Revising the Importance of Emergency Savings for Families

Unmasking Emergency Savings

Strategies for Nigerian Families to Accumulate Funds for Unforeseen Crises

Emergency savings represent hard-earned cash set aside for life's whirlwinds. These unexpected situations may include sudden medical expenses, urgent home repairs, job loss, or family emergencies.

Pivotal Function of Emergency Savings

These funds act as a financial safety net, providing foundational support during challenging times. They create a barrier against financial crises and the stress that comes with them. When an emergency strikes, having ready funds ensures prompt action and peace of mind.

Shielding Against Financial Perils

Emergency savings help families stay afloat amid financial misfortunes. They discourage debt accumulation by enabling families to avoid high-interest loans or credit card debt. Moreover, these savings empower families to maintain their established lifestyle, ensuring their quality of life remains intact during times of crisis.

Setting the Groundwork for Financial Flexibility

Building an emergency savings fund necessitates discipline and forward-thinking strategies. To successfully create a buffer against unanticipated events, individuals and families must adhere to a well-structured plan and diligently save a portion of their income.

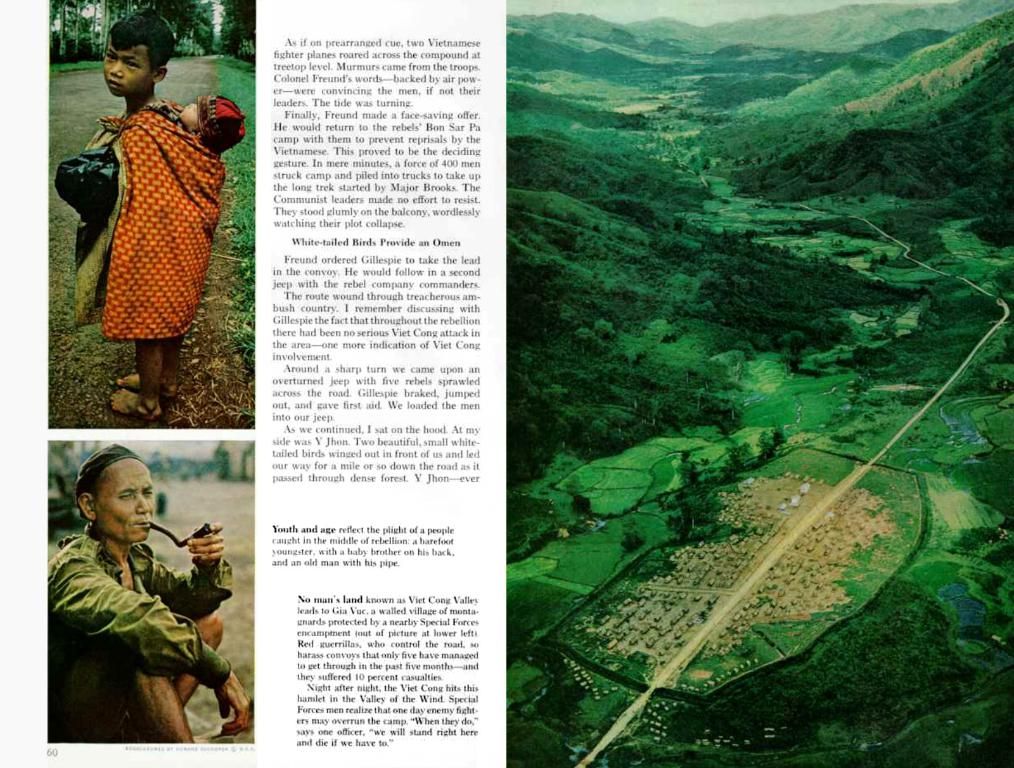

'Together, With Purpose' - Enlisting the Family in Saving

Including everyone in the saving process encourages unity and a collective sense of responsibility. Discuss the importance of emergencies funds openly with all family members, fostering a shared understanding of the value of a well-prepared future. Create a family savings goal to build a spirit of camaraderie and teamwork around your financial journey.

A Walk Through Financial Foresight

Regularly review and adjust your emergency fund to ensure its relevance and success. Changes in life circumstances, such as new jobs or increased expenses, may necessitate additional savings to maintain your family's financial security. Always stay informed about the status of your emergency fund, cultivating a sense of confidence and security in the face of unforeseen challenges.

Clarifying Your Family's Financial Footing

Baring Your Financial Soul

To begin, examine your family's overall financial health. Evaluate income sources, both regular and irregular, as well as monthly expenses. Remember to include family debts, such as loans, credit cards, and mortgages.

Naming Your Family's Story

Discover the perfect name that represents your family's values, traditions, and dreams through a personalized consultation. This process melds cultural insights to create a name truly unique to your family.

Uncovering Financial Truths

Recognizing the Current Status

Start by identifying your family's income sources and expenses. Next, analyze your current savings and investments. Evaluate the amount you've set aside for emergencies and debts.

Discovering the Naked Truth

Probe past emergencies to gauge potential costs. This knowledge helps establish a realistic target for your emergency fund. Remember, every family's situation is unique; adapt your strategies to meet your specific needs.

Building a Powerful Financial Security Defense

Setting Clear Expectations

Define what financial security means for your family. Establish short-term and long-term savings goals. For instance, aim for a specific emergency fund target. Create benchmarks to help you monitor your journey towards financial stability.

Expecting the Unexpected

Consider potential emergencies your family might encounter. These may include medical emergencies, job loss, or natural disasters. Evaluating potential scenarios helps prioritize your saving efforts for maximum effect.

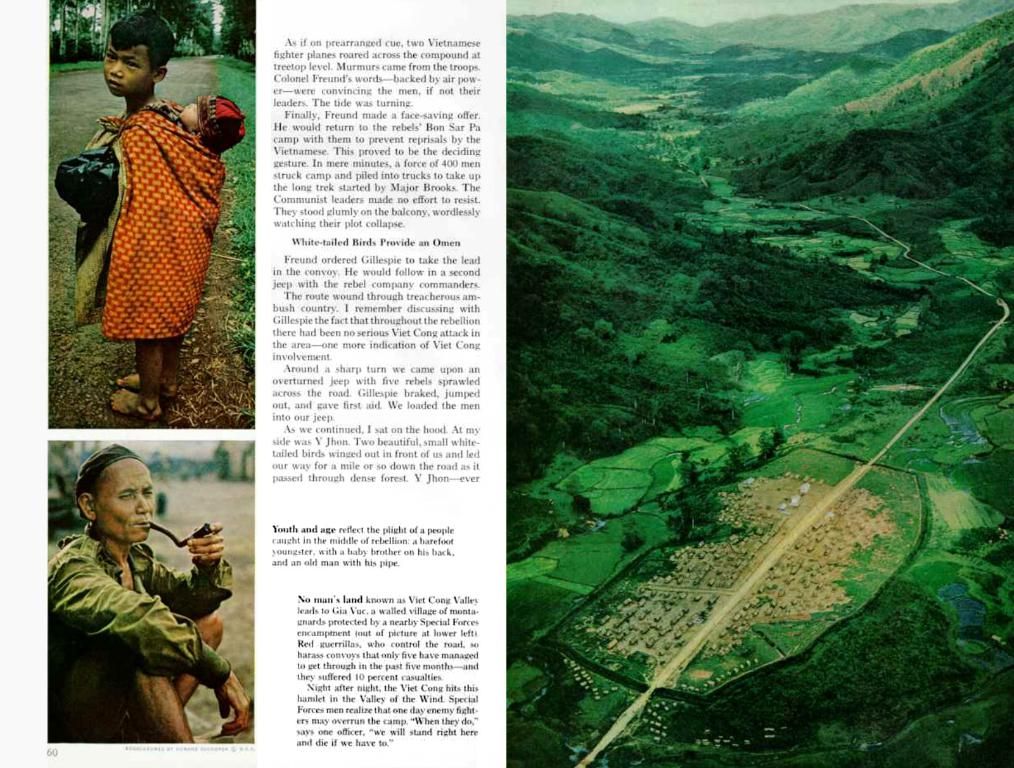

Establishing a Family Budget

Crafting a Shield of Stability

Construct a budget to reveal your family's financial ebbs and flows. Include all income sources and expenses. Assign funds specifically for the emergency savings account to ensure financial security is uncompromised. Adjust discretionary spending to boost savings, if necessary.

Keeping a Vigilant Eye

Review your budget regularly to ensure it remains accurate and in line with your family's changing needs. Making consistent adjustments helps maintain a robust financial foundation.

Contemplating Your Savings Options

Deciding on the Right Home for Your Savings

Determine where to keep your emergency savings. Open a separate savings account, ideally one with a higher interest rate, to avoid using emergency funds for routine expenses. Investigate other interest-bearing accounts for better returns.

Navigating the Savings Wilderness

Local investment opportunities sometimes offer higher yields while remaining accessible. Consider such options for superior returns and quick access to your emergency funds.

Preparing for the Unexpected

Staying Ahead of the Game

Remain abreast of economic developments that might impact your family. Develop a plan to adapt if your income fluctuates. Diversifying income sources can help alleviate financial stress during emergencies. Constantly educate yourself about financial literacy to stay informed and productive.

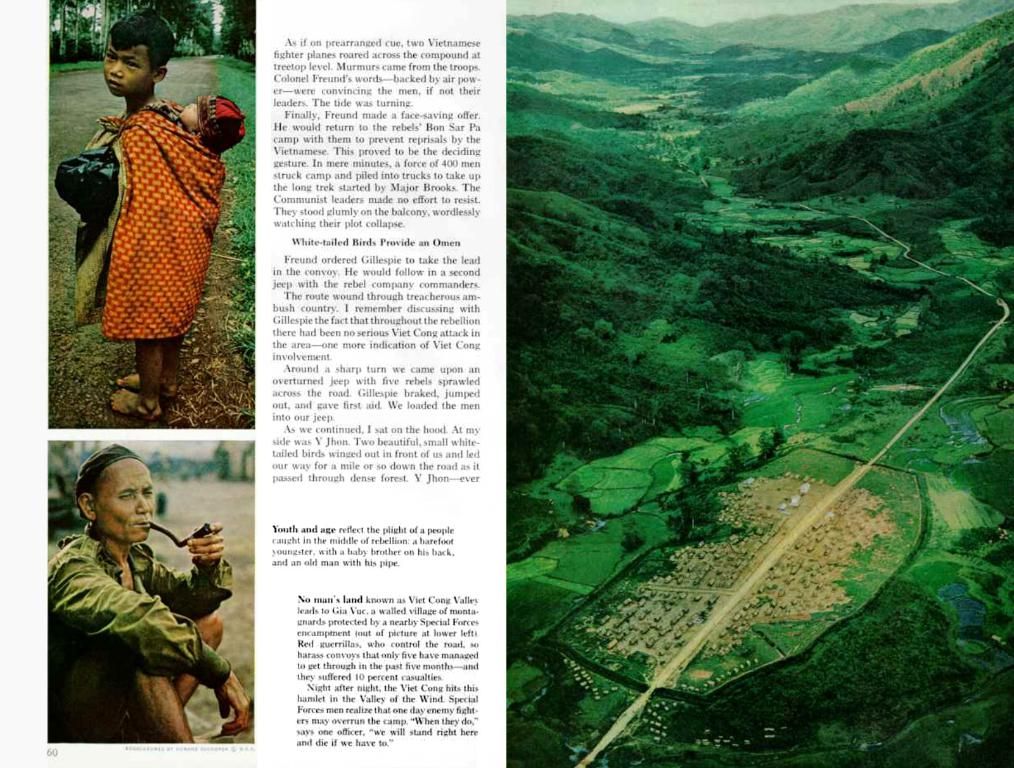

Establishing Realistic Savings Goals

Guarding Your Financial Future

An emergency fund is an investment in your family's future financial well-being. Determine your financial needs by assessing your family's unique situation. Prioritize saving based on the potential financial impact of emergencies.

Aiming for Financial Freedom

Set specific savings targets based on your understanding of your family's realistic financial needs. Most experts recommend saving three to six months' worth of expenses for a sound emergency fund. However, individual circumstances might necessitate a larger savings goal.

Setting the Course for Success

Embarking on the Savings Journey

With a clear plan in place, start building your emergency savings fund. Regularly contribute to your account, ensuring the journey toward financial security remains enjoyable and rewarding.

Being Flexible and Data-driven

Regularly review your progress and adjust your goals as needed. Flexibility is essential for long-term financial stability. Stay well-informed about changes in the economy and your personal financial landscape to ensure your emergency fund continues to serve its purpose.

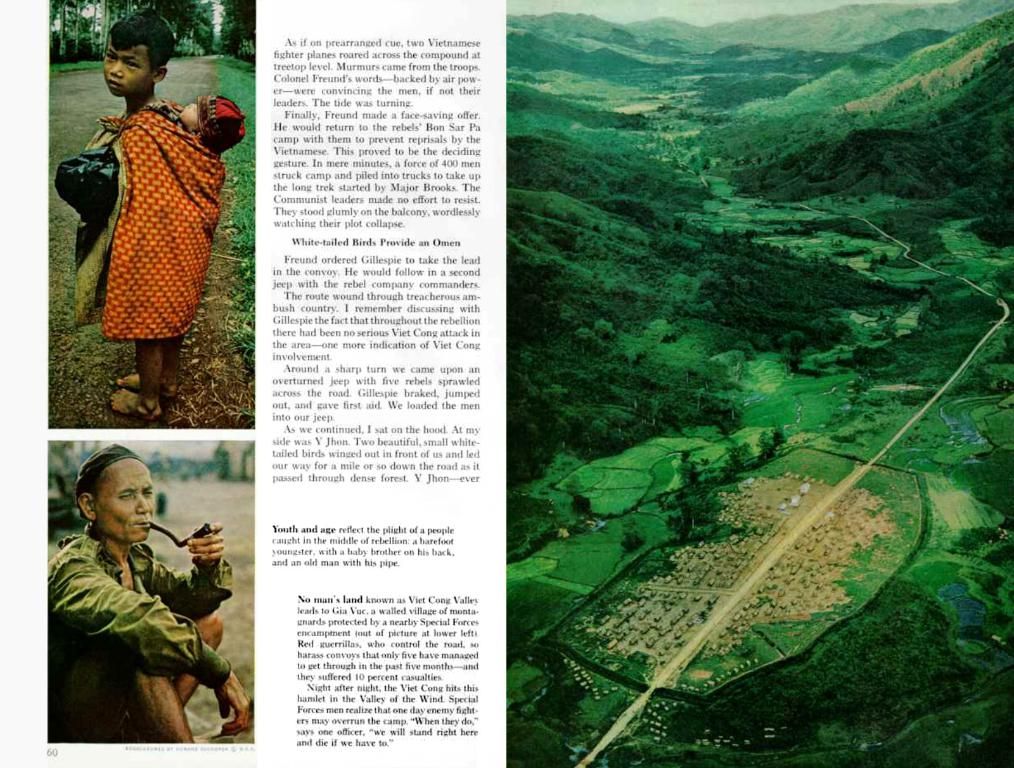

Embracing Professional Guidance

Leveraging Expert Wisdom

Consulting with a financial advisor can offer valuable insights to help make informed decisions. A professional can help tailor a savings plan to your family's specific needs and financial goals.

Empowering Yourself

Devote time to learning about financial planning strategies, so you can make informed choices. Participate in financial literacy workshops and immerse yourself in educational resources to take control of your family's financial future.

You might also like: Constructing a Vibrant Family Budget: Nigerian Parenting Secrets

- As part of their family budget, kids and parents must work together to set aside a portion of their income for an emergency fund, ensuring financial safety and peace of mind.

- When creating a family budget, it's essential to allocate funds specifically for the children's school expenses, helping provide them with a quality education.

- To build a comprehensive financial security plan, parents should consider the health and wellbeing of their children, setting aside funds for necessary medical treatments or unexpected health emergencies.

- Adhering to a structured budgeting and saving plan can help families maintain financial stability, enabling them to prioritize investments in their children's education and personal-finance education.

- Encourage saving habits in your kids by setting personal finance goals as a family, such as saving for a baby's future or a down payment on their first home.

- A well-structured family budget should include allocations for both immediate family expenses and long-term savings, such as retirement, children's education, and personal-finance safety nets.

- As parents work toward building their emergency savings, they can set an example for their kids by teaching them the importance of saving, budgeting, and financial responsibility, instilling essential life skills that help them thrive in their own financial journeys.