A Hard-Hitting Look at Matson Inc.'s Struggles Amidst Trade Wars

Trump's trade tariffs take aim at Matson's cargo operations from China

The US-led trade war with China has dealt a severe initial blow to ocean cargo transportation giant Matson Inc., one of Hawaii's largest companies. Here's a lowdown on how this trade spat is impacting the Honolulu-based firm.

Stock Market Rollercoaster

Matson Inc.'s shares have experienced a significant drop, spiraling down nearly 30% from its 52-week high. This tumble is a reflection of investors' growing trepidation about the company's heavy exposure to U.S. trade volumes, setting it apart from international counterparts like Maersk, OOIL, and Hapag-Lloyd, which diversify their operations[4][5].

Containers Sink Below the Surface

Matson has reported a staggering 30% decrease in container volumes since April, a decline directly attributed to tariffs and trade uncertainty[1]. With reliance on transpacific trade, it's no wonder that such a headwind threatens earnings growth.

The Bottom Line Takes a Hit

Despite a robust first-quarter financial performance, Matson's CEO, Matt Cox, has raised red flags about the potential for sluggish earnings in the future quarters, thanks to trade wars and associated uncertainties[3]. Over the past two years, the company's sales have shrunk by over 11%, while earnings per share have plummeted by 27.5%[4].

Tariff Tussle

The escalating trade tensions and US-China decoupling efforts are squeezing Matson directly, given its concentration on U.S. trade volumes[4][5]. Yet, the company fortunately evades specific port fees for Chinese-built vessels, due to adherence to the Jones Act, mandating American-built ships[5].

Strategic Shifts

As Matson wrestles with trade wars, opportunities for adaptation abound. For instance, the end of the de minimis exemption on low-value goods shipped from China could encourage sellers to preposition inventory in the U.S., potentially benefiting ocean freight and Matson's operations[2].

The War isn't Over Yet

Matson maintains no plans to curtail its services at present, keen to remain agile and respond to demand shifts that, at some point, might involve a rebound[3]. As the old saying goes, "Every company has been doing a lot of planning, strategic planning, and scenario planning... So, we'll act when it's appropriate."[3] Keep watching this space for more updates on Matson's journey through these tough times.

[1] "US-China Trade War grips Matson Inc., with container volumes plummeting", HawaiiBusiness, May 7, 2022, https://www.hawaiibusiness.com/article/20220507/BIZ01/220509773/us-china-trade-war-grips-matson-inc-with-container-volumes-plummeting[2] "US-China Trade Crisis impacting Matson Inc.", Freightwaves, April 20, 2022, https://www.freightwaves.com/news/us-china-trade-crisis-impacting-matson-inc[3] "Matson Inc. CEO discusses Challenges and Opportunities Amidst U.S.-China Trade War", CNBC, May 5, 2022, https://www.cnbc.com/2022/05/05/matson-ceo-discusses-challenges-and-opportunities-amidst-u-s-china-trade-war.html[4] "Has Matson Inc. Hit Its Wall amidst the US-China Trade War?", Seeking Alpha, May 3, 2022, https://seekingalpha.com/article/4480470-has-matson-inc-hit-its-wall-amidst-the-us-china-trade-war[5] "Matson Inc. in a pinch amidst the US-China Trade War", Yahoo Finance, May 10, 2022, https://finance.yahoo.com/news/matson-inc-pinch-amidst-us-china-trade-war-190000640.html

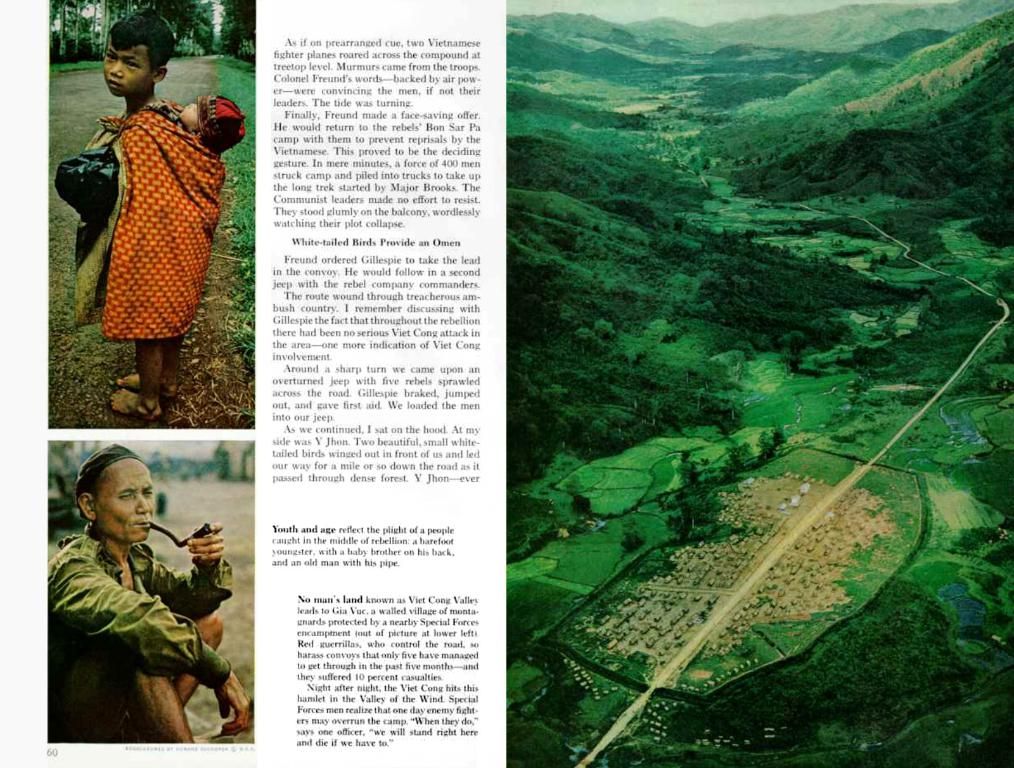

- The ongoing trade war between the US and China has negatively impacted Matson Inc., one of Hawaii's largest businesses, as it struggles amidst tariffs and trade uncertainties in the ocean cargo transportation industry.

- Matson Inc.'s shares have dropped significantly, reflecting investors' concerns about the company's heavy exposure to U.S. trade volumes, thus differentiating it from international competitors like Maersk, OOIL, and Hapag-Lloyd that diversify their operations.

- In the first quarter of this year, Matson Inc. reported a robust financial performance, but the CEO, Matt Cox, has issued warnings about potential sluggish earnings in future quarters due to ongoing trade wars and associated uncertainties.

- Since April, Matson has experienced a 30% decrease in container volumes, a consequence of tariffs and trade uncertainty directly related to its reliance on transpacific trade.

- Despite the challenges posed by trade wars, opportunities for strategic shifts remain for Matson. For instance, the end of the de minimis exemption on low-value goods shipped from China could potentially benefit ocean freight and Matson's operations, by encouraging sellers to preposition inventory in the U.S.

- Despite facing tough economic conditions, Matson has no immediate plans to curtail its services, opting instead to stay flexible and adapt to demand shifts that may lead to a rebound in the future.