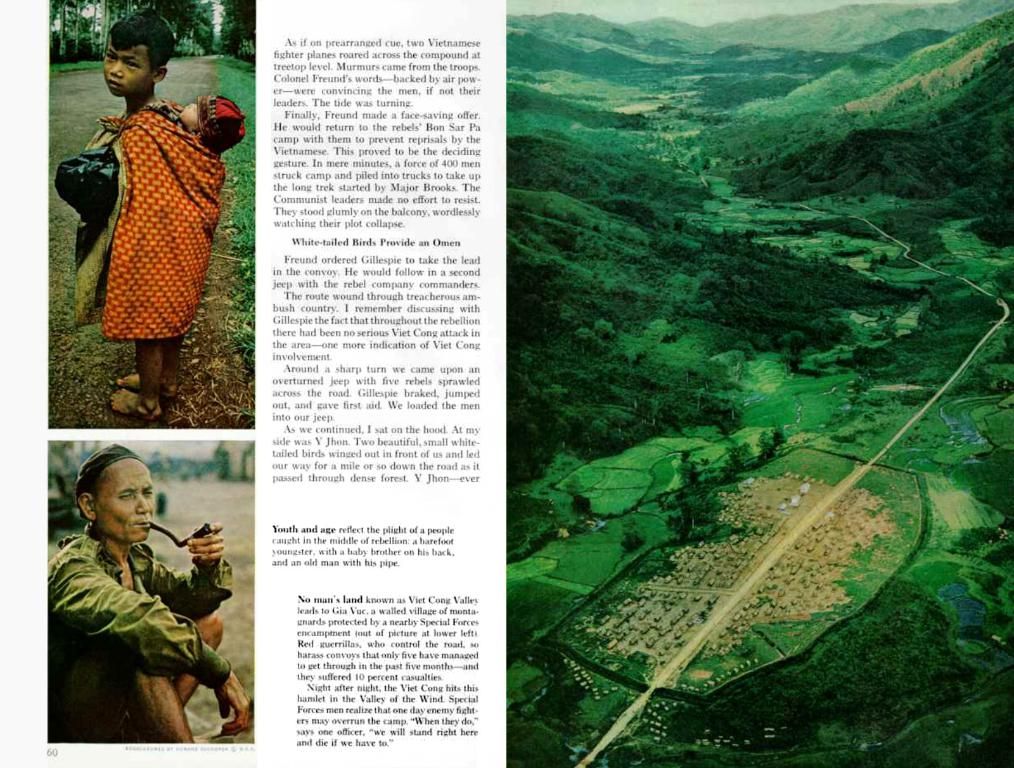

VAT Refund Procedure for Non-Resident Tourists in the Philippines: Detailing the Process for Obtaining a Value-Added Tax Refund as a Non-Resident Tourist in the Philippines

As the sunny season rolls in and the Philippines continues to entice global travelers, the Bureau of Internal Revenue (BIR) has made waves with Revenue Memorandum Circular 09-2025. This circular announces the implementation of Republic Act 12079, an exciting new value-added tax (VAT) refund mechanism designed specifically for non-resident tourists.

What does this mean for you, a jet-setting shopper? If you're dropping at least PHP 3,000 (approximately KRW 77,000) on goodies from accredited Philippine stores during your vacation, you can take advantage of the VAT refund program. But keep in mind, these purchases need to leave the Philippines within 60 days of your shopping spree.

Wondering how you can claim your refund? The Department of Finance is teaming up with renowned, international VAT refund operators to streamline the process. Both electronic and cash options will be available to ensure a smooth experience for all travelers.

Mark your calendars! Republic Act 12079 is set to take effect on Dec. 24, 2024, just 15 days after its publication in the Official Gazette on Dec. 9, 2024. The BIR shared more details about this exciting initiative on April 7, 2025.

So, remember to splurge and shop till you drop in the Philippines! With an impressive VAT refund program in place, you'll want to make the most of every centsavo.

P&A Grant Thornton stays on top of the latest financial trends and developments. For more insights into the world of numbers, keep an eye on their updates!

ADVERTISEMENT

- The sunny season in the Philippines is attracting global travelers, with the Bureau of Internal Revenue (BIR) introducing a new Value-Added Tax (VAT) refund mechanism for non-resident tourists.

- Starting Dec. 24, 2024, the VAT refund program will be in effect, following the implementation of Republic Act 12079.

- Shoppers spending at least PHP 3,000 (approximately KRW 77,000) can qualify for this refund program, provided they depart the Philippines within 60 days of purchasing.

- The Department of Finance is collaborating with international VAT refund operators to simplify the refund process, offering both electronic and cash options.

- In the Philippines' banking-and-insurance industry, policy-and-legislation updates like this are significant, sometimes impacting politics and general news.

- As a business or industry professional interested in finance, it's essential to follow the latest news and trends, such as this VAT refund program, for a better understanding of the market.

- Stay informed by following P&A Grant Thornton's updates, a reliable source for financial insights and trends in the Philippines and beyond.