The Evolution of California's Real Estate Market Spanning Over Half a Century

California Housing Market: A Journey of Long-Term Growth and Cyclical Volatility

The California housing market, a dynamic landscape shaped by economic, regulatory, and demographic factors, has exhibited a long-term upward growth trend over the past five decades. This trend, however, has been punctuated by distinct periods of rapid increase, significant corrections, and recovery phases.

In the 1990s, the market presented a period of correction, with a slight dip in the early years followed by relative stability and slower price increases. The California Assessment Tax on Real Property (CASTHPI) value in Q1 1985 was 124.50, showing a continued rise in home prices, while the value on January 1, 2011, indicated a continued decline during the Great Recession at 391.53.

The early 2000s witnessed a dramatic surge in the California housing market, with the CASTHPI value reaching 260.96 in Q1 2000. Fueled by easy credit conditions and subprime mortgages, the market experienced a boom, with the median home price more than doubling since 2001, reaching about $576,000 statewide. However, this period was followed by a severe bust during the Great Recession (2007-2009), characterised by steep price declines and foreclosures across the state. The CASTHPI value on October 1, 2008, showed a significant drop to 444.67.

The market's slow but steady recovery started around 2012, with the CASTHPI value on January 1, 2012, at 381.37. The recovery was shaped by tighter lending regulations, low interest rates, and restrained housing supply due to ongoing zoning and regulatory restrictions. The state's improving economy boosted job growth and buyer confidence, although the supply shortage and pent-up demand pushed prices upward, leading to renewed housing affordability challenges. The CASTHPI value on January 1, 2017, was 578.98, showing a gradual climb in the recovery period.

Recent trends have seen the market grappling with an affordability crisis, exacerbated by high prices and rising interest rates. The CASTHPI value in Q1 1999 was 250.09, showing a slight rebound towards the end of the decade. However, beginning in 2022, inflationary pressures led the Federal Reserve to sharply hike interest rates, doubling mortgage costs from around 3% in 2021 to above 7% by 2023. While higher rates typically suppress prices, California home prices have remained near record highs due to persistent supply shortages and strong demand.

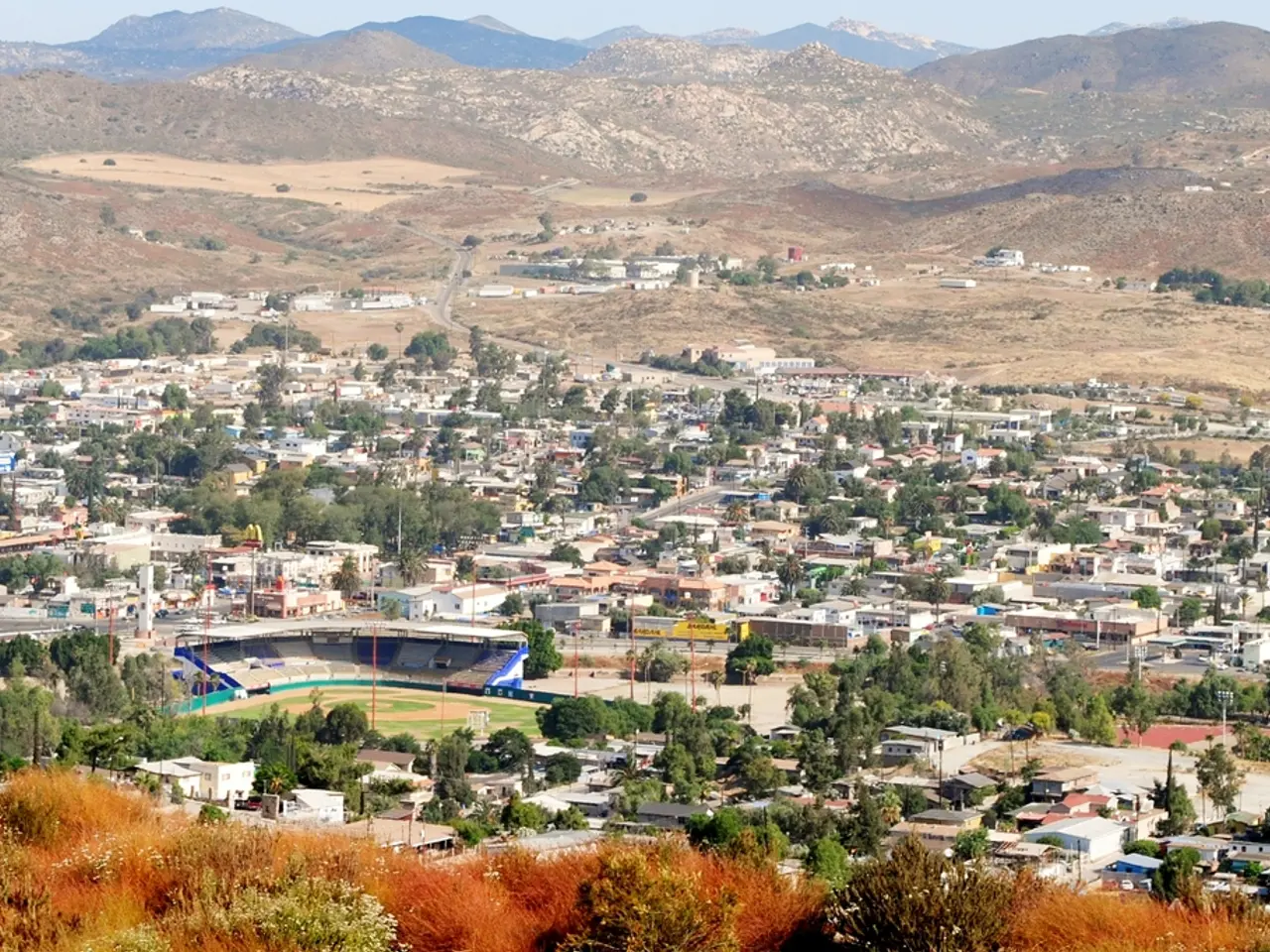

Significant price and market condition differences have persisted across California regions. Coastal and high-demand urban areas consistently experience higher prices and constrained supply compared to inland or less dense regions. The California housing market graph from 1975 to 1989 shows a comparatively slower, steady climb, with the index starting at 41.69 in Q1 1975.

In summary, the California housing market is characterised by long-term price appreciation despite cyclical volatility, periods of boom driven by credit expansion and population growth, sharp downturns linked to financial crises and market corrections, ongoing supply constraints due to regulatory, environmental, and zoning policies, recovery phases dependent on economic improvement and regulatory changes, and a current affordability crisis exacerbated by high prices and rising interest rates. These trends underscore a complex interplay of economic forces, policy decisions, and demographic shifts influencing California’s housing dynamics over time.

- The long-term growth trend of the California housing market, which has been influenced by economic, regulatory, and demographic factors, presents an attractive prospect for real-estate investing.

- Analysis of the California housing market reveals that while it has experienced periods of rapid increase, significant corrections, and recovery phases, its overall growth trend has been consistently upward over the past five decades.

- The growth in the California housing market in the early 2000s, fueled by easy credit conditions and subprime mortgages, led to a surge in housing prices and eventual foreclosures, providing a valuable lesson in the risks of such investment strategies.

- The housing market analysis shows that despite the current affordability crisis, which is exacerbated by high prices and rising interest rates, coastal and high-demand urban areas consistently have higher prices and constrained supply compared to inland or less dense regions.

- In the realm of financing, understanding the cycles of growth, correction, and recovery in the California housing market is crucial for both homebuyers and investors, as it offers insights into potential opportunities and challenges in the real-estate finance sector.