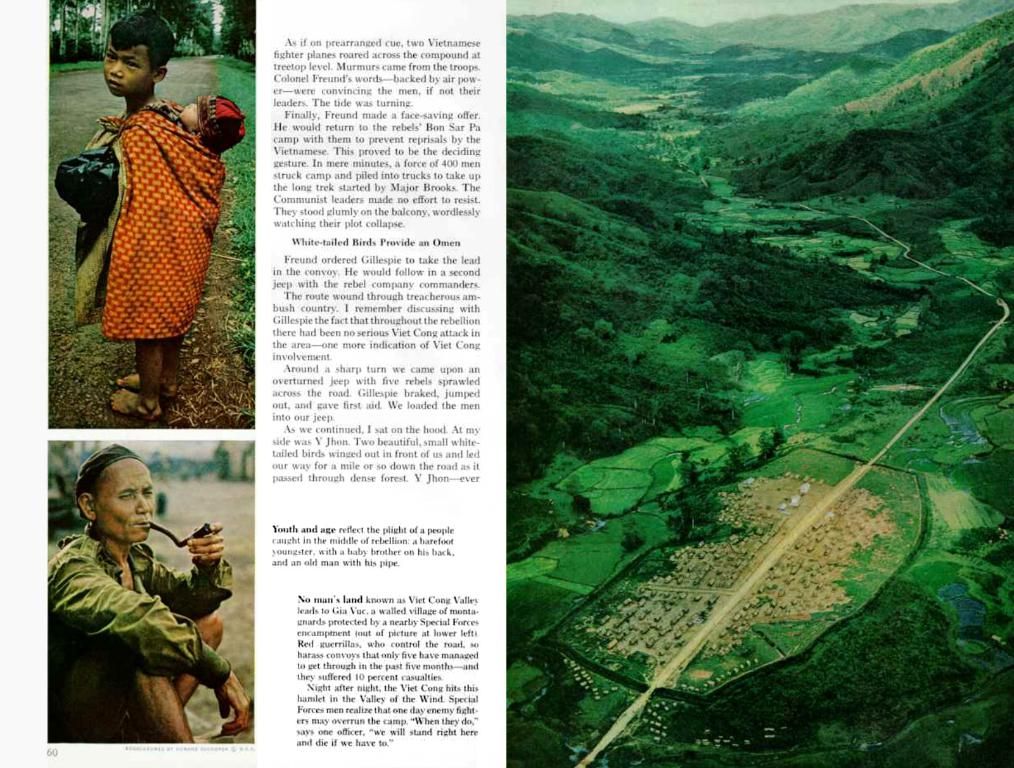

After the hefty price increases in 2024, valuations have scaled new heights, causing concern amongst investors about a potential market bubble. The recent DeepSeek storm hasn't eased these fears. The likelihood of a pullback is now looming.

But is a sell-off imminent? Goldman Sachs recently shared their insights on the issue.

Brace Yourself for a Correction? Goldman's Prediction

In their study, chief global equity strategist Peter Oppenheimer noted, "The steep rise in stocks lately has led to them having perfectly lofty valuations. We anticipate the markets to register further growth this year, primarily due to earnings, but they are becoming increasingly vulnerable to a correction. Such a correction could be triggered by increased bond yields, economic growth disappointments, or earnings shortfalls."

Goldman Sachs also flagged the skewed market weighting as another risk factor for a correction. They claim that the dominance of the Magnificent Seven companies could create an imbalance for global exchanges.

Goldman's Take: What This Means for Investors

Though Goldman predicts a continued market rise, an interim correction seems plausible, if not probable. However, this shouldn't be seen as a sell signal, but rather a chance to buy low if the market does indeed take a dive.

Moreover, Goldman advises investors to engage in stock picking in the current tricky market environment, as it may offer better opportunities compared to the crowded indices.

Related Reads:

- High-dividend Stock: A Top Pick According to UBS

- Markets on the Verge of a Shock Moment? If This Happens, Expect a Crash Soon

(Enrichment Data)

Goldman Sachs recently revised its S&P 500 forecast, reflecting an optimistic yet cautious outlook in the face of economic uncertainties. Here's a summary of their findings and recommendations:

Goldman Sachs' Analysis

- Forecast Adjustments: Initially, Goldman projected an EPS of $262 for 2025, representing a 7% year-over-year growth, thanks to decreased tariff risks and improved economic prospects. However, fresh reports suggest possible revisions to the EPS growth forecasts owing to increased tariffs and weaker economic growth.

- S&P 500 Targets: The company has set a short-term goal of approximately 6,100 for the S&P 500, marking a moderate increase from prior predictions. Over the next year, they project the S&P 500 could reach 6,500, indicating an 11% rise from current levels.

- Economic Uncertainties: Despite these adjustments, Goldman Sachs remains watchful of ongoing economic uncertainties, such as trade tensions and potential recession risks.

Investment Strategies

- Caution and Selectivity: Given the mixed outlook, investors are encouraged to exercise caution and choose high-quality stocks with robust fundamentals to navigate market volatility.

- Diversification: Diversifying portfolios across various asset classes and sectors can help offset risks related to economic uncertainties.

- Monetary Policy Watch: Keeping a close eye on monetary policy changes and geopolitical developments is essential, as these factors can significantly affect stock market performance.

Overall, while Goldman Sachs anticipates potential gains in U.S. equities, their strategies underscore caution and adaptability in response to changing economic conditions.

- The steep rise in stock prices, as Goldman Sachs notes, has led to them having lofty valuations, indicating that the finance sector may be vulnerable to a correction.

- For investors seeking opportunities amidst market volatility, Goldman Sachs advises stock picking, as it could offer better prospects compared to crowded indices, following their prediction of a possible correction in the stock-market.