Buckle Up for Economic Uncertainties: Is an Interest Rate Shock on the Horizon? Trump's Aggressive Policies Push US Inflation to the Test

Trump exerts influence on the U.S. Federal Reserve, citing favorable economic indicators

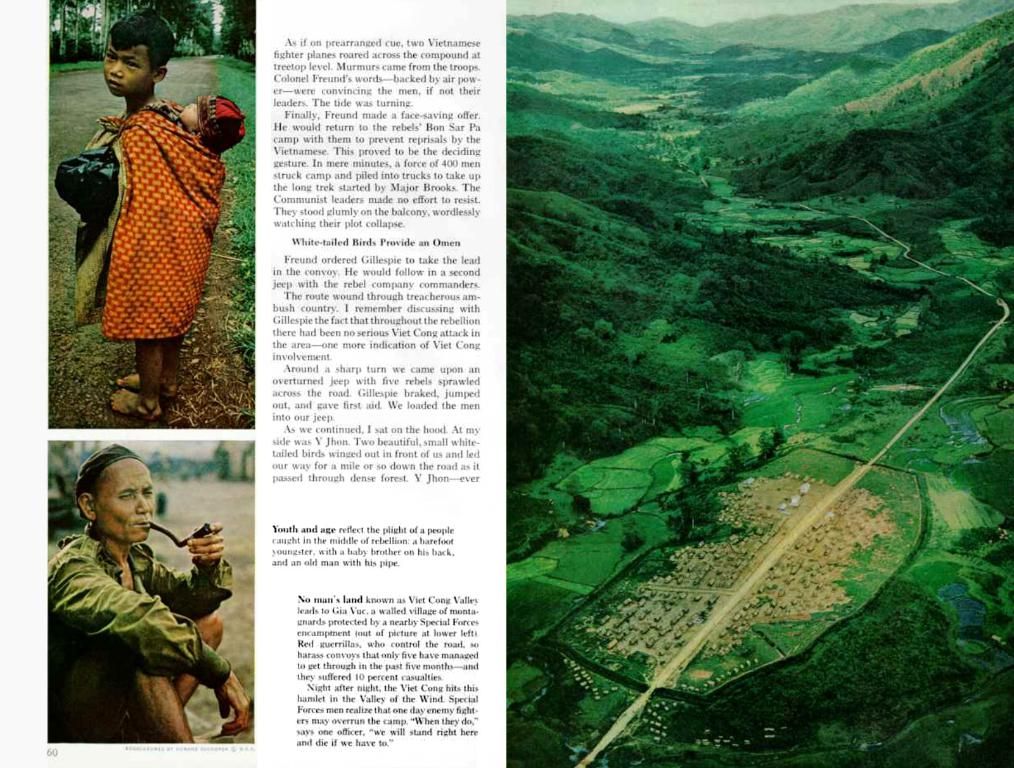

Tapping the Keys, Not the Brakes: The Federal Reserve remains focused, as Trump throws his weight around, challenging them to reduce key interest rates significantly. The central bank, seemingly unfazed, however, is treading carefully, waiting for more clarity about Trump's policy moves and their impact on the economy.

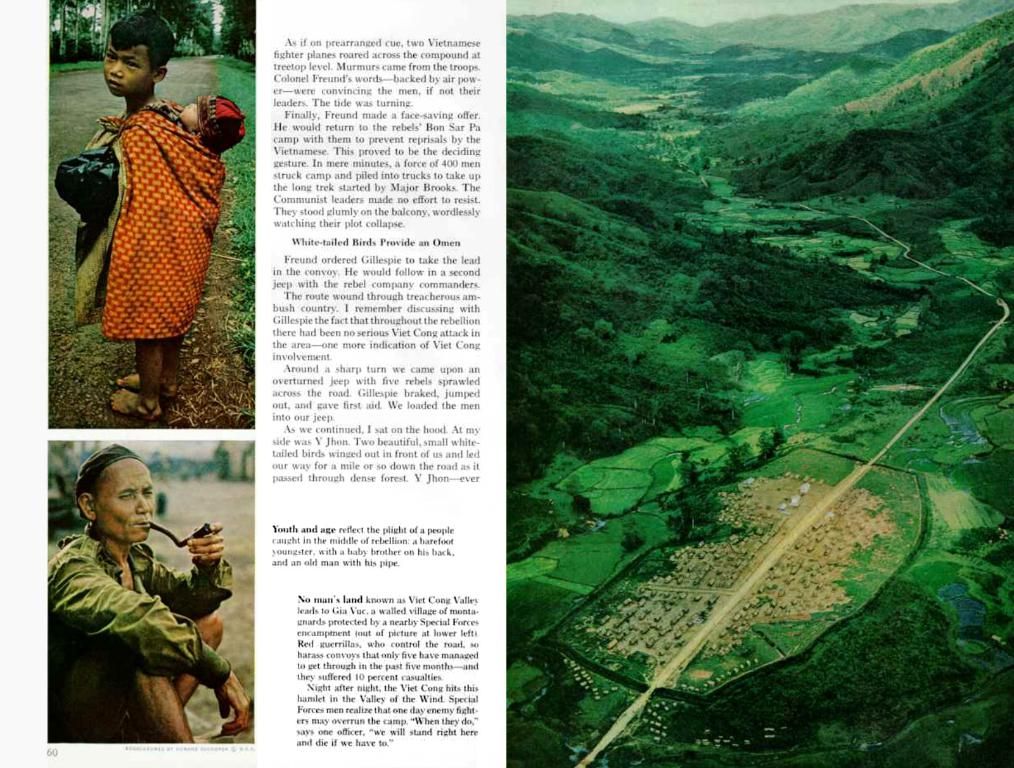

May saw consumer prices in the US inching up by a less-than-expected 2.4 percent year-on-year, according to the Labor Department. A decline from the 2.5 percent forecasted by economists. On a monthly basis, the cost of living increased by just 0.1 percent, primarily due to cheaper gasoline. "Great numbers!" exclaimed US President Donald Trump, echoing his enthusiasm for the price development, despite doubts from experts.

Enigma of Inflation: Economists are far from reassured, as the tariff shock might only surface in the months to come. Elmar Völker, an economist at Landesbank Baden-Württemberg (LBBW), voices his concerns, "The development of US consumer prices remains a conundrum. Donald Trump's colossal tariff hikes have yet to cast their shadow." This, despite companies expressing their intentions to pass on tariff-induced price hikes to consumers.

US President Trump unveiled high tariffs on imports from numerous countries in April, initially with a 10 percent basic tariff rate, later partially suspended. However, the impact of these tariffs on consumer prices remains unclear. Economist Bastian Hepperle of Hauck Aufhäuser Lampe Privatbank AG, remarks, "There's not much to glean from the price data as of now, but a gradual inflation wave could slowly build over several months."

The Gold Mine Controversy: Despite Trump's pressure for a rate cut, the US central bank maintains its shrewd stance, keeping the key interest rate in the 4.25 to 4.50 percent range. Chair of the Federal Reserve, Jerome Powell, aims to gain clarity about Trump's policy flip-flops and their potential consequences for inflation and the labor market. Currently, many experts don't see a rate cut until September.

Cyrus de la Rubia, chief economist of Hamburg Commercial Bank, summarizes the situation, "Given the ever-present risk that tariff decisions might drive up inflation, interest rate cuts this year would only be feasible if the economy plunges into a recession."

- Inflation

- Economic Cycle

- Consumer Prices

- Monetary Policy

- Fed

- Donald Trump

- USA

Enrichment Data:Overall: There is no clear indication of an immediate interest rate shock in the U.S. directly attributed to Trump's pressure on the Federal Reserve and tariff policies. However, ongoing economic uncertainties and potential supply shocks could influence future rate decisions:

- Tariff-Induced Supply Shocks: Federal Reserve Chair Jerome Powell has warned about potential supply shocks due to tariff-induced supply chain issues, which could impact economic stability and monetary policy decisions.

- Interest Rate Outlook: The Federal Reserve has recently signaled a less aggressive approach to easing financial conditions, with expectations of fewer rate cuts in 2025 compared to previous projections. This stance is influenced by inflation trends and economic growth rather than direct pressure from Trump.

- Economic Uncertainty: The economic environment remains uncertain, partly due to geopolitical and trade tensions. These factors could lead to shifts in interest rate policies if they significantly impact inflation or growth.

- The inflation rate in the US, as reported by the Labor Department, has slightly increased but remains ambiguous due to the potential impact of Donald Trump's tariff policies, creating uncertainty about the future monetary policy decisions by the Federal Reserve.

- Despite Donald Trump's pressure for a significant interest rate cut, the Fed's monetary policy remains cautious, considering the economic uncertainties and the potential consequences of supply shocks resulting from tariff-induced supply chain disruptions.