Title: When Macro and Micro Data Clash: Understanding the Implications

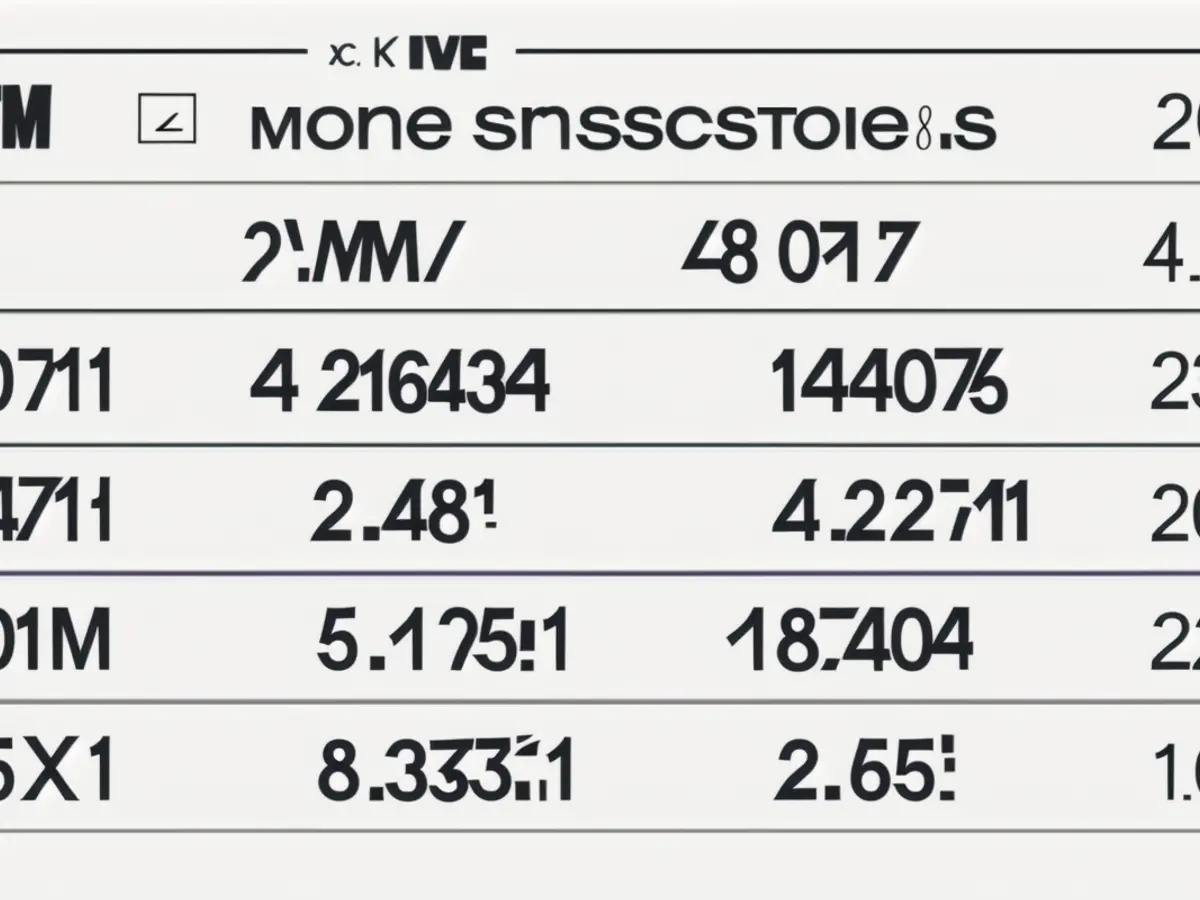

Kicking off the new year, three major market indexes took a dip, with the exception being the small cap Russell 2000, which saw a slight increase of over 1% [1]. Looking back at 2024, it was a banner year for equities with the S&P 500 and Nasdaq surging past the 20% mark [1]. However, the heavy industrial DJIA and small cap Russell 2000's gains of 13% and 10% respectively, appear modest in contrast due to a lack of prominent tech names [1].

The tech sector truly reigned supreme in 2024. In fact, on an equal weighted basis, the average Magnificent 7 stock soared over 60% for the year [1]. All of these tech giants – Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla – saw impressive growth in 2024 [1].

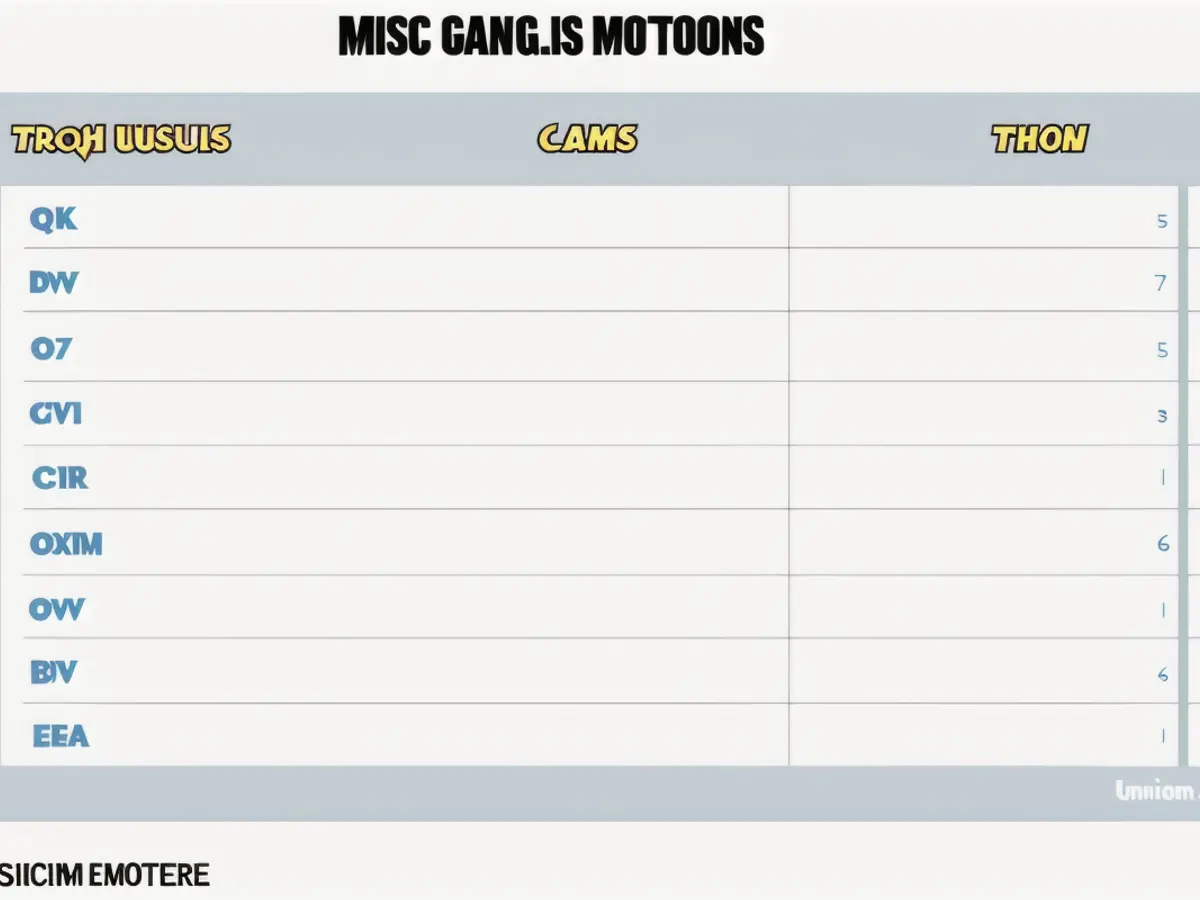

Some notable observations:

- With the exception of Apple, all seven Magnificent 7 companies had reached new record highs by mid-December [1][3].

- Nvidia peaked in early November, while Microsoft achieved its high-point in early July [1].

- For the first two trading days of 2025, six of the Magnificent 7 stocks rose, with only Apple lagging behind [1].

As we gear up for 2025, the burning question on traders' minds is, "Can 2025 replicate 2024, or come close?" [1] With tech driving the market, it's anybody's guess.

Macro-Micro Divergences

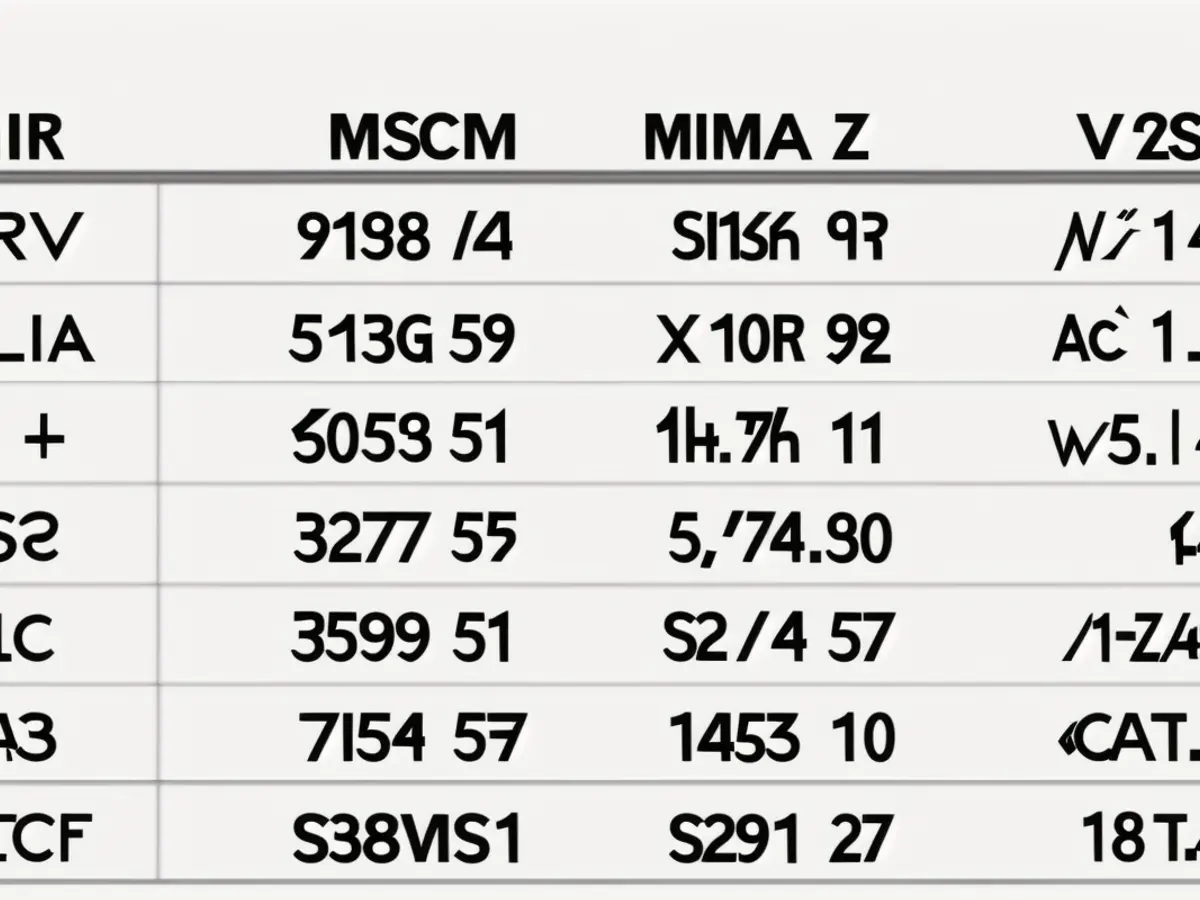

There are noticeable disparities between the macroeconomic data and what a closer examination of the microeconomic realm reveals [2]. For instance, despite the +3.1% reported GDP growth rate in Q3/’24 and projections for Q4 to surpass 2.6%, nominal online spending rose by +6.7% for the holiday season while in-store sales saw a modest increase of +2.9% [2]. Given a 2.7% year-over-year CPI increase, this suggests real spending growth of just 1.1% [2].

Other Concerning Micro Indications

- Industrial Production remains stagnant today, at the same level as 2022 [2].

- The Employment Survey shows a decline of -725,000 jobs over the past 12 months [2].

- The average duration of unemployment for job-seekers currently hovers around 24 weeks, a level last seen in May 2019 [2].

Fed and Inflation

The Fed has adopted a more aggressive stance, causing interest rates to soar as a result [2]. Despite macroeconomic data appearing robust, underlying indicators reveal potential economic sluggishness [2]. The lagged effect of falling rents is likely to push CPI readings below the Fed's 2% target by the end of Q1 '25 [2].

Final Thoughts

2024 was a prosperous year for equities, with the Magnificent 7 companies driving the market's stellar performance [1]. However, the disaggregated data indicates a sense of unease in the broader economy [2]. With shifting economic trends, the market's focus will turn towards determining if 2025 will reproduce 2024's success.

(Joshua Barone and Eugene Hoover contributed to this blog.)

The NASDAQ, being a technology-heavy index, closely followed the trajectory of the tech sector in 2024, experiencing significant growth due to the success of big tech companies [2]. Unemployment data from the Employment Survey showed a concerning decline of -725,000 jobs over the past 12 months, which might impact consumer spending and industrial production in 2025 [2]. Despite the robust GDP growth and CPI increase, the average duration of unemployment has reached a level not seen since May 2019, signaling potential challenges for the economy [2]. With the Fed adopting a more aggressive stance and causing interest rates to soar, there are concerns about a possible recession in the near future [2]. The Fed's aggressive actions might also pull down inflation figures, as the lagged effect of falling rents could push CPI readings below the 2% target by the end of Q1 '25 [2].